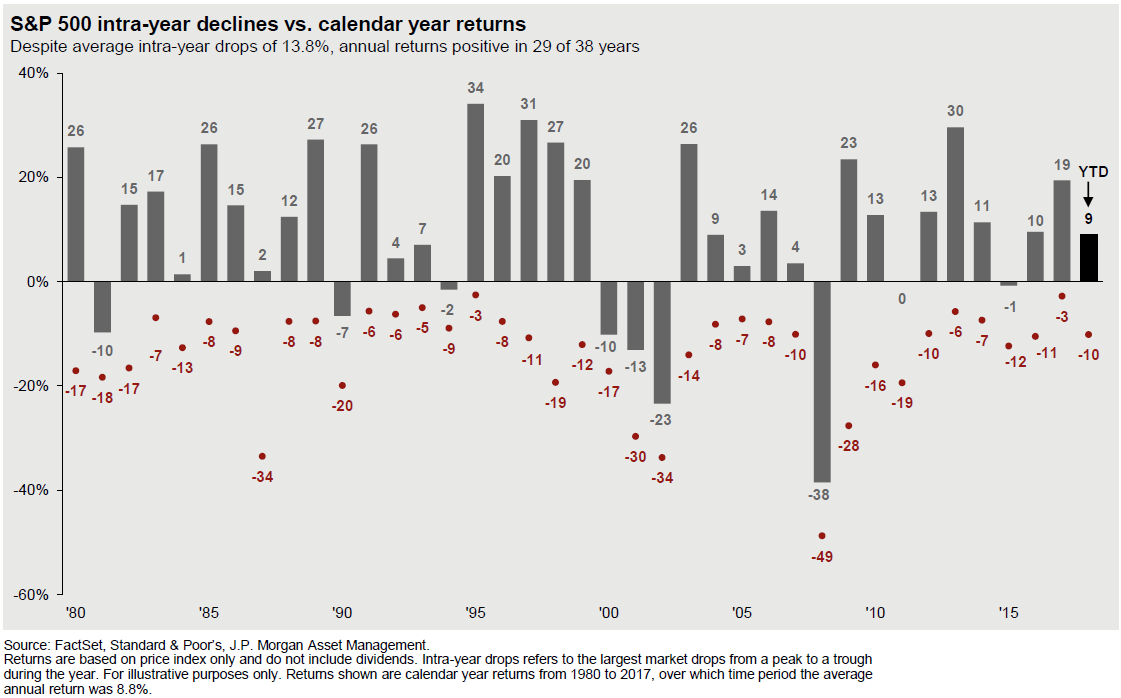

Intra-Year Declines

Investors are once again being reminded that the stock market does not advance in a straight line. Historically, corrections of 10% or more are a normal part of the market cycle. Over the last 38 years the average intra-year drop has been 13.8%. Only two years over the period experienced drops of less than 5%, yet full calendar year returns were positive more than 75% of the time, reinforcing the connection between risk and return.

While repeated days of stock market declines are worrisome, a correction on the level recently seen falls within historical norms and is considered part of a healthy market cycle by many. Absent weakening economic fundamentals, these selloffs typically do not persist beyond several months and brings market valuations to more reasonable levels.

Stock market volatility can be managed by adequate diversification and a balanced approach to portfolio construction. If you would like to learn more about managing risk, retirement planning, or other wealth management issues, please contact a member of our Wealth Team.