Message from the Chair and CEO

For Cape Cod 5, 2019 was a year marked by adapting, embracing change and innovation, and being willing to learn and try new things. We also made it clear what will always remain the same: our core values of fairness, mutual respect and the highest ethical standards and trustworthiness.

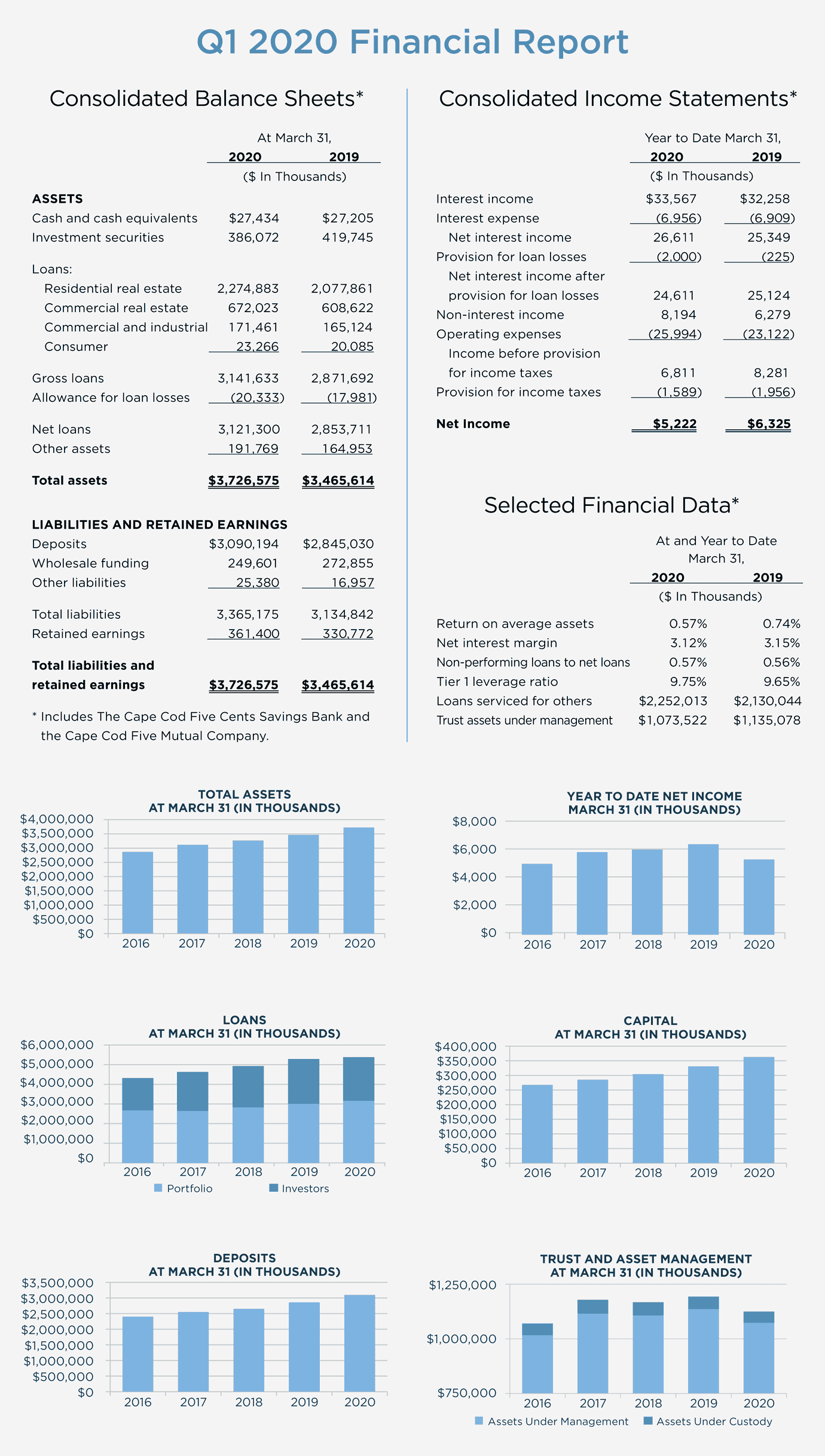

Never did we imagine that those two elements – adapting to change and standing firmly on our core values – would be drawn on in such a dramatic way as they have been for the last several months. 2020 has, so far, been a year like no other. Therefore, we feel compelled to include the first quarter of this year in this first-ever digital-only Annual Report.

