Investment Portfolio Construction Enhancements

Published August 25, 2020

As a fiduciary and trusted financial advisor, Cape Cod 5 is committed to working in the best interest of our clients and providing relevant facts and updates as to our processes and approach. The purpose of this update is to provide you with information relative to some enhancements we are making to our portfolio construction.

The current market environment has prompted our investment team to implement a number of dynamic changes to portfolios. These enhancements reflect weeks of research and statistical analysis incorporating forward-looking expectations in both the equity and fixed income markets. When considering changes, we look at an intermediate time horizon with the goal of providing value that endures over many quarters.

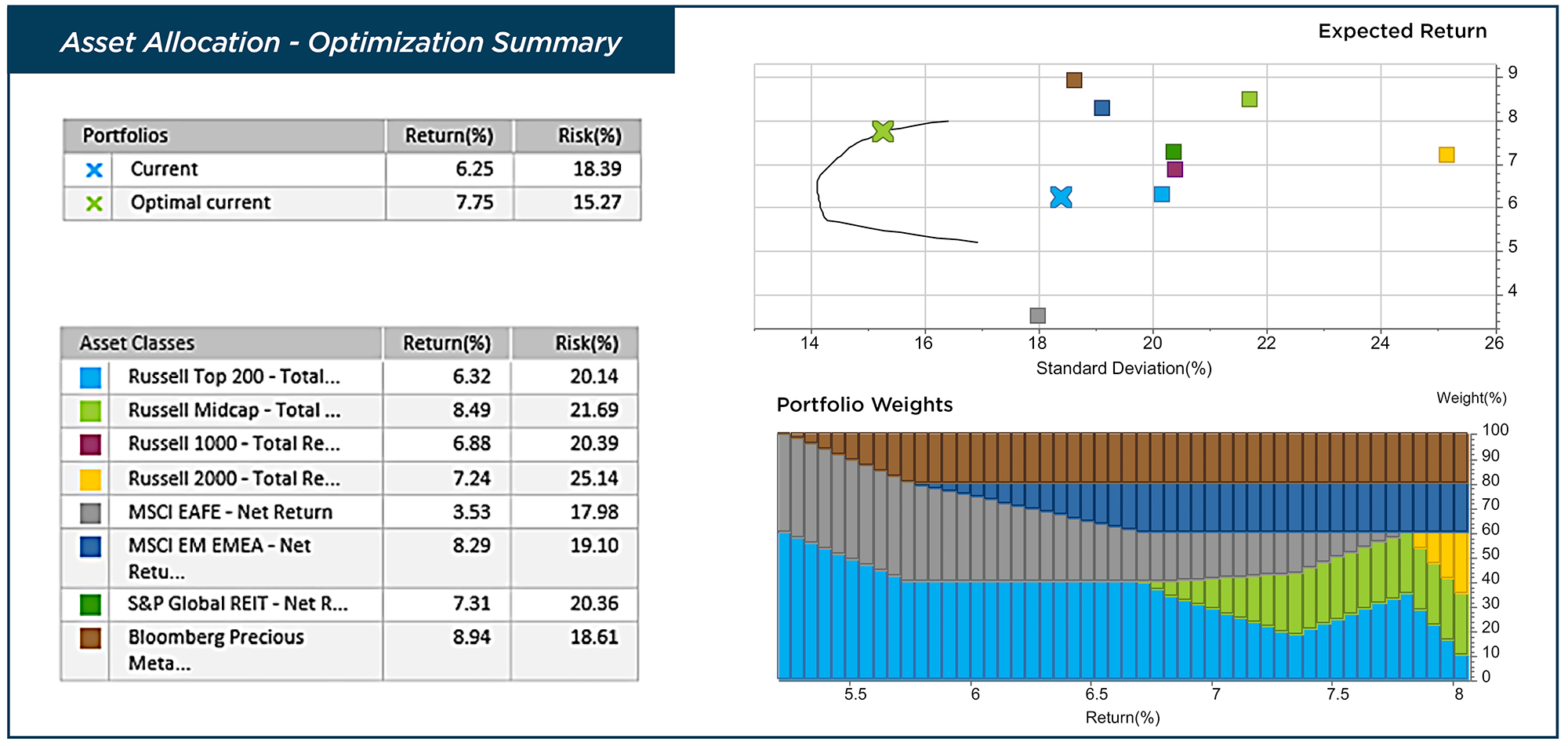

The investment portfolio construction process is a complicated exercise. We begin with the current portfolio, then incorporate current economic conditions with future expectations. We add a comprehensive list of potential investments and analyze outcomes using a variety of tools including sophisticated “optimization” software. Our objective is to identify opportunities that reduce risk, enhance return, or offer some combination of the two. A sample output is illustrated in the chart below:

The result of this exercise is the addition of three new asset classes: 1) Treasury Inflation Protected Securities; 2) Emerging Market Debt and; 3) Precious Metals. We expect the net effect of these additions to reduce extreme drawdown in equities while improving credit quality and diversification in fixed income.

