Our investment philosophy is to build high quality, tax-aware portfolios delivering consistent, competitive results that meet the objectives of our clients within their risk profile.

Our investment team focuses on creating personalized portfolio, incorporating your unique circumstances, that are designed to protect and grow your assets through all market environments. We strive to deliver competitive risk-adjusted returns, utilizing asset allocation, diversification and security selection, to mitigate market risk and reduce volatility. Your financial peace of mind is our top priority.

Investment Management Services

- Professional management of IRAs, revocable, irrevocable, and charitable trusts, individual agency accounts, foundations

- Portfolios built using individual securities, low-cost passive and active funds, or a combination of both

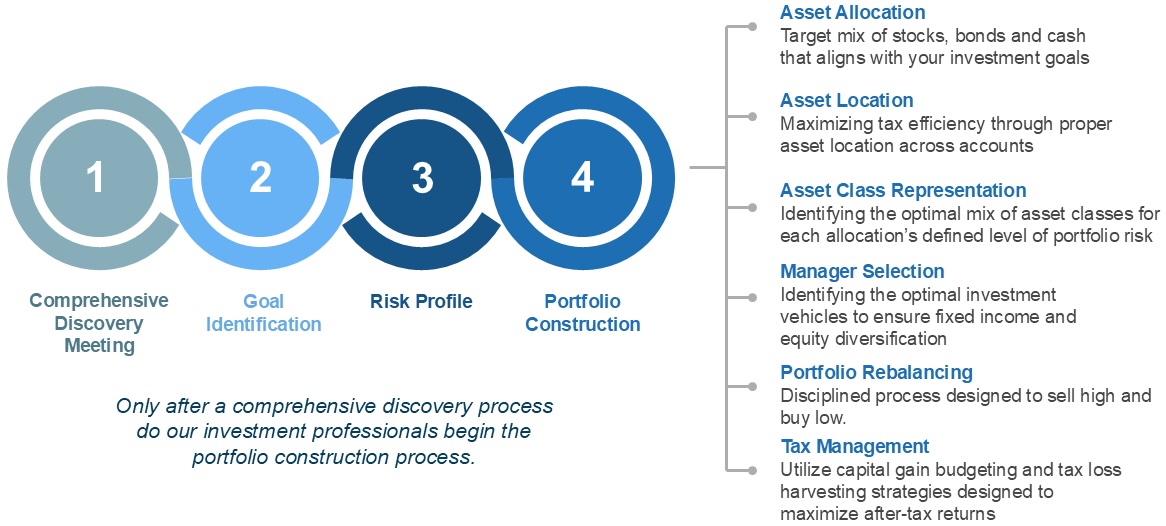

- Initial comprehensive discovery meetings to clarify goals

- Disciplined investment team process with audit oversight

- Development of risk profile, a key component to portfolio construction

- Portfolio construction process driven around appropriate investment allocation

- Consistent rebalancing of portfolio utilizing a disciplined process to keep your asset allocation in line with your investment objectives

- Tax management including annual capital gains budget, tax loss harvesting, efficient asset class location and tax efficient strategies

In-person meetings with your investment officer to review results, provide investment updates and discuss any changes in client circumstances or financial goals

Investment Process