While it may feel like anything from 2019 might be a lifetime ago given the dramatic and unwelcome change that has upended our world, from our perspective, our financial strength and progress toward goals within that prior time strengthened our ability to address the challenges we are now facing and support our customers, communities and employees during this time. So there is merit in touching on some of the highlights.

Financial Strength & Accomplishments

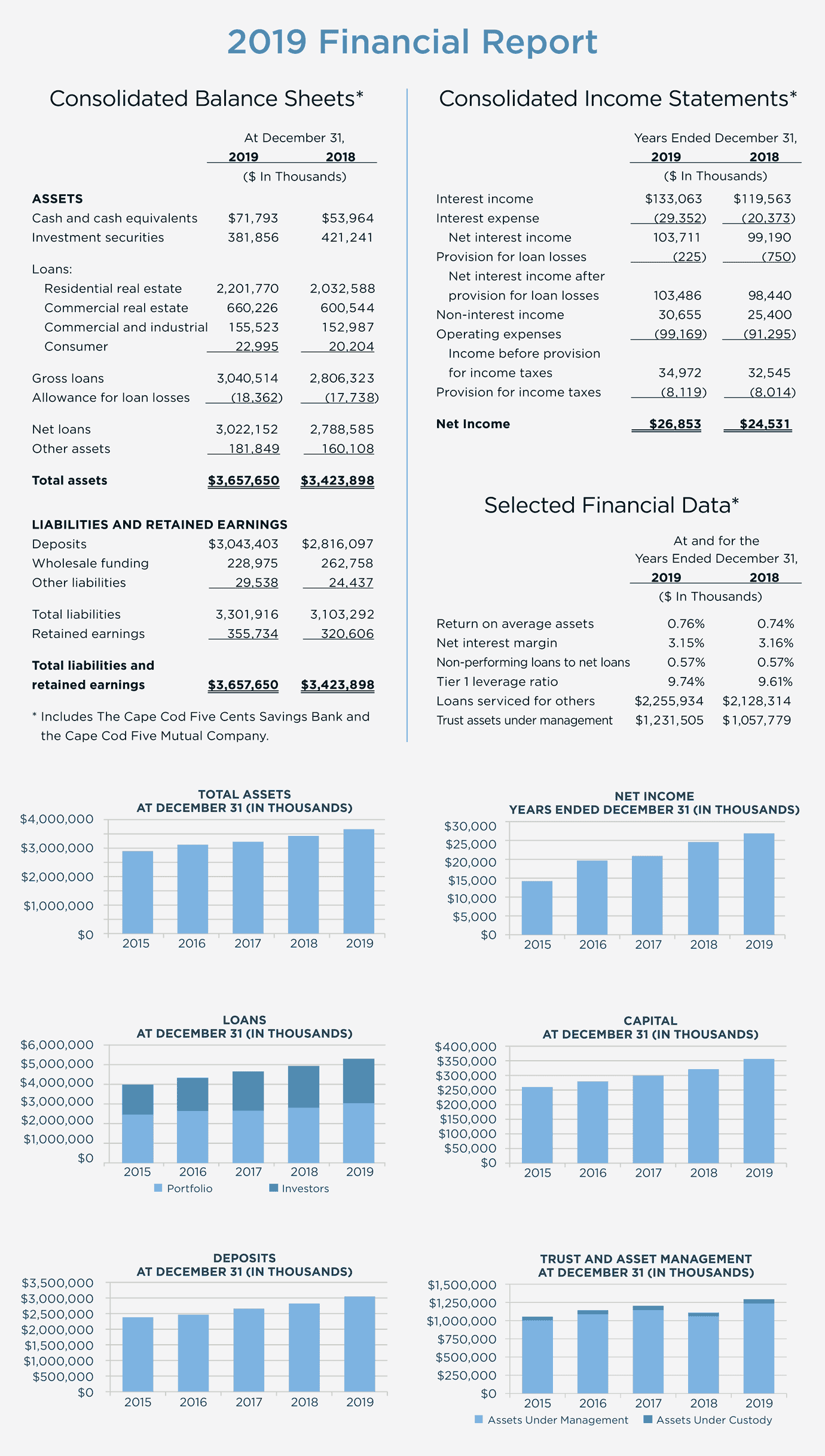

The Bank achieved record earnings with net income of $26.9 million, representing a 9.5% increase over the prior year. This equated to a return on average assets of 0.76%, which marks a 13-year high for the Bank. This was driven by strong business line results as our employees worked together to serve the needs of our customers while leveraging the important advancements we’ve made in digital technologies and processes.

Total assets grew by 6.5%, ending the year over $3.6 billion, driven by strong growth in both loans and deposits. Residential and consumer loan volume of $1.1 billion marked an all-time high and the commercial loan portfolio totaled $816 million at year end, up 8.3% for the year. Deposits increased 8.1% for the year, representing our highest deposit growth rate since 2012 as we gained market share in virtually every market in which we have a Banking Center. Assets under management totaled $1.2 billion, up 16.4% year-over-year as a result of strong market performance and new business. Capital increased to $355.7 million, driven by the strong earnings, and the Bank remains well capitalized according to all regulatory definitions.

Growth & Investments in the Future

We started 2019 by cutting the ribbon on our new Banking Center at The Pinehills in Plymouth and ended the year with the opening of our Hyannis Route 132 Banking Center. We also announced plans for a full-service location in Provincetown, scheduled to open this year.

One of the more visible strategic accomplishments for Cape Cod 5 in 2019 was the completion of HQ5 – our new headquarters in Hyannis – which will enable us to advance all of our strategic goals, support our customers and community for decades to come, and stands as a pillar of our environmental stewardship.

