Market Review Q1 2024 | Market Review Q2 2024 | Market Review Q3 2024 | Market Review Q4 2024 | Market Review Q1 2025 | Market Review Q3 2025

Second Quarter 2025

The Best Offense is a Good Defense

One needs to construct a well-diversified portfolio that can be held for the long term, whatever the latest news cycle might bring.

A recent geopolitical event perfectly illustrates why financial market prediction is so difficult. Oil was trading around $66/barrel on June 13th when Israel launched a surprise assault on Iran’s nuclear program. Over the following days oil prices would reach as high as $77/barrel, with news headlines forecasting prices breaking $100/barrel. The U.S. joining the fray with precision strikes on Iran’s most protected nuclear assets further heightened the rhetoric, with higher oil seeming like a foregone conclusion. Yet where was oil trading on the morning of June 24th, less than two weeks after the conflict began? $66/ barrel. This sequence of news and market responses is further evidence of the folly of trying to guess market reactions to news events.

Waiting for the Federal Reserve’s Next Move

Looming in the background of recent events, but sure to return to the fore as the new quarter unfolds, are the deliberations at the Federal Reserve.

Jerome Powell, Chairman of the Federal Reserve, and President Donald Trump continue to seem at odds with some of their stated goals. The last interest rate cut by the Fed was in December of 2024, when the overnight rate was lowered by 0.25% to a new range of 4.25%-4.50%. Since then, the slowing of progress on the inflation front coupled with the possibility of tariffs reigniting inflation has halted further cuts. President Trump, on the other hand, wants lower interest rates sooner as opposed to later as this would help lower Federal borrowing costs and likely help the real estate market. For now, the market anticipates at least two rate cuts later this year. A cut in rates, say at the end of July, would be very accommodative and could support the continuation of the rally in the second half of the year.

Tariff Turmoil Roils Market

And it is the rally off the lows of April 8th that is really the biggest story of the second quarter.

The market strength at the start of the year was derailed by the talk of tariffs taking center stage, culminating in Trump’s presentation on April 2nd of what was called “Liberation Day.” Markets were shocked by the proposed tariff levels and what, if they were enacted, would happen to global economic growth. Stocks sold off immediately, with the S&P 500 eventually falling below 5,000 on April 8th. This marked a pullback of 19% from February highs, putting the market at the edge of bear market territory, traditionally recognized as a 20% decline. Investors were justified in their concerns, as many thought this was just the start of an even larger and longer decline.

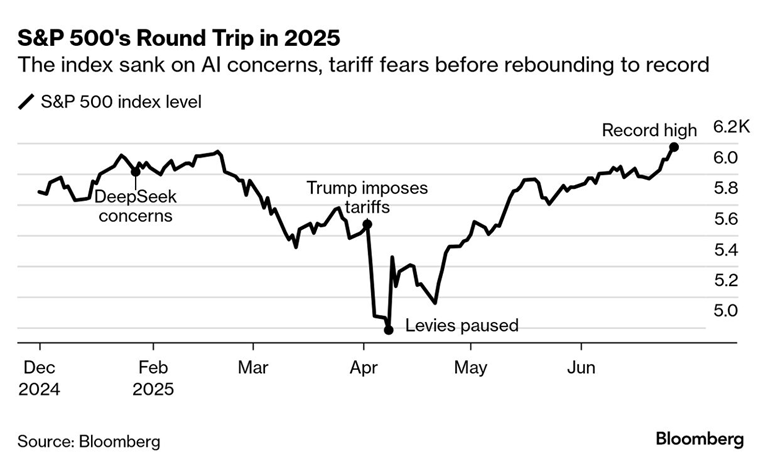

As the impact of these trade policies hit markets, Trump put a pause on most tariffs on April 9th.1 In the following weeks he would soften his stance further, even reaching an agreement with China on May 12th that included a sharp tariff reduction from both sides. The softening rhetoric and signs of possible trade normalization buoyed markets around the world. The sharp reversal in our own S&P 500 can be seen in the chart below:

Record Rebound in Equity Markets

The S&P rallied strongly from an almost 20% drawdown and reached a new all-time high on June 27th, closing at 6,173 and would finish the second quarter with a gain of almost 11%, at 6,205.2

Artificial Intelligence (AI) and the infrastructure to support its development and growth dominated the second quarter. In February, Chinese company DeepSeek had demonstrated noticeable advances in AI with a seemingly much lower chip and hardware investment, prompting fears of a slowdown in spending by the tech giants. This fear was premature as earnings calls from the largest tech companies highlighted increased AI spending far into the future. The strongest sectors of the second quarter were once again technology focused with Information Technology and Communication Services climbing 23.5% and 18.5% respectively.

