March 23, 2022

If you currently invest in a taxable account, it may be time to rethink your retirement strategy. Research suggests taxable accounts lose approximately 1% in return each year to taxes – often referred to as “tax drag”. Even tax efficient index investing is not immune to tax drag.

The challenge with taxable accounts is that any annual dividends, income, or realized capital gains can be subject to tax in the year received. Whether paid directly from the investment account, or elsewhere, the net result is less money available for future growth (and compounding).

The impact can be barely noticeable in a year. On a $10,000 investment returning 8% and losing 1% to taxes, the difference is about $100 the first year. However, that 1% difference on a single $10,000 investment can have a big impact over a longer period – over 30 years the difference is more than $24,000!1 There are options to consider to help improve retirement outcomes.

For instance, consider Vanguard’s popular LifeStrategy Moderate Growth Fund (for illustration purposes only and not an endorsement or guarantee of future returns). The fund invests in a diversified mix of stock and bond index funds, and is low cost, diversified and relatively tax efficient. With almost $20 billion in assets, it is a popular choice for retirement savers. According to Vanguard’s website, the fund has returned 7.91% per year since inception (9/30/1994)2. After tax on distributions, the fund returned 6.81% - strikingly close to the numbers used in the scenario above.

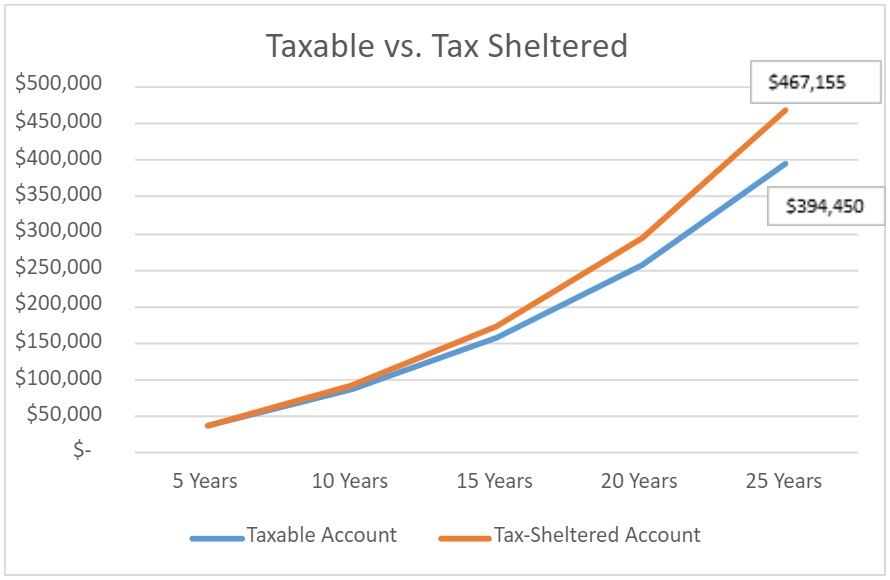

Using Vanguard’s LifeStrategy Fund as a proxy, and assuming contributions of $6,000 per year (currently the annual maximum contribution to an IRA if you are under age 50) over 25 years, the difference on ending values in a tax shelter account vs. a taxable account amount to more than $70,000.

Tax drag clearly adds up over time. Simply electing to invest in a tax-sheltered account like an IRA or Roth IRA instead of a taxable account is an easy fix. There are rules and limits around these types of accounts, but the benefits are compelling.

If you are considering investing and have earned income, you can make a 2021 contribution to an IRA or a Roth IRA up until April 18 of 2022.

Not sure about whether a Roth or Traditional IRA is right for you? Click here to learn more.

1Assumes $10,000 initial investment and 8% annual returns compounded over 30 years compared to same investment compounded at 7% per year. Assumed no sale of shares took place and did not consider after-tax values at the end of time horizon for each account type.

2As of 2/28/21; Vanguard uses the highest federal tax rate to calculate after-tax return; Vanguard does not include State tax rates. Any potential service fees were not included.

Examples are for illustrative purposes and should not be considered investment advice. Consult a professional before making any investment or tax related decisions.

These facts and opinions are provided by the Cape Cod Five Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.