Throughout the year, the Bank continued to expand its ability to serve as our customers’ trusted advisor through the expansion of our digital capabilities and offerings. We worked to further enhance the Bank’s culture and were proud to once again be named one of the Boston Globe's Top Places to Work and one of American Banker’s Best Banks to Work For.

Looking Ahead

The current economic, societal and public health stresses make us feel even more committed to our mission as a responsible employer, trusted financial partner and corporate citizen. All the effort that has been invested over the last several years into providing many alternate methods of banking with us – online, via mobile and through our new fleet of ATMs – has empowered our customers to continue to carry out most of their banking needs safely from their home or office or by visiting us at a drive-up.

We are committed to continually looking for opportunities that have and will arise to carry out and expand our mission. As challenging and difficult this time is for so many, it has shone a bright light on the strength and resilience of our region and its residents – as well as the 560 innovative and committed employees of Cape Cod 5. And it reminds us of the fact that the only way that we get through this is together. Our promise is that we will continue to be here for you today, tomorrow and every day. Just as we have been throughout our 165 year history.

With gratitude,

Dorothy A. Savarese

Chair & CEO

Cape Cod 5

In this Report

________________________________________

2019 Review | COVID-19 Response & Relief Efforts

Awards and Recognition | Financials

Senior Leadership Team | Trustees & Directors and Corporators

About Cape Cod 5

2019 | Laying the Groundwork for 2020

2019 Review

Cape Cod 5's accomplishments in 2019 strengthened our ability to address the challenges we are now facing - as a community and a nation - and expanded the foundation upon which we are building our forward-leaning efforts. The advancements in technology and investments in the future made during the previous year have allowed us to very quickly adapt and evolve to meet our customers' and communities' needs during the COVID-19 pandemic and its impact.

