February 1, 2023

Market Commentary

The National Debt Ceiling: What is Happening & What You Should Know About It

Entering 2023, many of the same concerns that dominated markets in 2022 remain: high inflation, rising interest rates, slowing economic growth and declining corporate profits. Investors and policy makers are now confronted with an additional brick in the wall of worry – the debt ceiling – adding to an already palpable level of uncertainty.

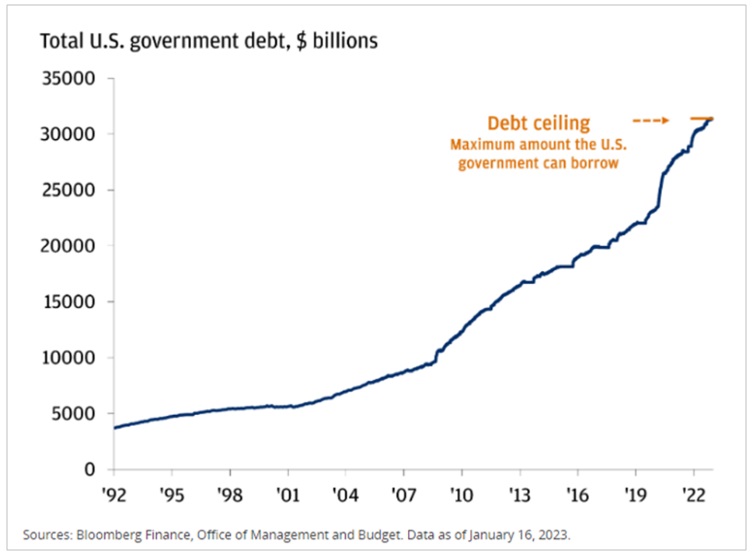

The debt ceiling represents the maximum amount the U.S. government can borrow to fund its operations and make interest payments to owners of our government-issued debt. Historically and consistently, our national budget has run a deficit with more outlays than inflows, and the government looks to the Treasury to sell bonds into the market to finance the difference. The debt ceiling has been in existence in some form since it was established by Congress in 1917. Since World War II, the debt ceiling has been raised or suspended 102 times to facilitate an increase in borrowing needed to fund our budget shortfalls.1

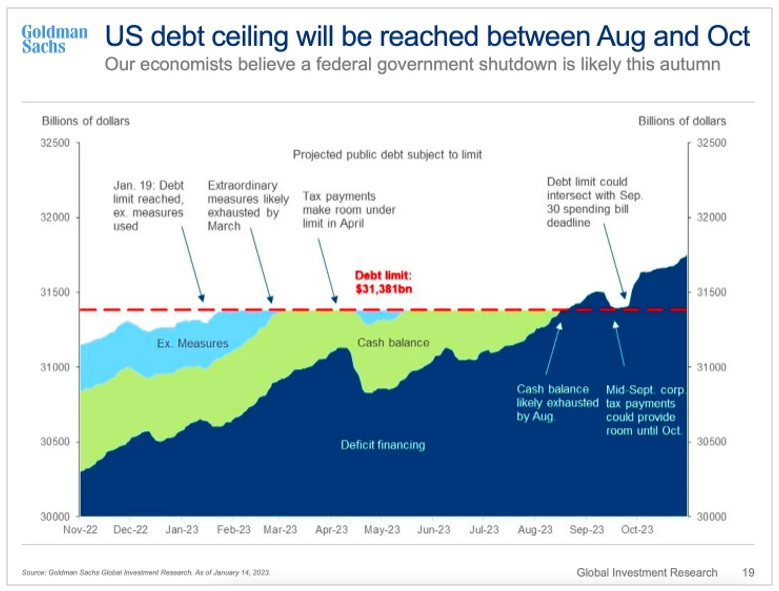

As we write this today, our current $31.4 trillion maximum level of debt has been reached, triggering the Treasury to operate under what’s called “extraordinary measures” while waiting for Congressional approval to increase our government’s borrowing power. Until then, the Treasury will be utilizing a combination of tax revenues and selective funding to honor its obligations, with economist estimates suggesting we have several months before any serious consequences.

To be clear, the Treasury has not confirmed how long they can fund operations before exhausting their cash balances. The Congressional Budget Office’s updated budget release in early February may provide further guidance. It sounds ominous and pundits agree that an ultimate default could have catastrophic global economic and market impacts.2

Many times before and as recently as 2021, our country has been at this crossroad with a smooth resolution. Yet today’s concerns with respect to the government’s continued reliance on debt, its ballooning budget deficit and the inability of policy makers to find common ground, could result in further uncertainty in the markets, manifested by heightened volatility.

The most contentious debt ceiling debate in recent history was in 2011, where parties were unable to reach an agreement to raise the debt ceiling until two days before funding would have been exhausted. In this case, despite averting a crisis in the final hour, the political impasse had far-reaching ramifications. Consumer confidence plummeted, U.S. economic policy uncertainty hit a record high, the dollar tumbled, credit spreads widened to reflect greater risk levels, short-term treasury yields soared, and the S&P 500 declined 17% in the weeks preceding an agreement. Despite ultimately raising the debt ceiling, Standard and Poor’s downgraded our debt rating from AAA to AA+ based on the dysfunction of policy makers. Intermediate and longer dated treasuries remained the perennial safe haven in times of uncertainty, with their yields falling and prices rising, as investors flocked to U.S. government debt despite the threat of downgrade and default.3

With the economy and markets already under pressure from restrictive monetary and fiscal policy and with 2011 as a stark reminder of the risk around the debt ceiling debate, we are optimistic that House and Senate members will work together to avoid damaging the full faith and credit of the United States. If we look to history as a guide, the debt ceiling debate may be protracted, but will ultimately be resolved with a default averted. In the interim, we counsel our clients to remain invested and resolutely focused on the long-term, especially during times of unexpected volatility.

We appreciate the confidence you place in Cape Cod 5 as your trusted financial advisor to help you navigate times of uncertainty like these, and encourage you to reach out to your relationship team if you have questions or concerns about your unique position.

1 Guess Who’s Back, Back Again: Debt Ceiling Drama | Chase

2 Debt ceiling: What it is and what it means for you | Fidelity

3 Your Guide to the Looming Debt Ceiling Showdown (bluematrix.com) | Wells Fargo

Rachael Aiken

Rachael Aiken

Senior Investment Advisor

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5