Market Review Q1 2024 | Market Review Q2 2024 | Market Review Q3 2024 | Market Review Q4 2024

Market Review Q1 2025 | Market Review Q2 2025

Third Quarter 2025

The Path of Least Resistance was Higher

Buoyed by strong earnings, a still-soild economy and the resumption of a Fed rate-cutting cycle, all major asset classes advanced in the third quarter as a relative calm washed over the markets after several quarters of disruption from political and policy uncertainty.

Market Averages Reached Record Highs

The S&P 500 and Nasdaq hit multiple record closing highs during Q3, with September ushering in new all-time highs for the Dow Jones Industrial Average and small-cap Russell 2000.

Domestically, the large cap S&P 500 rose 8.1% and the tech-laden Nasdaq rallied 11.2%, but their strong performance was outdone by the Russell 2000's impressive 12.4% rally that started earlier in the year and gained steam in Q3 with September's Fed rate cut and the expectation of more cuts to come later in the year.

At the S&P sector level, there was narrow leadership, with only three of the eleven sectors outperforming the index: technology 11.3%, consumer discretionary 10.3% and communication services 9.1%.

Technology and tech adjacent companies continued their outsized impact on S&P 500 returns in the third quarter as returns from the mega-cap tech, also known as the Magnificent 7, accounted for approximately 70% of the index level return. Their outsized impact can be attributed to two factors: the sheer size of these companies as a percentage of the S&P 500, as well as their actual performance.

Equity markets outside the U.S. rallied, too. The ACWI-ex U.S., a proxy for global markets excluding the U.S., rose 6.9%, with developed markets ceding leadership to emerging ones. A sharp rotation out of European stocks, along with the 19.5% return in the Chinese markets, propelled emerging markets 10.6% higher, while developed international markets trailed with a 5.7% return for the quarter.

Bonds posted solid gains as rates fell across the yield curve in the third quarter with the Federal Reserve's resumption of its rate cutting cycle.

The curve steepened with the yield at the 2-year tenor falling further than the yield at the 10-year and 30-year tenors. Short-end rates fell on the realization and anticipation of further Fed rate cuts. Long-end yield declines were more muted, still pricing in concerns over the path of inflation and fiscal policy.

Finally, precious metals advanced, with gold continuing its relentless rally by climbing 16.7%. Silver saw its own spike, rising 30% in the quarter.

Strong Second Quarter Earnings Tempered Valuation Concerns

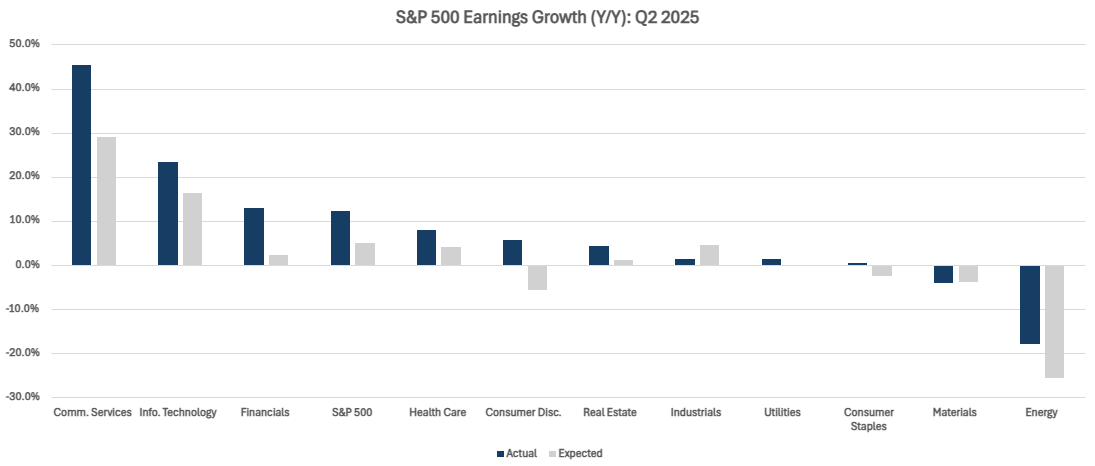

Corporate earnings reported for Q2 came in well ahead of expectations and are anticipated to remain strong for Q3, providing fundamental validation for an expensive market.

Q2’s outperformance on the top and bottom line was exceptionally strong relative to history, with the percentage of companies beating expected revenue and earnings growth well above 1-year, 5-year, and 10-year averages according to FactSet.

And it was not only a technology story - eight of the eleven S&P 500 sectors reporting positive earnings growth exceeding expectations.

Looking ahead to the reporting about third quarter, S&P 500 earnings expectations have increased, with estimates materially higher for the communication services, financials, consumer discretionary and technology sectors, and with only healthcare earnings growth expected to decline. A continuation of earnings growth and greater sector participation would be a healthy backdrop for future market gains.

At this juncture, future earnings growth hinges on expanding profit margins. Corporate America has been quite adept at defending margins in recent years, with tariffs now presenting another test.

Q2 earnings commentary revealed a growing cohort of companies pressured by tariffs and working to implement mitigation measures to protect their profitability. Yet up to this point, corporate America has been reticent to pass through cost increases to final consumers. In the absence of productivity enhancements, it will be difficult to defend margins and achieve the expected level of earnings growth for the rest of the year without price hikes.

AI optimism remained a powerful driver for markets and the economy.

