Market Review Q1 2024 | Market Review Q2 2024 | Market Review Q3 2024 | Market Review Q4 2024

Market Review Q1 2025 | Market Review Q2 2025 | Market Review Q3 2025

Fourth Quarter 2025

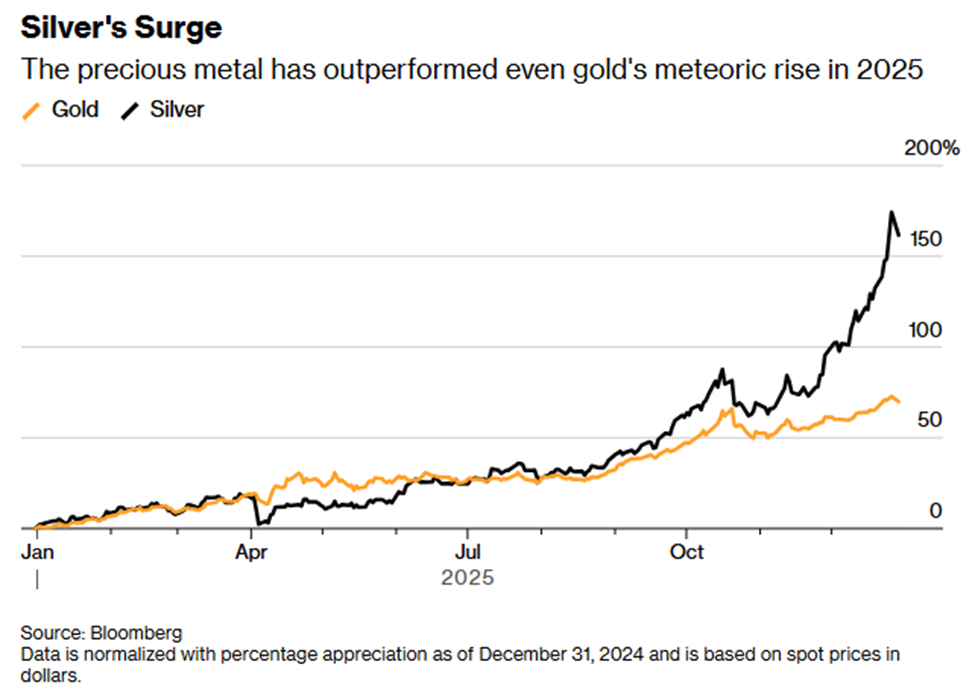

Silver and Gold Lining in a Cloudy Quarter

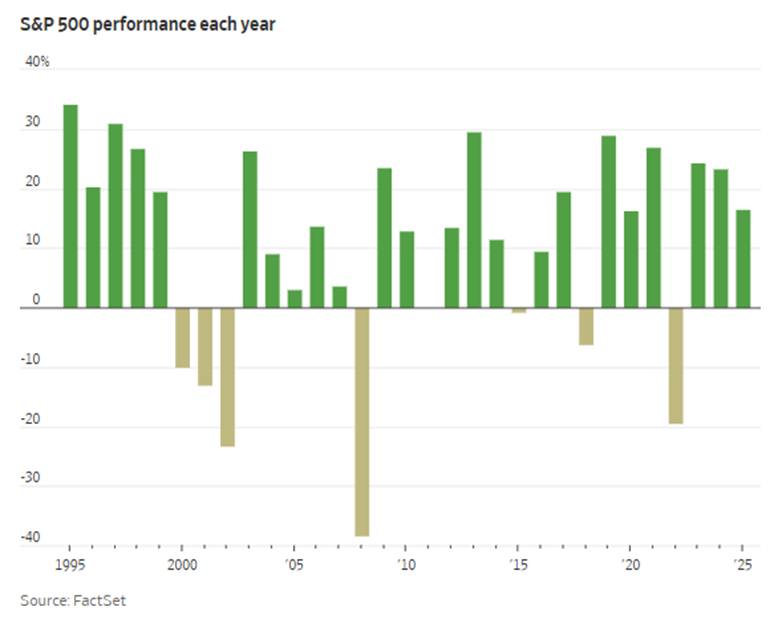

As 2025 came to an end, investors breathed a sigh of relief, with equity markets posting the third consecutive year of double-digit positive returns. Navigating the markets and economic policy was especially challenging in the fourth quarter due to limited statistical data, evolving trade agreements, uncertainty around the impact of tariffs on corporate earnings and demand, and changes in the labor force that clouded the decision-making process. The silver lining in this tumultuous year was precious metals, the prices for which soared as investors sought to diversify and hedge risks.