Our financial strength, long-standing resiliency and the tireless dedication of our employees will continue to enable us to stand by you as we navigate through this difficult time together.

Published: April 28, 2020

Market Review - First Quarter 2020

We are in the midst of a health and human life crisis. And yes, an economic crisis as well. For perhaps the first time ever on a global scale, the world made a conscious decision to value human life over economics. Adopting behavioral changes, namely shelter-in-place and social distancing, as the best measure to mitigate the spread of the coronavirus will save thousands, probably millions of lives. The economic cost, in the short run, will be significant.

In these anxiety-fueled times, it’s easy to come up with a list of why we should abandon our financial plan. In an environment where bad news overwhelms good, it can be hard to lose sight of the strength and resiliency of the human spirit. Without fail we move forward, progress and advance for our benefit, our families and communities. That’s what we do. That’s why we will get through this. Businesses will restart, jobs will reappear and markets will recover.

Economy

Going into 2020, the U.S. and global economy was well-positioned for another year of steady yet moderate growth. That all changed with COVID-19. Out of necessity to prevent a global health and human life crisis, governments made the difficult decision to essentially shutter their economies.

In an effort to curtail some of the damage, massive global synchronized relief programs were quickly rolled out, led by the U.S. Federal Reserve twice cutting rates, dropping the overnight lending rate back to 0 -.25%, all-time lows not seen since the great recession. The Fed also launched more than a half dozen programs to create liquidity in the financial system, including a $700 billion commitment to purchase Treasury, agency and mortgage-backed securities, and restarting quantitative easing (QE).

The Federal Government followed with the passage of the CARES Act, a $2 trillion dollar relief program designed to help Americans bridge the period between now and when we get “back to business.” Will it be enough? We don’t know yet. We do know policy officials have acted quickly and aggressively and have publicly stated they will continue to do so.

We also know the economic data is going to be bad. Really bad. Estimates for second quarter GDP are significantly negative. The range is wide. Really wide. It almost doesn’t matter. What matters more is “how long” things will remain this way. Earnings season, which starts unofficially in mid-April, will shed more light on this question. Over the course of about six weeks we will hear publicly from CEOs of major U.S. companies about their outlook. A consensus around “how long” will begin to take shape.

Weekly initial unemployment claims surged from about 200,000 (March 14) to 3.3 million (March 21) to 6.65 million (March 28) - the highest ever recorded. Last month’s Labor Department nonfarm payroll reported 5.8 million unemployed (3.5%); that will jump to at least 5.5%. Some estimates call for the unemployment rate to top 20% in the weeks and months ahead.

