July 2025

Market Commentary

A Hot July and Hotter Markets

As many parts of the country dealt with record-breaking temperatures in July, investors felt continued heat from the equity markets. A V-shaped equity market recovery after the April Liberation Day sell-off was expected to slow as tariff negotiations ground on beyond their postponed target dates, yet the S&P 500 hit 6,363 on July 30th, marking a new high. Additional insight into the trajectory of the economy was clearer with tax legislation signed into law, the first reading on second quarter GDP, and confirmation that the Fed remains cautious with monetary policy, leaving the fed funds rate unchanged.

July marked the beginning of the third quarter, heightening the anticipation of how corporate earnings fared in the second quarter given the implementation of varying tariff levels in April. As of the end of July, for the 170 companies included in the S&P 500 Index who have released Q2 earnings, 80% posted better-than-expected earnings, defying expectations for earnings to cool. The caveat to this positive result is that overall, Q2 earnings growth is expected to come in at 6.4%, the lowest level since first quarter 2024. While some companies, such as Ford and GM, did cite a large hit to earnings from tariffs, many companies shared an improved outlook for earnings in the second half of 2025.

With the S&P 500 posting a 2.24% return for the month and stretching the year-to-date (YTD) return to 8.59%, exuberance was focused primarily on large cap stocks. Smaller companies felt some relief in the month, with the Russell 2000 Index posting a 1.73% return, but still lagging YTD with a -0.08% return.

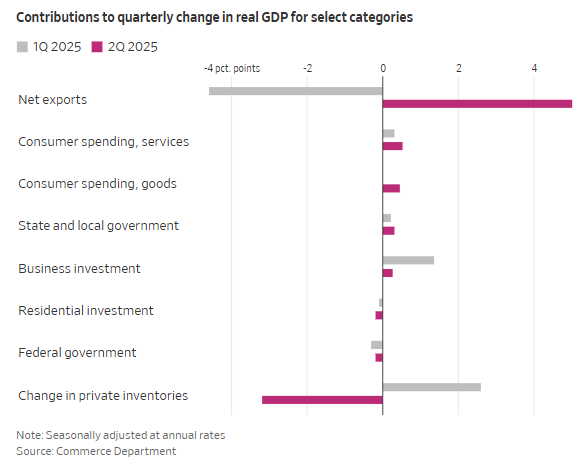

At the end of the month, a better-than-expected first reading of Q2 GDP at 3.0% implied signs of stronger economic growth emerging. However, looking under the surface, the surge of imports seen in the first quarter reversed, and instead imports fell by 30.3% as companies sought to avoid tariffs. This, along with a large decrease in private inventories, weaker fixed investment and tepid consumer spending, indicated economic growth may not be as hot as the headline number would indicate.

Source: Wall Street Journal

The employment picture appears to be cooling modestly, which could suggest some companies are scaling back hiring in the face of potentially rising costs. The new corporate mantra is “no hire, no fire” as finding qualified employees remains challenging in many sectors. Nonfarm payrolls were 73,000 in July, a miss from the 110,000 expected, and the June number had a significant downward reduction to only 14,000 from the original reading of 147,000. The July ADP payroll number came in at 104,000, a huge rebound from the decline of 23,000 in June. The unemployment rate ticked slightly higher in July, moving up to 4.2% from 4.1% in June, but remaining at a manageable level. Wage growth rose more than expected, with average hourly earnings increasing 3.9% year-over-year in July.

Inflation readings in July came in slightly hotter than the prior month, with the Fed’s favorite core personal consumption expenditures (PCE) index, which excludes food and energy, moving from an upwardly revised 2.7% in May to 2.8% in June. The headline PCE index also showed an increase, moving from an upwardly revised 2.4% in May to 2.6% in June.

As expected, the FOMC left the federal funds rate unchanged on July 30th at a range of 4.25-4.50% with most Fed Governors believing current policy is modestly restrictive but still allowing growth. What did change at this meeting is that two Governors voted to reduce by 25 basis points, marking the first time in over 30 years that there were two dissenting votes. Markets now show a 75% likelihood that the Fed will cut by 25 bps in September in response to much weaker than expected jobs numbers. The Fed certainly has a difficult balancing act factoring in a slowing jobs market coupled with inflation rates moving further from the 2.0% target.

Your Cape Cod 5 team of advisors continues to monitor market and economic factors and is here to talk through how they may impact you. Please reach out if you have any questions or concerns.

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.