July 27, 2022

Market Commentary

“Flattening the Hill”: Takeaways from this week’s Fed Meeting

Cycling this weekend in the heat and the wind, my thoughts turned to the recently wrapped up Tour de France for motivation. Cyclists use the term “flattening the hill” to represent the extra force and power to push up and over a hill. While the “hills” on Cape Cod are more like bumps compared to the Alpe d’Huez and other famous Tour climbs, the concept of “attacking” the hill to maintain momentum holds true and perhaps serves as an appropriate metaphor for current Fed policy. The Fed is facing a Hors Catégorie climb (the hardest in cycling) in its quest to tackle the current inflation situation. The only option is to climb as hard and as fast as possible.

Today’s 0.75% increase (75 bps) is the Fed pushing the pedals – hard. Inflation is out front and 75 bps is, in the Fed’s view, the right amount of force to close the gap.

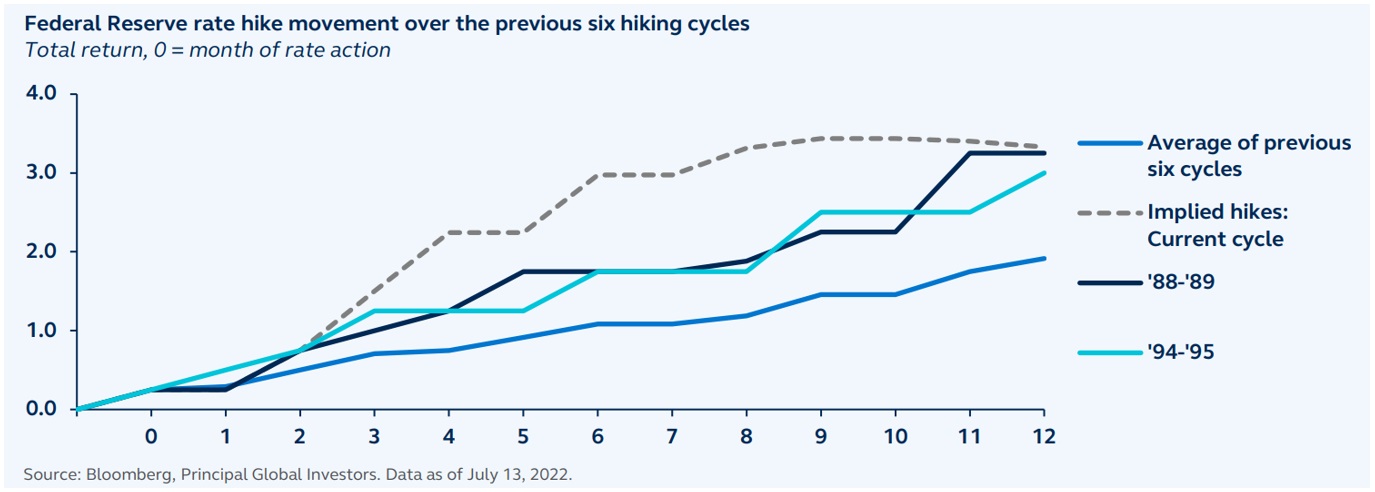

This is the fourth increase this year and the second 0.75% increase in a row – a total of 2.25% increase in less than five months. For context, the average increase in the previous six cycles was 2% over 12 months (see chart below). In the last tightening cycle of 2015-2018, the Fed increased rates by a similar amount, but took four years to do it! The Fed is pushing hard indeed, and for good reason. During the last tightening cycle, inflation averaged less than 2%, not the 8% plus we have today1.

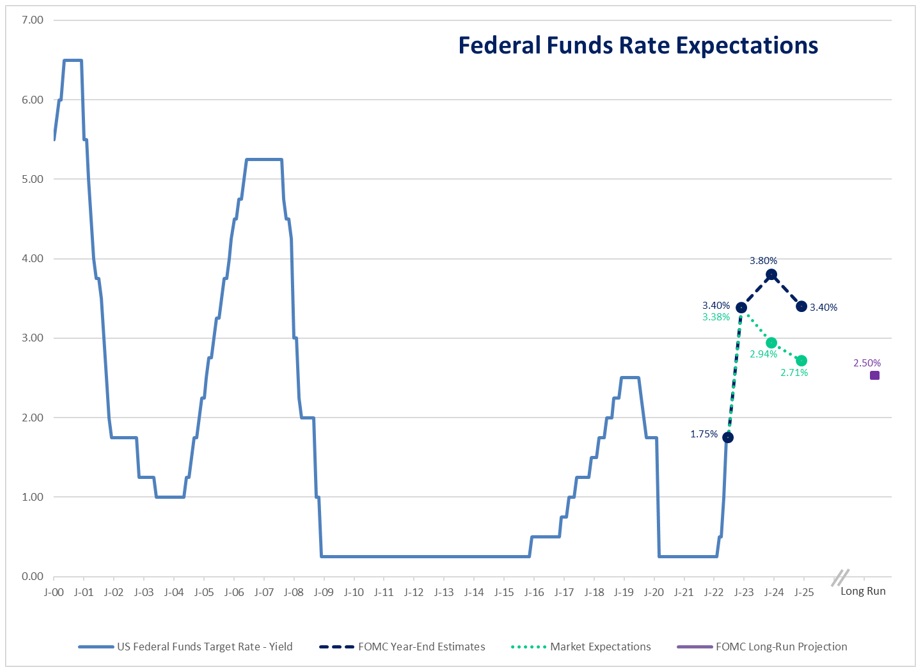

The 75 bps hike was in-line with expectations and markets remained positive after the announcement. Investors have a strong aversion to surprises, so we view this as good news as consensus and policy forecasts are similar (see chart below). If policy tracks close to expectations, volatility should remain contained.

Source: Facset; Cape Cod 5

This chart offers a second important observation – both policy makers and market consensus see a top in 2023 with an almost immediate cut. In other words, expectations are that the Fed will “flatten” the inflation hill and once complete, almost immediately begin the process of lowering rates.

Market Implications

The bond market has had a tough year. Generally a safe haven in times of market volatility, the speed and magnitude of Fed policy has caused some pain in the bond market. Current yields along with Fed futures, however, suggest most of the damage has been done. In the aftermath, investors will be left with yields that are much more compelling and substantially above levels at the beginning of the year. In January 2022, a two-year Treasury bond offered about $220 of annual income for every $100,000 invested. Today the same $100,000 generates about $3,000 in income2.

Equity markets are also influenced by rising rates. Valuations reset as investors become less willing to wait for future cash flows as short-term rates rise. With the two-year Treasury bond at about 3% today, investors are less willing to pay 30x earnings for a growth stock. This reset is evident with year-to-date price-to-earnings (P/E) ratios for the S&P 500 dropping by 25%. Instead of paying 21.4x earnings, which was the case at the beginning of the year, the S&P 500 now trades at 15.9x. This “compression” happened even as earnings grew by about 7%3.

While valuations for both stocks and bonds are more attractive today, a rally in either, or both, will be dependent on the Fed’s ability to flatten the “inflation hill”. If inflation begins to moderate and investors build confidence that “peak” inflation is behind us, the market should find solid footing.

We value the trust you place in Cape Cod 5 and encourage you to discuss any individual concerns with your investment advisor. As always, we're here to help.

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, CIMA, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

1 www.macrotrends.net

2 www.ycharts.com; Cape Cod 5

3 JP Morgan; Zacks; as of 6/30/22

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5