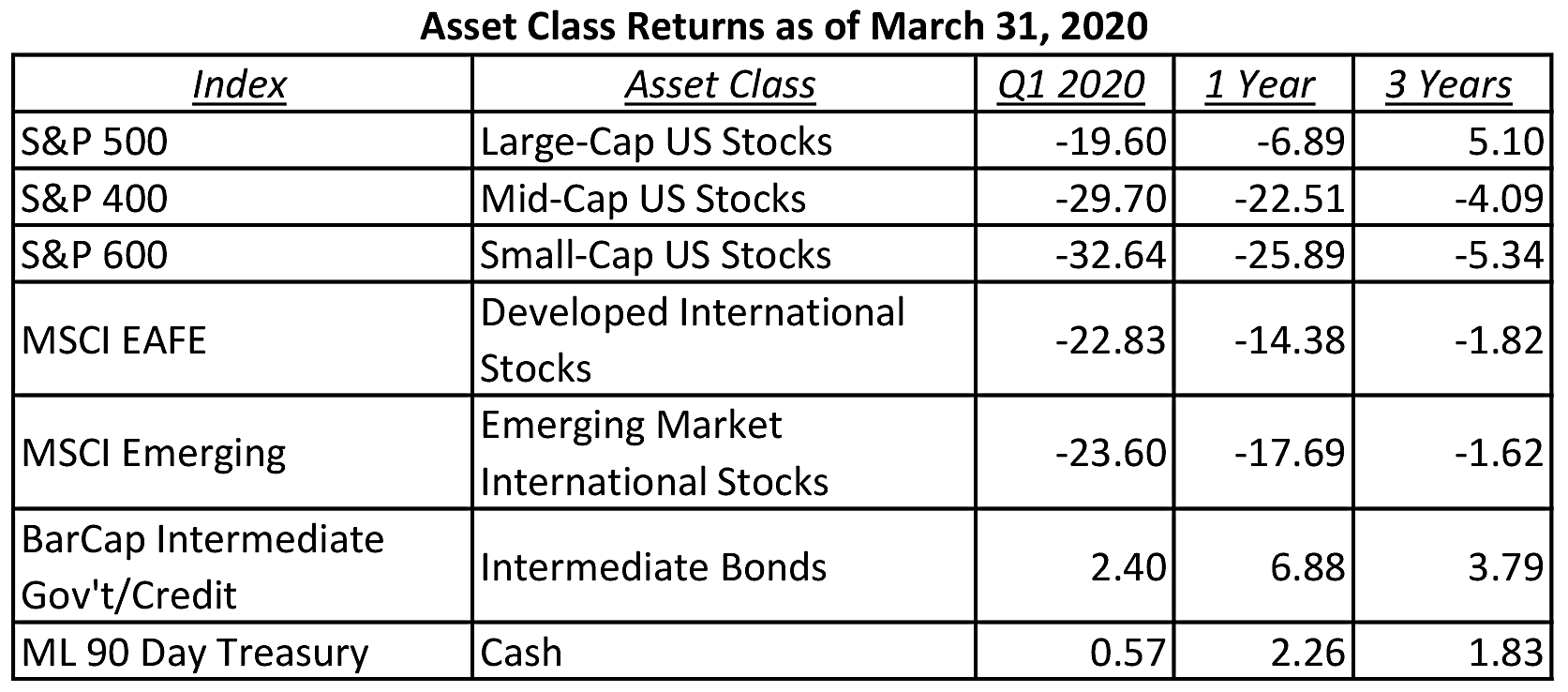

Equities

After a year of relative calm, the first quarter of 2020 upended the status quo with a period that will go down as one of the most volatile three months in the history of the stock market. The speed and magnitude of the stock market reaction to the coronavirus is unprecedented.