When evaluating investment managers we focus on experience, style purity, liquidity, cost, tax efficiency, performance and consistency of return. The investment team is agnostic when considering active versus passive managers, preferring to concentrate on the focus areas listed above. For the most part, the process has led to mostly passive manager representation. These new asset classes are no exception.

Below please find a brief overview of the new asset classes being introduced as part of Cape Cod 5’s portfolio construction enhancements

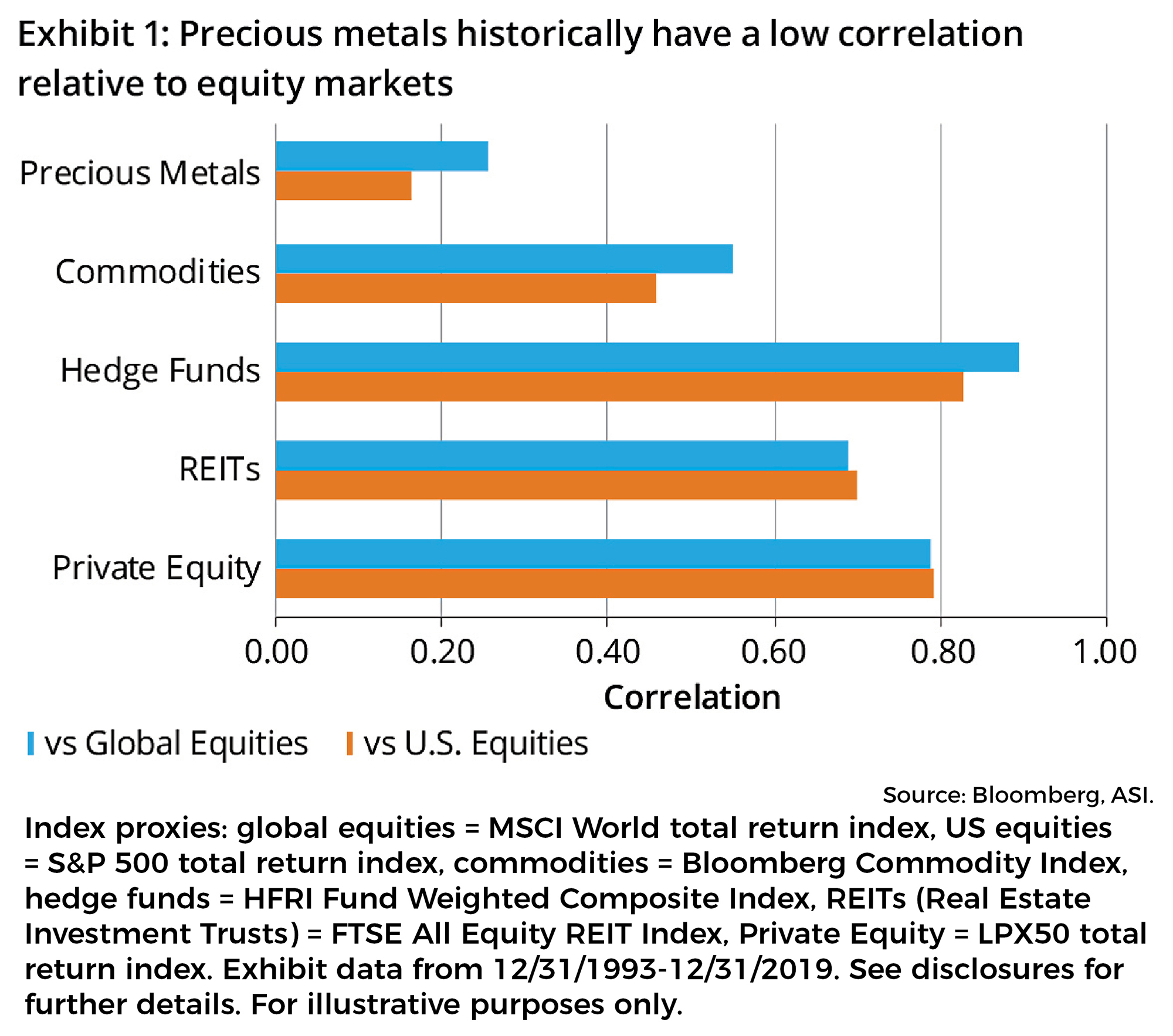

Precious metals are a form of commodities that are rare and possess high economic value. The value of these metals is based on various factors including their relative scarcity, use in industrial applications and investment demand. Precious metals can serve an important role in an investment portfolio for several reasons including for capital appreciation and favorable returns, to increase diversification (exhibit 1) as an inflation and currency hedge, and for protection during periods of economic and market upheaval.

As the name suggests, precious metals consist of a basket of metals (usually gold, silver, platinum and palladium) as opposed to a single metal such as gold. A basket approach provides diversification benefits while preserving the unique investment characteristics of each precious metal.

Investment options include buying the physical asset, investing in a company that mines for the metal, or through a professional money manager. Professional money managers use different approaches to gain exposure to this asset class, often using sophisticated strategies such as structured notes and derivative contracts.

