October 2025

Market Commentary

No Tricks, Just Treats: Markets Rally Through October

While the government shutdown and volatile trade headlines concerned investors, broad-based positive corporate earnings and a second fed funds rate cut reassured investors, pushing indices higher again in October.

October Highlights by the Numbers:

- S&P 500 closed +2.27%, its sixth straight monthly gain

- Nasdaq rose +4.7%, its seventh consecutive monthly gain

- Russell 2000 +1.76%, its sixth successive monthly gain

- US Dollar rose 2%, mitigating its double-digit decline

- Gold +3.1%, its fourth monthly gain despite profit-taking late in the month

AI Driven Tech Rally

October gains were narrow and concentrated around AI and chip-related companies. The Equal Weight S&P 500’s October return was negative, declining 1.8% and trailing the S&P 500 by 3.2%.

S&P 500 market leadership came from the technology sector, which was up 6.2%, followed by healthcare up 3.5% and consumer discretionary up 2.4%. Meanwhile, the other eight sectors trailed the S&P index’s nearly 2.3% return, with five of the sectors posting negative monthly returns.

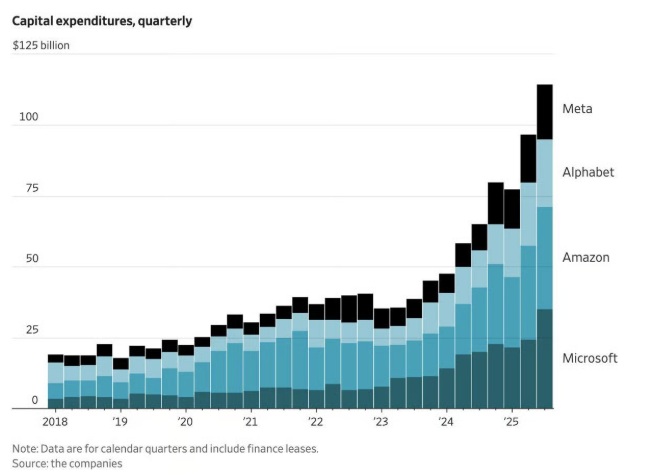

The announcement of many high-profile AI deals and partnerships from the likes of Nvidia, Microsoft and Oracle fueled the momentum. Strong earnings and revenue growth from Magnificent Seven cohorts Amazon, Microsoft, Apple, Meta and Alphabet, along with their continued commitment to capital expenditure (“capex”) spending, reinforced AI’s growth story and the market’s returns.

AI spending expectations have surged over the past year. The chart below illustrates the exponential expansion in capex from AI hyperscalers on a quarterly basis over the past several years. This level of spending has investors wondering if they are overinvesting, to the detriment of future earnings - a question that was raised after Meta and Microsoft reported earnings this cycle.

Source: Wall Street Journal

Earnings on Pace for Double-Digit Growth

At the end of October, 64% of the S&P 500 companies had reported earnings, with 83% beating their earnings estimates and 79% beating top-line sales expectations. Earnings strength from technology, healthcare, and financial companies helped put the third quarter blended S&P earnings growth rate at 10.7%, well above the anticipated 7.0% growth rate expected at the start of earnings season. This all set the stage for double-digit earnings growth for the fourth straight quarter.

An Extended Government Shutdown

The government shutdown negatively impacted market sentiment. The lack of meaningful progress and ongoing disruption to individual and corporate plans and budgets resulted in ongoing tension for the markets.

As this is being written, the shutdown has the dubious honor of being the second longest on record, at 31 days. And it is quickly approaching the unwanted distinction of being the longest as we approach the first week of November.

As the shutdown extends, the potential economic impact grows. Estimates range from a 0.1% to 0.3% negative impact on quarterly GDP for every week the government remains shuttered. Some estimates point out the possibility of an even greater impact, given the economy may already be in a vulnerable position.

Federal Reserve Expresses Uncertainty About Future Actions

The Fed, as expected, reduced the fed funds target by 25bp to 3.75%. What was not expected was the unusual division among governors, with two dissents coming from opposite directions, and Chair Powell’s hawkish comments that warned investors that a December rate cut is not guaranteed.

Chairman Powell expressed some hesitation on any future rate decisions due to the dearth of government data, the gold standard. And while the Fed looks to private and state level data to ascertain economic conditions, he prefers not to “drive in the fog,” making another cut in December “not a forgone conclusion, far from it.” As he said at the October meeting, “What do you do if you’re driving in the fog? You slow down.”

Here’s one last Halloween treat. Historically, a strong market at this juncture, which is defined as up 10% through the end of October, usually leads to a strong finish for the year, with markets gaining on average 4.8% in November and December, according to Bespoke.

We can only hope that the pattern holds for equity investors as we close out 2025.

We’re here for you

As always, your Cape Cod 5 team of advisors is here to help guide you through uncertainty. If you have any questions, please reach out to us.

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.