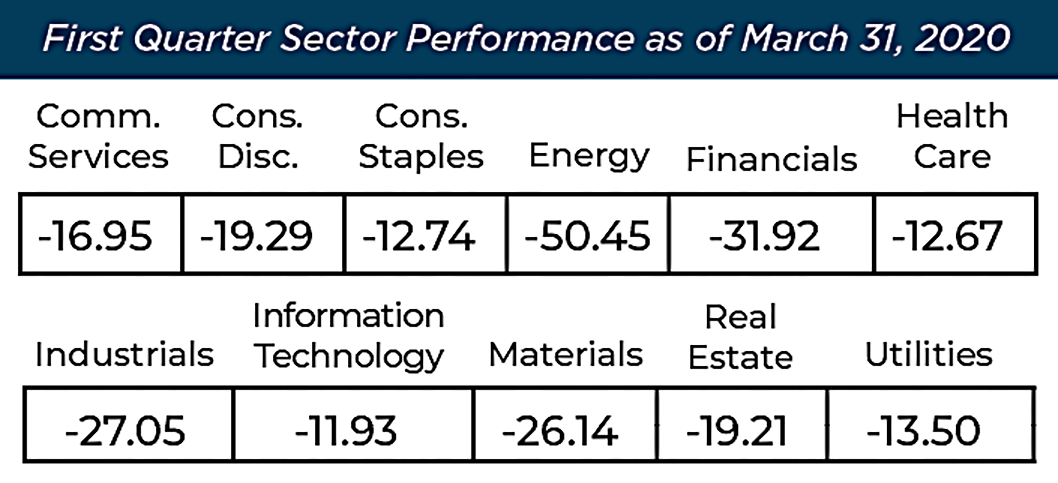

The first 33 days of the quarter were a continuation of 2019, as the S&P 500 moved higher in a steady and calm fashion rising 4.8% to the all-time high of 3,386.15 on February 19. Then, with the reality of the impact of COVID-19 setting in, the last 29 days of the quarter were dramatically different. In just 23 days, the S&P 500 dropped 33.9% to 2,237.40 by March 23. The next three trading days saw the S&P soar 17.6% only to give up and claw back gains throughout the final days of the quarter. In the end, the S&P 500 lost 19.6% for the quarter - the worst first quarter since 1938. Small-cap stocks fared worst losing 32.64%. Mid-cap stocks dropped 29.70%. All sectors suffered double-digit declines. Energy, hit by COVID-19 and a price war between Saudi Arabia and Russia – two of the largest producers - lost more than 50%.

March was the most volatile month on record with an average daily swing of 4.8%. Only four days saw swings of less than 1%. Truly unprecedented.

