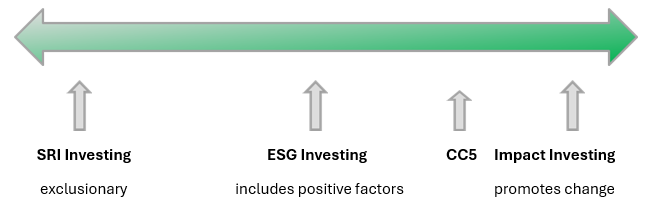

At Cape Cod 5, we believe that your investing should align with your values. That's why we offer Socially Responsible Investing (SRI) and Environmental, Social, Governance (ESG) strategies to enable you to do well while doing good.

What is Socially Responsible Investing?

SRI is an investment strategy that considers both financial returns and social good. It allows you to invest in companies and funds that prioritize:

Environment Sustainability - renewable energy, carbon footprint reduction and eco-friendly practices

Social Responsibility – ethical labor practices, diversity and community support

Corporate Governance – transparency, accountability and ethical leadership

Our approach includes a proprietary discovery process built around the United Nations 17 Sustainable Development Goals. Strategies are diversified across institutions and asset classes using managers with a long history of investment performance and SRI/ESG impact.

At Cape Cod 5, we provide clients with options:

SRI Investment Funds – professionally managed mutual funds and ETFs that focus on sustainable and ethical businesses

Green Bonds and Impact Investments – support projects that fund renewable energy, affordable housing and community development

Customized SRI Portfolios – work with our advisors to build an investment portfolio that reflects your values. Your portfolio can be a blend of SRI and non-SRI investments designed to meet your unique life goals.

Why Choose SRI with Cape Cod 5?

A Trusted Local Team – Our knowledgeable and dedicated team of professionals will help guide you through all of your options to ensure your investments align with your values and goals.

Competitive Returns and Wealth Strategies – SRI investments have proven to perform competitively over time.

Local and Global Impact – Support sustainable initiatives both within our community and beyond.