May 2025

Market Commentary

A Tale of Two Markets: Equities Soar, Bonds Stumble

In May, domestic equities surged while bonds faced significant challenges, creating a stark contrast in market performance. The S&P 500 rose over 6%, marking its strongest May since 1997 and the best monthly gain since November 2023. Conversely, bond markets experienced volatility, with yields climbing and prices falling, highlighting that this is once again a tale of two markets.

The S&P 500 turned positive for the year on May 13, fueled by optimism over tariff relief following de-escalation in U.S.-China trade tensions and a delayed 50% tariff deadline for the European Union, now set for July 9. However, stalled trade negotiations raise doubts about meeting this deadline, potentially reintroducing reciprocal tariffs. Sector performance was led by Technology (+10.79%), followed by Communication Services (+9.61%), Consumer Discretionary (+9.38%), and Industrials (+8.63%). Healthcare lagged, declining 5.72%.

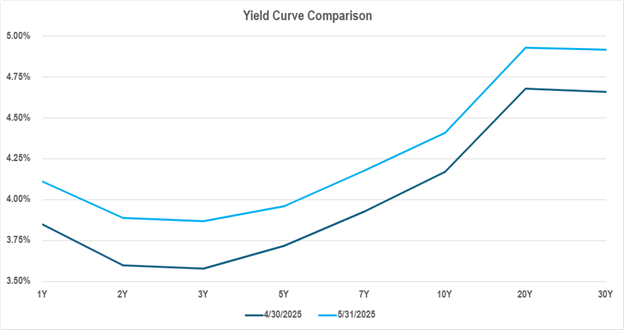

In contrast, the bond market endured a sell-off, pushing Treasury yields to notable highs. The 30-year Treasury yield crossed above 5% before closing at 4.93%, up 25 basis points. The 10-year note reached 4.6% mid-month, ending at 4.42% (+24 basis points), while the 2-year note peaked at 4.05%, closing at 3.91% (+29 basis points). Several factors drove this turmoil, including shaken investor confidence in U.S. fiscal policy amid rising deficits and tariff uncertainties. Persistent inflation concerns, largely tied to President Trump’s tariff policies, and the Federal Reserve’s projection of only two rate cuts in 2025 further pressured yields.

Source: FactSet

A pivotal event was Moody’s downgrade of the U.S. credit rating on May 16, citing the nation’s $36.1 trillion debt and the fiscal impact of a proposed Republican tax-and-spending bill expected to add trillions more. This downgrade intensified Treasury market selling, particularly after a poorly received $16 billion 20-year bond auction on May 21, where yields hit 5.104%. The downgrade also raised concerns about increased Treasury issuance to fund borrowing needs, compounded by fears of eroding foreign investor confidence and strained market liquidity, though no immediate data confirmed widespread foreign selling.

The equity rally reflects short-term optimism, while bond market turbulence signals deeper concerns about U.S. fiscal sustainability. Investors may face potential volatility ahead, but for now let’s enjoy the equity market’s return to positive performance for 2025 and the carry provided by higher yields in bonds.

Your Cape Cod 5 team of advisors is here for you. Please reach out if you have any questions or concerns.

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.