The Benefits of Diversification

Recent market volatility, driven in part by concerns around rising short-term rates, slowing global economic growth, and trade tensions with China, has many investors reassessing their investment strategy.

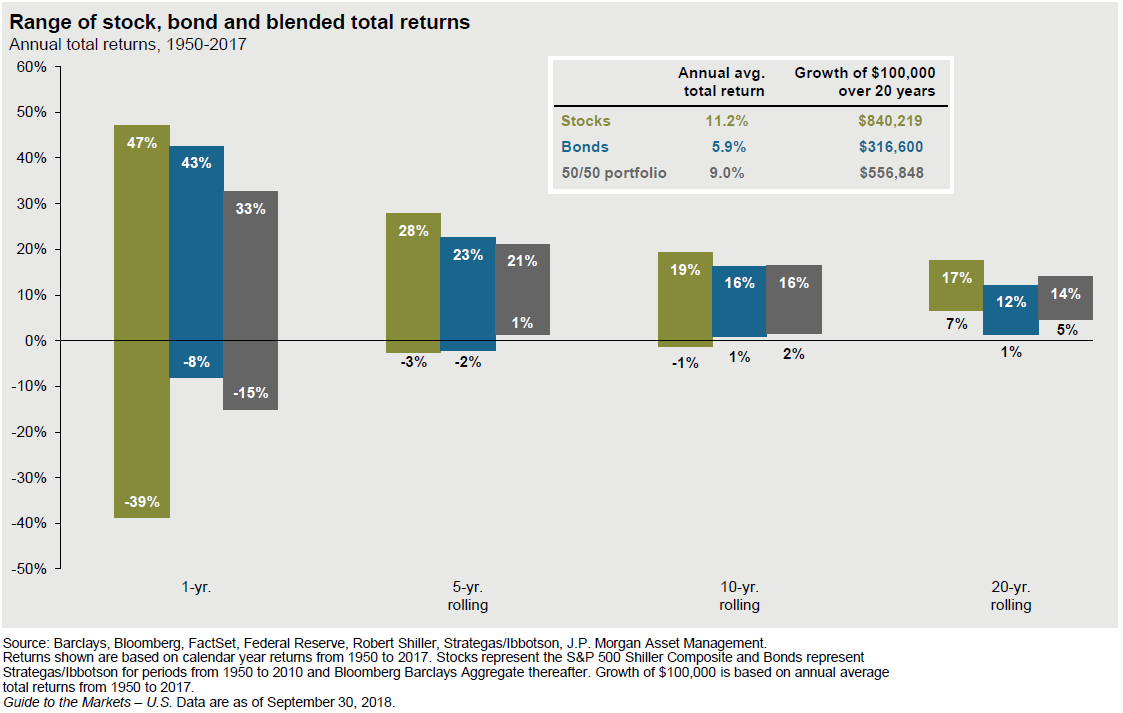

The chart below is a representation of the average range of returns for stocks, bonds and a 50/50 mix over short, intermediate and long-term periods. While stocks have delivered better average annual long-term performance, short term results can be dramatic, and in bad years, the experience can be traumatic for some investors.

Historically, corrections of 10% or more are a normal part of the market cycle. If, however, the recent selloff has you wondering if your current strategy is right for you, consider reviewing options with a qualified professional.

Stock market volatility can be managed by adequate diversification and a balanced approach to portfolio construction. If you would like to learn more about saving for retirement, goal-based planning, investment strategies or other wealth management issues, please contact a member of our Wealth Team.