The fourth quarter was especially foggy, with a 43-day government shutdown that began on October 1, eliminating data from the U.S. Bureau of Labor Statistics and the U.S. Bureau of Economic Analysis – the gold-standard sources of information on GDP, jobs, and inflation. The Fed, investors, business leaders and economists leaned on alternative sources, such as private employment data from ADP and anecdotal information gleaned from credit card companies, real estate organizations, and employment websites such as LinkedIn.

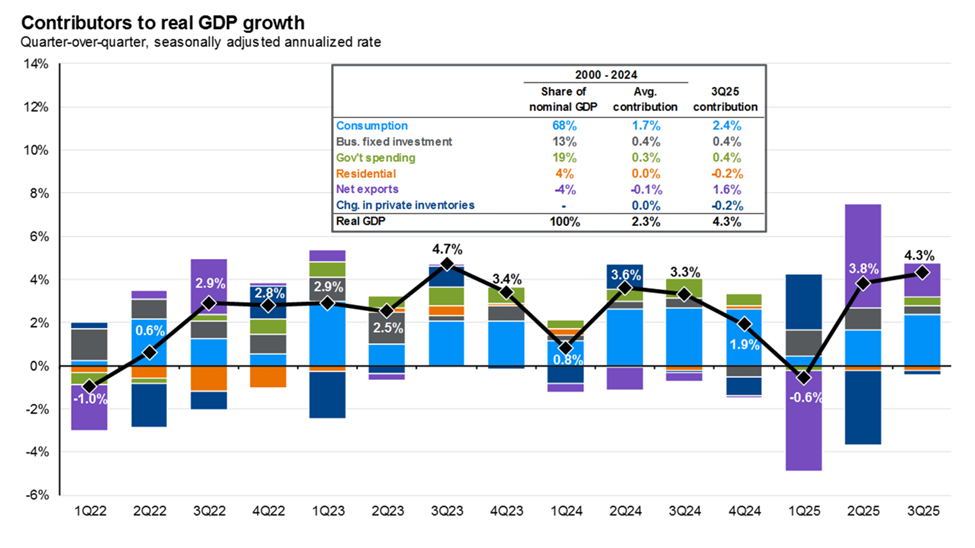

GDP (Gross Domestic Product) for the third quarter was estimated at a 4.3% quarter-over-quarter increase, the highest reading since the third quarter of 2023. This followed GDP coming in at -0.6% in the first quarter and 3.8% in the second quarter. Growth in the third quarter was driven by increases in consumer spending, exports, and government spending, partially offset by decreases in imports and corporate investment. It appears that some of the distortions in the first half of the year, when imports surged as companies built inventories and consumers bought goods ahead of tariffs, have now dissipated.

Source: BEA, FactSet, J.P. Morgan Asset Management.

Guide to the Markets - U.S. Data as of December 31, 2025

The employment market, recently characterized as a “no hire, no fire” environment, remains murky. Demographic shifts are clearly underway, with the retiring baby boomer generation and fewer immigrant workers reducing the number of people looking for employment, thereby shrinking the available labor pool. Less clear is the demand side, as cautious employers may be hesitant to hire amid concerns regarding a potential slowing of the economy. Additionally, productivity gains may be limiting new job growth.

With that as a backdrop, the unemployment rate increased in November to 4.6% from September’s 4.4% level, higher than expected, and the highest level since September 2021. Notably, there is no unemployment reading for October as the data was not collected and will not be replicated due to the government shutdown. After several years of above-average wage increases, wage growth in November came in at 3.5%, down from 3.7% in October and the lowest level since May 2021. Nonfarm private payroll growth remained tepid in 2025 after the largest revision ever reported in September reduced payroll growth by 911,000 for the one-year period ending March 2025. Government payrolls declined by 162,000 in October and a further 6,000 in November, following the expiration of severance packages for furloughed workers. Manufacturing payrolls also saw back-to-back declines, falling by 9,000 in October and 5,000 in November.

Inflation data for October and November was also unavailable due to the shutdown. Once the data was reported in December for an abbreviated portion of November, the rate of inflation appeared surprisingly tame, possibly due to changes in the way the Bureau of Labor and Statistics is now calculating inflation. Headline Consumer Price Index (CPI) rose 2.7% on an annualized basis in November from 3.0% in September, and Core CPI dropped to 2.6% in November from 3.0% in September.

The Fed’s dual mandate of promoting maximum employment and maintaining stable prices (controlling inflation) was especially challenging in 2025, with Fed Chair Jerome Powell likening policy making to driving in fog. The Federal Reserve also faced mounting pressure from the new Administration to significantly reduce rates, testing its independence. The Fed was forced to strike a delicate balance of gauging perceived weakness in the labor market with a potential uptick in inflation due to tariffs. Despite that lack of data in the fourth quarter, the Fed continued the easing cycle it started in September, cutting the Fed Funds Rate by 25 bps in October and December, for a total 75 basis point reduction in 2025.

