“Mega–MAAA”: The Influence of Size and Momentum in 2020

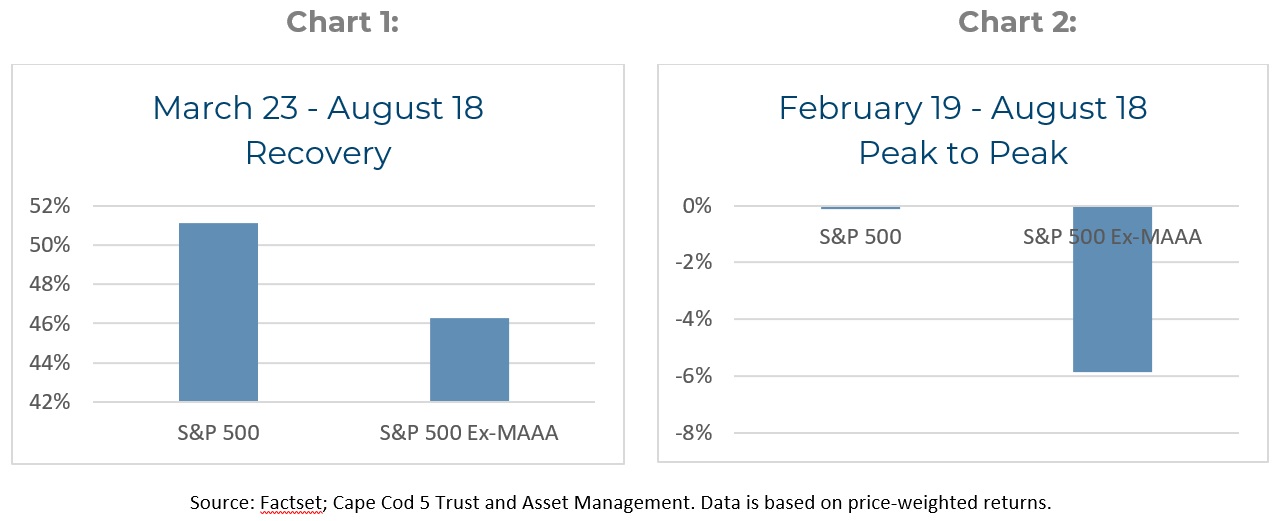

Building on an exceptional 2019, the S&P 500 reached an all-time high on February 19, 2020. Almost exactly six months later, the S&P closed at a new all-time high. In between, however, the S&P lost 34% over 23 trading days – the fastest drawdown of that magnitude. Over the next 121 trading days following the decline, the S&P 500 rebounded 51.5% - the fastest recovery ever. Setting aside the “why” for another day, the drawdown and subsequent rebound have been record-setting, but what has been the driving force behind this rally?

In the U.S., there are four publicly-traded companies with a market cap exceeding one trillion dollars – Microsoft, Apple, Amazon and Alphabet, or “Mega-MAAA”. The influence these mega-cap companies had on the overall S&P 500 recovery was significant (Chart 1). Perhaps even more noteworthy, from the February peak to the August peak (Chart 2), the S&P 500 would have posted an almost 6% loss without these four titans.

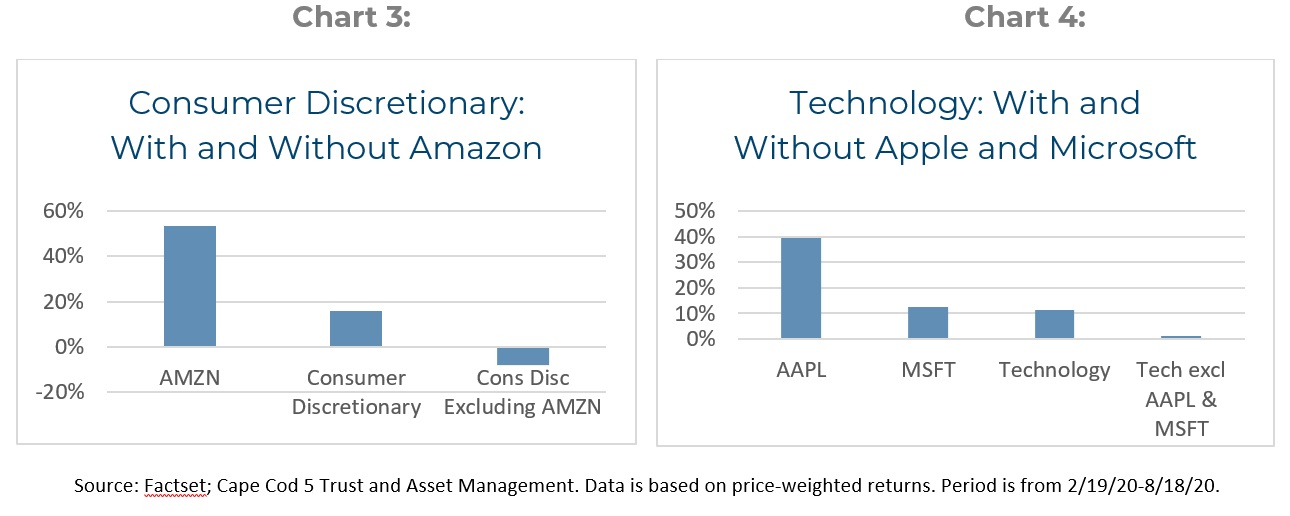

At a glance, people might categorize these companies as “Big Tech”, but this is not quite accurate. Alphabet (Google) resides in the Communications Services sector, representing approximately 23% of the sector. Amazon can be found in Consumer Discretionary, representing roughly 24% of that sector. Only Apple and Microsoft are actually in the Technology sector. Their combined weight is 46% of the sector!

Each company’s influence on its respective sector is more significant than their impact on the S&P 500. Without Amazon’s 50%+ return, the Consumer Discretionary sector would flip from a gain to a loss in the peak-to-peak period (Chart 3). Without Apple and Microsoft, the Technology sector would have experienced a performance drop of 10% over the same period (Chart 4).

With a peak-to-peak average weighted performance of 26.65% for these four Mega-MAAA stocks (vs. -0.11% for the S&P 500) and a size advantage that requires the combined market-caps of the next 26 companies in the index to match, these companies’ influence on the broader index results is huge. Bottom line: the story of this market rebound is that these trillion dollar titans are carrying this rally.

Contact our Wealth Team More Market Insights from Cape Cod 5

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Lee C. Gatewood, Senior Investment Officer

Jonathan J. Kelly, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®,CIMA, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Christopher E. Chen, Investment Analyst

These facts and opinions are provided by the Cape Cod Five Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.