September 23, 2022

Market Commentary

Key Takeaways from the Federal Reserve Board Meeting

As widely anticipated, the Federal Reserve Board (FRB) raised the Fed Funds rate by 75 basis points (0.75%) at the September 20-21, 2022 meeting and indicated continued increases of 75bps and 50bps by year end.

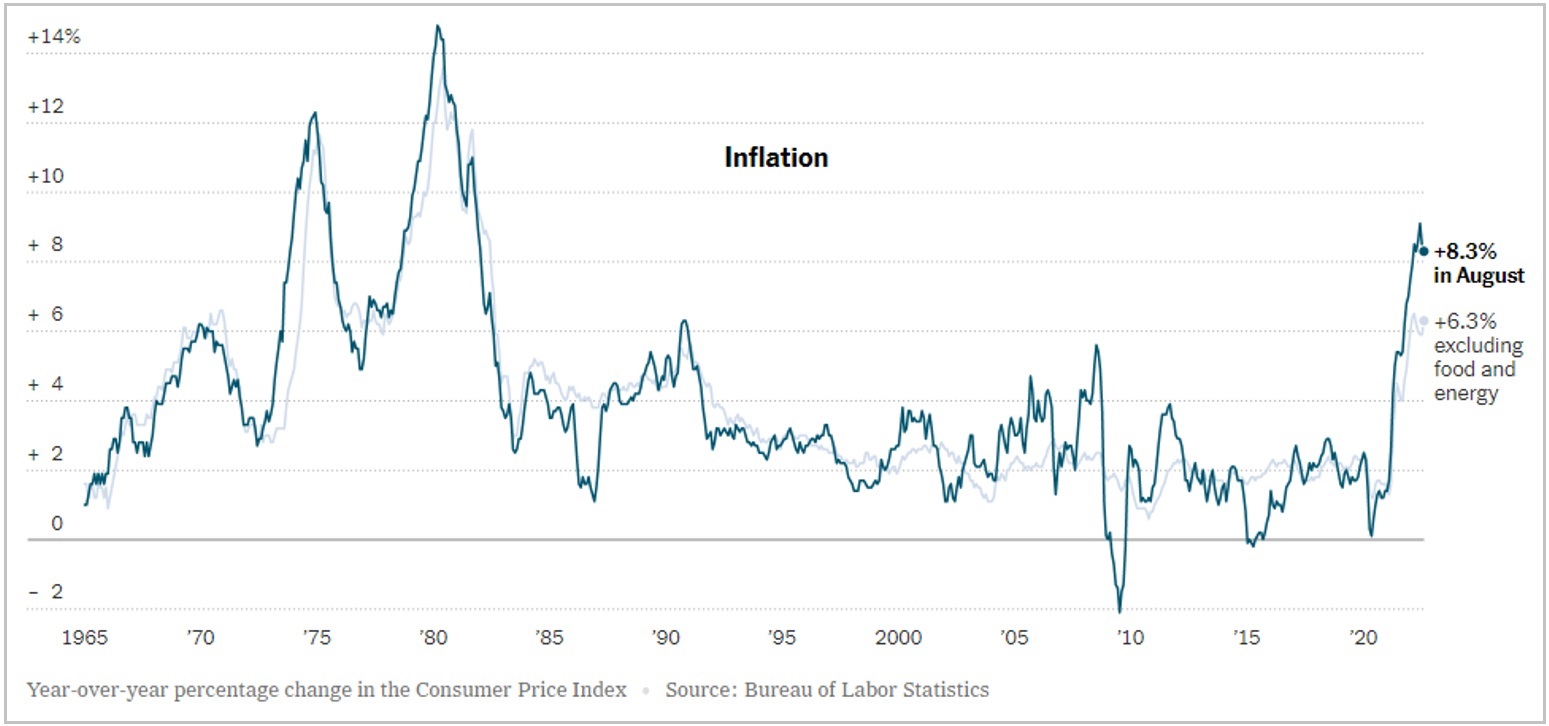

Lessons learned from the pernicious stagflation of the mid-1970s to 1980s are driving aggressive Fed action to avoid a repeat of that cycle. The result is higher rates for a longer period of time, along with expected higher unemployment and lower growth.

The 0.75% (75 bps) rate increase was not a surprise considering that Fed Chair Powell indicated at several recent appearances that the Fed will be very aggressive at lowering the inflation rate using their primary tool: rate increases. In August, Mr. Powell said that restoring price stability "will likely require maintaining a restrictive policy stance for some time." The stagflation of four decades ago resulted in a deep recession and a very high unemployment rate. Back then, inflation started mainly because of a supply disruption in the energy markets due to the Middle East oil embargo.

Inflation today is primarily due to the supply disruptions created by the pandemic of 2020-2022 and the more recent Russian invasion of Ukraine. Energy supply and food supply, as well as manufacturing and transportation, are persistent problems. One week ago the Core CPI (consumer price index without food and energy costs) came in at 6.3% annualized, higher than the previous month. This was a surprise as it was widely expected that the CPI would start to come down, showing signs of relief as gasoline prices fell rapidly three months in a row. In fact, Headline CPI (includes gas and food prices) did come in at 8.3%, lower than the decades-high number of 9.1% in May, but not as much of a drop as anticipated.

The goal of the FRB is to rein in inflation without causing a stagnant or recessionary economy – in other words, to engineer a “soft landing.” One challenge is that data like the CPI is backward-looking and could result in the FRB moving too far too fast in hiking rates. The ripple effect of rate hikes will spread throughout the economy, especially slowing consumer and commercial borrowing, and increasing unemployment. The FRB has indicated they are willing to tolerate this in order to achieve price stability.

The FRB’s quarterly forecasts show Federal Open Market Committee (FOMC) members expect a sharp slowdown of GDP growth of 0.2% this year, then a return to expansion in 2023 with annual growth of 1.2%. The latest FRB dot plot showed a median Fed Funds rate of 4.4% by the end of 2022, increasing to 4.6% by the end of 2023, and then beginning to decline, to 3.9% by the end of 2024, 2.9% by the end of 2025, while the longer-run rate was unchanged at 2.5%. The Fed’s indication of higher rates in the future is dispelling any expectations of a reversal in the coming quarters. The Fed’s attitude seems to be that taking the medicine now is necessary to prevent a worse ailment in the future. With a potential recession looming, corporate earnings projections are being downgraded, hence the recent volatility of both the stock and bond markets.

We continue to monitor the rapidly changing interest rate environment in planning any potential portfolio changes, keeping your objectives in mind and the opportunities created. Tax-loss harvesting and periodic rebalancing are two useful strategies that are key components of our portfolio management. The former strategy allows us to offset realized or future gains, while the latter enables opportunistic acquisitions of attractive securities that may have been previously overvalued. In an ever-changing landscape, we strive to be the constant in your financial world, keeping a watchful eye over your investments.

As always, we’re here to help. Contact us at any time to talk about your investment strategy.

Robert D. Umbro

Senior Investment Advisor

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5