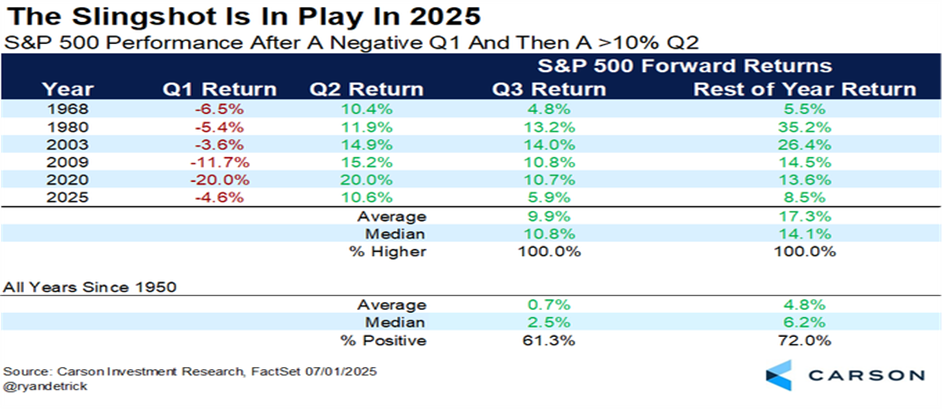

The setup for 2025, with a negative first quarter and then a positive double-digit second quarter return, is unusual but, as shown in the chart below, bodes well for the latter half of the year. In the six previous years with this occurrence, markets have gone on to provide an average return of 17.3% in the second half of the year versus the overall average second half of the year return of 4.8%.

As strongly as the U.S. stock market performed, it trailed most international markets in the second quarter due to the sharp decline in the dollar. Dollar weakness provides a strong tailwind for domestic holders of international investments. With international developed and emerging markets advancing nearly 12%, and many European equity markets hitting all-time highs.

Economy – Pause or Slowdown?

The tariff activity and continuing uncertainty around future policy have impacted economic activity.

One of the best measures of economic activity is the Gross Domestic Product or GDP. First quarter GDP came in at a negative -0.5%, the lowest quarterly measure in three years, as businesses accelerated their purchases of imported goods as they looked to build inventories in goods earmarked for steep tariffs. This increase in imports in anticipation of tariffs was the major reason behind a negative GDP reading in the first quarter. As we write this, the second quarter GDP is currently forecast to be between 2.5% and 3%, with trade activity largely expected to have normalized. We are mindful that the impact of tariff activity and the continued uncertainty around future trade policy may cast a shadow on the magnitude of this rebound.

While unemployment remains near historical lows, there are signs that the labor market is losing steam. A big question raised by AI is human displacement, as machines will increasingly be able to do the work currently done by humans. Amazon, one of the largest employers, just announced that robots will soon outnumber human workers at their warehouses.3

Countering signs of a slowdown is the resiliency of corporate earnings. First quarter earnings grew at 13.3% over the first quarter of 2024 and yearly growth for 2025 is now estimated to be 9%. Another positive development lies on the interest rate front, with the all-important 10-year Treasury rate continuing to decline, settling at the end of the quarter at around 4.25%. As mortgages and many commercial loans take their cue from this rate, any further declines would be stimulative to both the housing market and capital investments.

Looking Forward

While the first half of the year was often marked by volatility and uncertainty, we head into the back half of 2025 with a calmer backdrop. Markets have shown surprising strength and optimism, but the upcoming 2nd quarter earnings announcements will provide a report card on whether this exuberance was warranted.

As always, we appreciate your confidence in our team as we strive to build the best portfolio for you based on your goals, risk tolerance, and time horizon. We remain careful stewards of your assets, balancing growth with capital preservation. Please don’t hesitate to contact us if you have any questions or concerns.

Jonathan Kelly

Senior Investment Officer, Manager, Financial Planning

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA, Chief Investment Officer

Rachael Aiken, CFP®, Director of Investments

Brad C. Francis, CFA, Director of Research

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer, Manager, Financial Planning

Nancy Taylor, CFA, CAIA®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Investment Officer

Craig J. Oliveira, CFA, Senior Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

1https://www.nytimes.com/2025/03/13/business/economy/trump-tariff-timeline.html

2https://www.cbsnews.com/news/today-stock-market-recrord-s-p-500-dow-nasdaq/

3https://www.wsj.com/tech/amazon-warehouse-robots-automation-942b814f?mod=hp_lead_pos7

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.