September 28, 2023

Market Commentary

A government shutdown is looming. What does this mean?

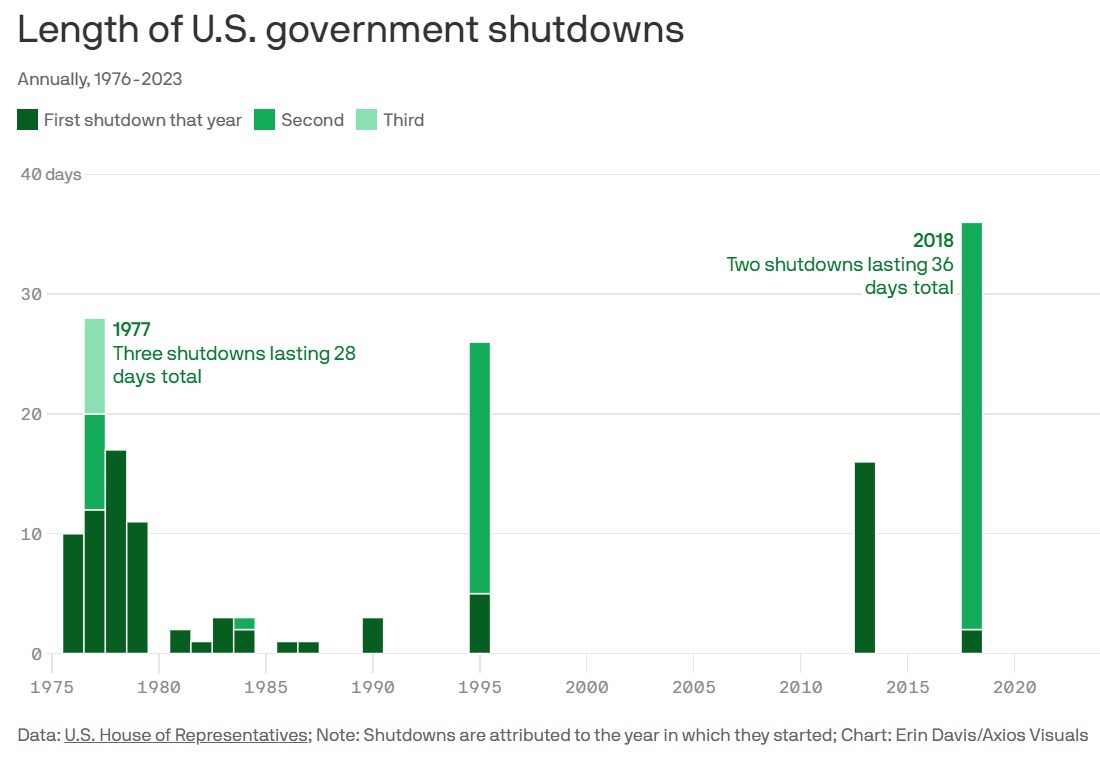

The U.S. government will shut down at midnight on Saturday if Congress has not agreed to a Congressional Budget Resolution for the 2024 fiscal year, which begins on October 1. This process is held up in the House of Representatives where there appears to be little agreement on four proposed spending bills. While this would not be the first time the U.S. government has experienced a shutdown, as depicted in the chart below, there is concern that this time, it could be protracted. The most recent government shutdown due to an inability to reach agreement on the annual budget process occurred at the end of 2018 and into early 2019. It lasted for 34 days, the longest of the 21 gaps in the budget process since 1976.

What government programs and employees will be impacted?

Using the 2018-2019 government shutdown as a barometer, the federal government is already preparing its workforce with contingency planning. We see the following economic impacts as top of mind for many people. Social Security and Medicare payments, along with the mail service, will not be impacted. However, most federal workers’ pay will stop, with non-essential service workers furloughed and those in essential services, such as active military and TSA, expected to report to work without pay. Pay would be reimbursed once the budget is agreed to and funding can begin, although the immediate impact for those living paycheck-to-paycheck could be dire. Those working on contract with the government do not get reimbursed once they can return to work. Nutritional assistance plans like the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), and inspection of health and safety programs would suspend much of their operations. National parks and museums will shutter operations, potentially having the collateral impact of reducing travel expenditures. Given that the government workforce contributes, on average, 25% of GDP, a lengthy shutdown could reduce GDP by 0.2% per week during a shutdown according to research by Goldman Sachs.1

What impact could the shutdown have on investors?

From an investor’s standpoint, there are several impacts to consider.

First, the rating of U.S. Government Debt could change even though a debt ceiling budget was agreed to in May and the government agreed to pay its debts. This year, Fitch downgraded the rating of U.S. debt to AA+ as a result of the lack of collaboration in Congress and the rising level of outstanding U.S. debt. Standard & Poor’s (S&P) downgraded the US debt in 2011 after a similar situation when Congress could not agree on raising the debt ceiling. Now, Moody’s is warning they may downgrade their rating of U.S. debt to Aa1, leaving the U.S. without the top debt rating from any nationally recognized rating agency.

Why does this matter? Generally, the lower the debt rating, the higher the interest rate required by the market. With already higher interest rates due to Federal Reserve actions to combat inflation over the last year, funding costs for the government’s debt burden have increased substantially. While, this could make credit spreads for corporate debt widen, resulting in pressure on bond prices, Fed policy and inflation over the longer term should have a larger impact on bond values. Currently the Fed is projecting two rate cuts in 2024, which would generally result in a positive boost to bond prices.

While we anticipate that the stock market will likely react negatively to a government shutdown, we expect the impact to be short-lived. We look to the most recent shutdown as an example. As seen below, the market (as represented by the S&P 500 Index) reacted negatively to the “minibus” appropriations bills enacted as a temporary measure in October 2018 when Congress could not agree to a full budget. Then, in December 2018 as Congress approached the new budget deadline without progress, the stock market declined precipitously. This government shutdown, which started December 22, 2018, lasted a record-breaking 34 days. By the end of the second quarter of 2019, the market recovered its losses as seen in the chart below. As a reminder, past performance is not a guarantee of future performance, as each situation is unique. There are many variables that impact stock market performance over the long-term, including corporate earnings, economic cycles, inflation, consumer confidence, and employment.

Your team at Cape Cod 5 Trust and Asset Management is diligently monitoring the current situation and the markets. Our process stresses diversification across asset classes, sectors and securities to weather these types of market disruptions. We encourage you to stay the course and we believe your portfolio positioning should remain the same, assuming you have not had any change in personal circumstances or investment objectives. Please feel free to reach out to your team if you have any questions.

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Nancy A. Taylor, CFA, CAIA®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

1 “How much does a US government shutdown cost the economy?”, Goldman Sachs, September 1, 2023

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5