Investors readily acknowledge that mega-cap tech stocks have led the S&P 500’s recovery off the April lows, and that cohorts of AI and AI adjacent stocks have continued to gain momentum supported by one part strong fundamentals and two parts enthusiasm for Generative AI.

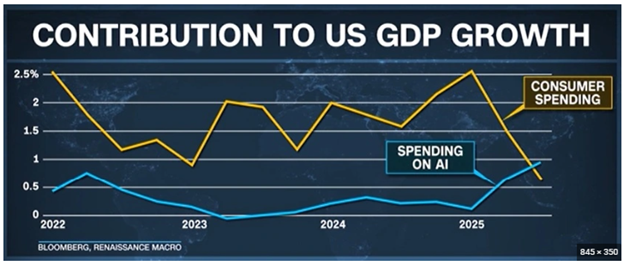

But perhaps less appreciated is AI’s contribution to GDP. According to Pantheon Macroeconomics, AI-related spending added 0.5% to GDP in the first half of the year, and without its contribution they estimated the U.S. economy would have grown less than 1%.

Taken one step further, Renaissance Macro Research estimates that in dollar terms, AI data center expenditures have exceeded U.S. consumer spending in the first half of the year.

This is an important factor to keep in mind while evaluating our economy’s performance, as well as the market’s.

Source: Bloomberg, Renaissance Macro

Dual Mandate Challenges Highlighted by Fed

The Federal Reserve was "front and center" this quarter with a spotlight on its independence and interest rate decision.

After a year on hold, the central bank delivered its widely anticipated 0.25% (or 25 basis points) cut in the Fed Funds Rate. As expected, equity markets rallied, and bond yields fell in response.

On the surface, the Fed’s rate cut decision removed a layer of uncertainty in the marketplace. While the Fed’s ongoing dilemma surrounding its dual mandate, growing dissent among Fed governors and political challenges to its independence remained areas of concern.

September’s cut seemed to reflect a policy pivot from prioritizing still high, sticky inflation to now focusing on thwarting further labor market weakness.

By his own admission, Fed Chair Powell cited the cut as a “risk management” move in response to the challenge that Fed faces with tools that “can’t do two things at once” – tame inflation and support the job market. As a result, “future policy is not on any preset path with the committee remaining data dependent.”

Moving ahead, the Fed is in an unenviable position of having to choose which of the dual mandates to focus on when both sides are at risk. Dissention among Fed Governors sets the stage for greater uncertainty with respect to the cadence and magnitude of any future rate cuts in 2025.

Looking Ahead

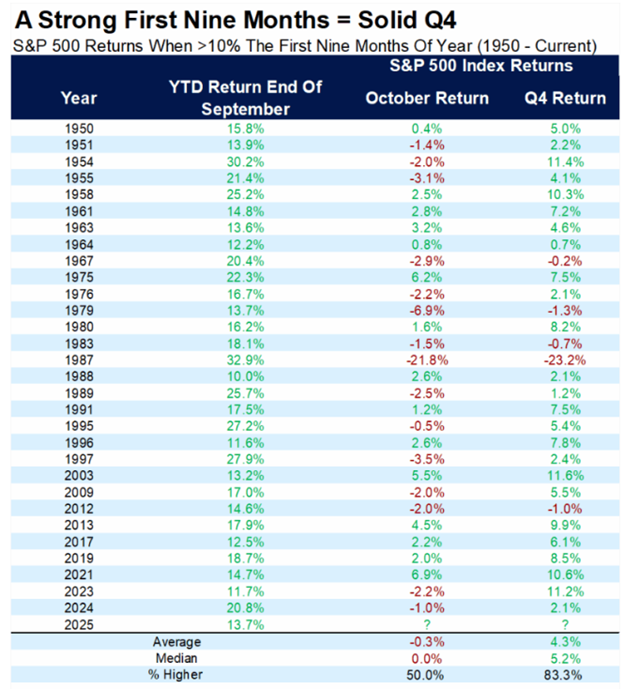

As we enter the fourth quarter, history reminds us that while October is the most volatile month of the year, the fourth quarter historically has been the best quarter of the year for the market, higher 80% of the time and up 3.8% on average, according to Carson Investment Research.

Reinforcing this favorable set up, the below history of market performance dating back to 1950, shows years where the S&P 500 was up more than 10% heading into the fourth quarter. As you can see, October returns were generally weak - sometimes even negative - but fourth quarter returns were higher 14 out of the 15 times, not a bad batting average.

Source: Carson Investment Research, FactSet 09/30/2025

Despite those favorable statistics, we recognize the myriad challenges that lie ahead – a government shutdown showcasing our dysfunctional government, the lagged effects of tariffs on the economy, earnings and consumer spending, the future path of monetary policy and a fully valued market by many measures - just to name a few. The wall of worry for the market is high.

To that end, your Cape Cod 5 team remains vigilant: attune to economic and market data that may impact markets and your investments as we enter the final quarter of the year. Finally, keep in mind, all year long we have leaned into diversification and managed risk, working to provide strong risk-adjusted return over a full market cycle.

We appreciate the trust you place in us to help guide and protect your financial future. If you have any questions or would like to discuss your plan, please reach out to us. Your Cape Cod 5 team of advisors is here for you!

Rachael Aiken, CFP®

Director of Investments

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer, Manager, Financial Planning

Nancy Taylor, CFA, CAIA®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Investment Officer

Craig J. Oliveira, CFA, Senior Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.