The investment team at Cape Cod 5 selected an experienced, well-regarded investment manager with a long history in the asset class. Exposure is achieved through a low-cost exchange-traded fund (ETF) offering substantial liquidity. The fund holds physical assets (actual bars of the precious metals) through an independent custodian.

Emerging market government bonds are debt instruments issued by developing countries. While emerging equity markets are associated with higher risk factors, their debt can be attractive. Yields on these types of bonds are compelling and compare favorably against high yield corporate bonds on a credit-adjusted basis. In addition to income, these bonds can provide diversification benefits.

Emerging market debt has grown significantly over the past decade. The emergence of more regions issuing debt has increased the volume of bonds, creating greater liquidity, wider country participation and higher quality issuers. Today, the emerging markets bond market has become a completely standard asset class for many investors.

Bonds can be issued in U.S. dollars (hard currency) or local currency. Local currency issuance has gained in popularity and demand in recent years. While governments remain the largest issuer, the corporate market has grown steadily. Bonds issued in local currency can be “hedged” to eliminate the impact of changes in local currency value relative to the U.S. dollar, which can increase volatility. To avoid this, Cape Cod 5 selected an investment manager focused on a broadly diversified, low-cost U.S. dollar denominated portfolio.

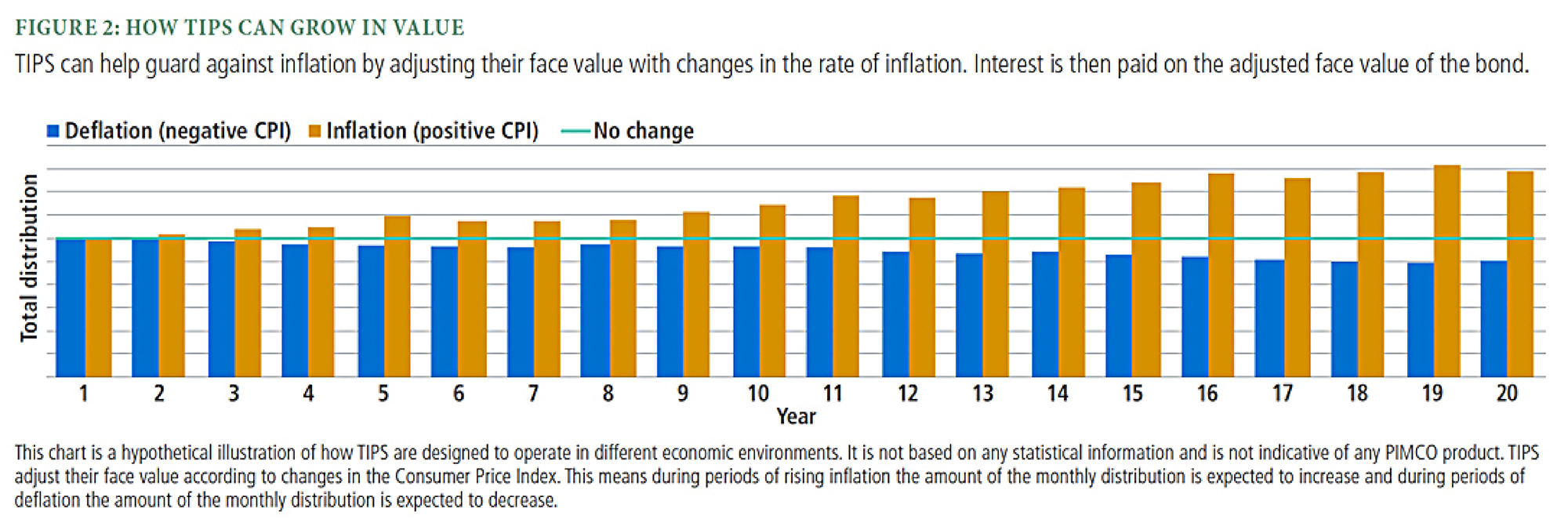

Treasury Inflation-Protected Securities (TIPS) are a type of bond designed to protect against rising consumer prices. TIPS are indexed to inflation, have U.S. government backing, and pay investors a fixed interest rate as the bond’s par value adjusts to changes in the inflation rate. In an inflationary environment, the Treasury pays interest on the adjusted par value of the bond, creating a rising stream of interest payments. In a deflationary environment, the face value and interest payments of TIPS decrease but maintain purchasing power with the now lower cost of goods and services.

TIPS offer a real rate of return – the return of an investment after inflation is taken into account. Conventional bonds keep a fixed face value until maturity and offer a nominal return with no inflation adjustment. With traditional government bonds, inflation can erode the purchasing power of future interest and principal payments. TIPS can be an effective diversification tool and have demonstrated an ability to lower overall portfolio volatility due to their low correlation with other types of investments.

As always, do not hesitate to call our team with any questions. We will begin the transition in August, carefully considering individual tax implications throughout the process.

Contact our Wealth Team More Market Insights from Cape Cod 5

Jason R. Lilly, CFA, CFP®, Chief Wealth Management Services Officer

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Lee C. Gatewood, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, CIMA, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Christopher E. Chen, CFA, Investment Analyst

These facts and opinions are provided by the Cape Cod Five Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.