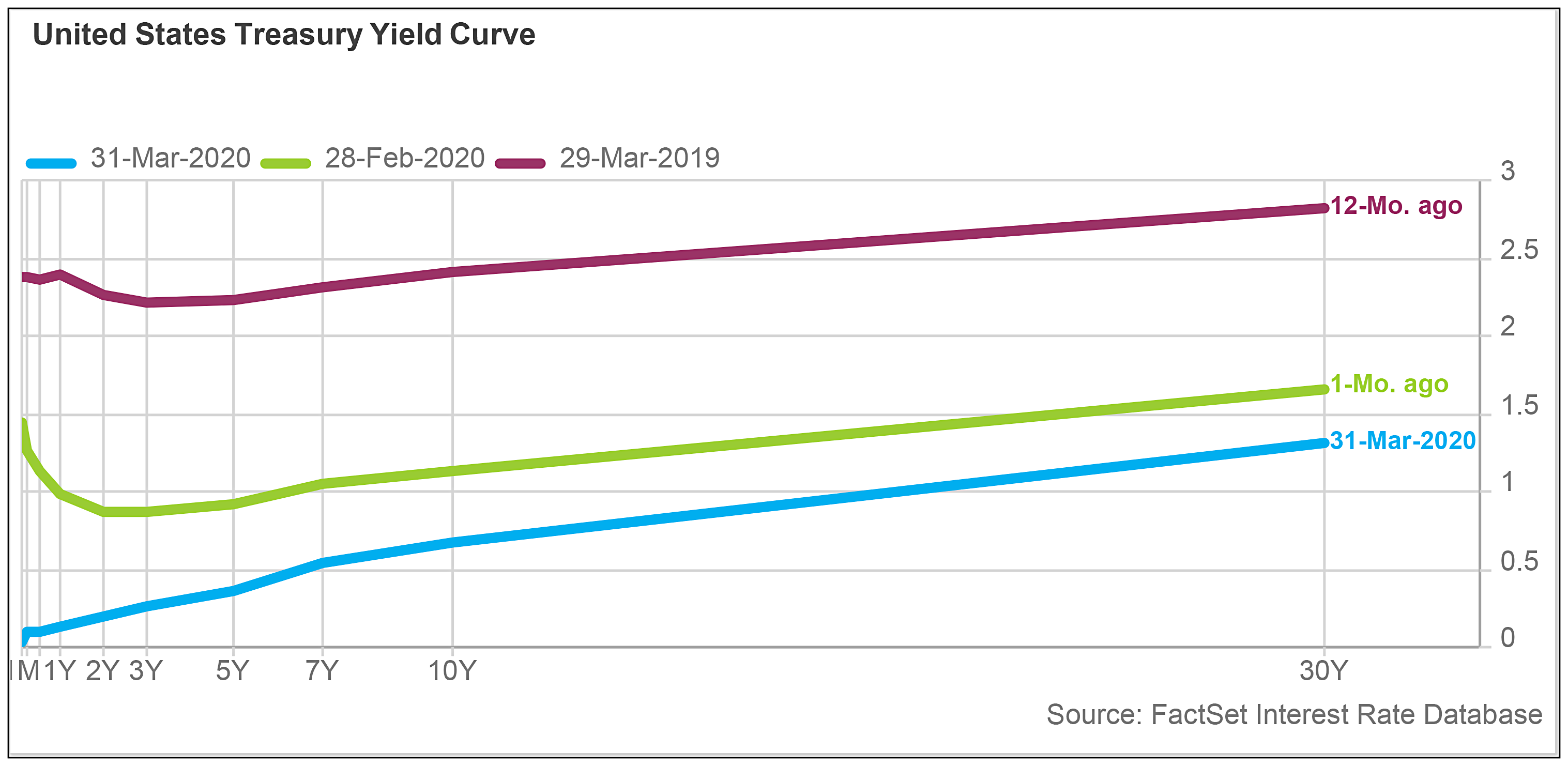

Fixed Income

While the Dow and S&P 500 grabbed most of the headlines with their jaw-dropping daily swings, bonds saw their fair share of crazy. The 10-year Treasury yielded 2.2% at the start of 2020. On March 8, yields hit all-time lows of .318%. On March 25, short-term Treasury bills (90 days or less) turned negative. High-quality municipal bonds lost more than 10% at one point as volatility spiked and bid/ ask spreads widened dramatically. The Fed’s quick action, injecting an enormous amount of liquidity through purchase programs, had a much-needed stabilizing effect. By quarter end the yield curve normalized, albeit at much lower rates. For the quarter, intermediate-term bonds returned 6.88%, providing a much needed ballast for stocks.

With rates so low and limited appreciation potential, the case for high-quality short maturity bonds becomes difficult when viewed through an income lens. Today, value is derived through the diversification benefits bonds provide against equity markets.

Final Thoughts

“Stay the course” is an often-used phrase by financial advisors during difficult market periods; unfortunately it does little to reassure investors that the financial future they envision is still intact. As investment professionals we know markets don’t always deliver – it’s part of the risk/return tradeoff. A good plan accounts for these periods of market declines.

Although the timing and magnitude is never certain – it’s one reason why staying invested is important – action that we can take is. Below are just a few things we have been doing:

1. Risk-Adjusted – selling high (bonds) buying low (stocks). This exercise alone can improve risk-adjusted returns considerably.

2. Tax loss harvesting – for many, the last 10-year bull market has created embedded unrealized gains. Selling appreciated securities in early 2020 to “rebalance” reduced equity exposure (selling high) but created a tax liability (capital gain). Using the market pullback to pair losses with gains reduces any capital gains tax liability. For those in higher tax brackets, this exercise can create a tax asset of up to 23.4% on unrealized losses.

3. Portfolio optimization – market selloffs provide opportunities to realign sector weights and security weights for better downside protection.

4. Anchoring to the plan – revisiting planning assumptions and accumulation goals ensures any values outside of acceptable ranges are identified, discussed and addressed.

5. Asset class and security selection – market selloffs can offer opportunities to add holdings at attractive prices.

The longest U.S. expansion on record is over. A recession (technically defined as two consecutive quarters of negative GDP) is expected, from which a new cycle will begin. A better time is ahead.

Since 1928, through 14 recessions and 21 bear markets, equity markets have never failed to regain a prior peak, and this time will be no different. The drivers in the next cycle most likely will differ from previous cycles.

Consider how we have adapted to change over these last few weeks. The foundation for the next cycle is already forming and the investment team has been working hard to make sure our clients are well positioned.

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Lee C. Gatewood, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Christopher E. Chen, Investment Analyst

These facts and opinions are provided by the Cape Cod Five Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

.jpg)