Equity Market Resiliency

Equity market investors were rewarded with the S&P 500 posting a 2.3% return for Q4 and a 16.4% increase for the year. Equity market volatility continued to unnerve investors as the markets experienced a large “Liberation Day” sell-off in April and then another brief sell-off in October due to the government shutdown. Markets quickly recovered and hit new highs by early November when concerns emerged that the AI trade may be in bubble territory, as valuations assume flawless execution and staggering demand for AI-related products and services.

Safety was sought in defensive sectors such as industrials and consumer staples, resulting in a 4.7% return for the Russell 1000 Value index compared to the 3.4% return for the Russell 1000 Growth Index in Q4. The only Magnificent 7 stocks beating the S&P 500 in the quarter were Alphabet, Apple, and Amazon. However, for the year, the S&P 500 equal weighted return of 9.3% was a full 700 basis points behind the market capitalization weighted index, displaying for a third consecutive year the powerful influence of the largest stocks in the index.

International stocks outperformed U.S. stocks in 2025, providing solid returns and diversification benefits after several years of lackluster performance. For the fourth quarter and the year, the MSCI EAFE Index posted a positive 4.9% and 31.9% return respectively. Emerging markets, benefiting from a weakened U.S. dollar and broadening of the global AI trade, posted a positive 4.8% for Q4 and 34.4% for the year.

Fixed Income Returns Were Additive

Fixed income investors benefited from a steeper yield curve and tight credit spreads, marking a strong year for the asset class. Positive total returns ensued as the 10-year Treasury moved from a high yield of 4.8% in mid-January and fell to a year-end yield below 4.2%, a 64 basis point (bps) decline. The 2-year Treasury yield hit a high of 4.4% in mid-January and ended the year at 3.5%, experiencing a 93 bps decline. This widened the 2’s-10’s spread from 40 bps to 69 bps, steepening the yield curve. The Barclays Aggregate Bond Index posted a total return of 1.1% in the fourth quarter and 7.3% for 2025. Interestingly, money market fund assets swelled to a record $7.65 trillion by mid-December, despite the recent Federal Reserve easing cycle that began in September, bringing money market funds yields under 4.0%.

Alternatives

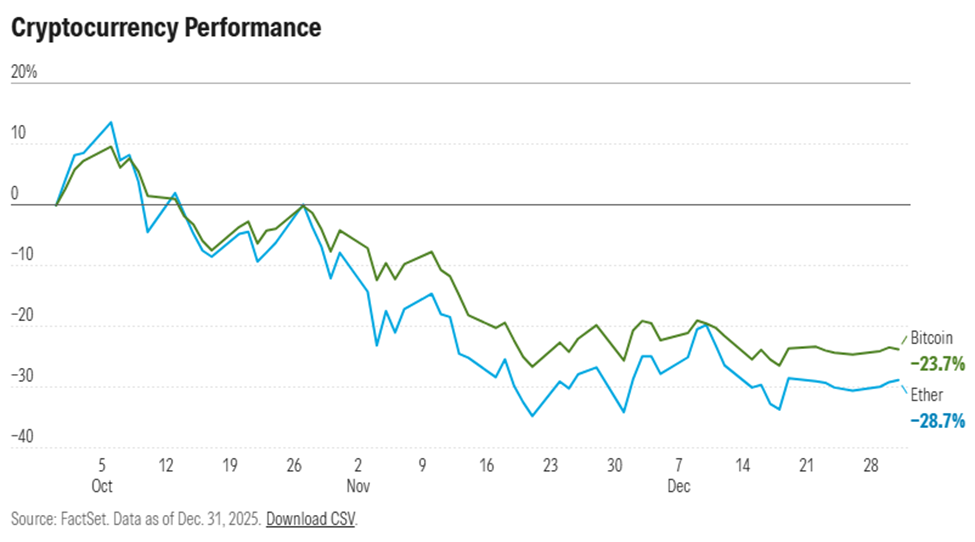

Alternative assets are on the cusp of becoming more mainstream, in part due to two major legislative changes in 2025. First, The Genius Act passed by Congress in June provides a framework for stablecoins, cryptocurrencies tied to the U.S. dollar. A second bill passed by Congress in August, The Financial Freedom Act, allows alternative assets, such as cryptocurrencies and private credit, to be invested in employer-sponsored retirement plans such as 401(k)s. Initially, Bitcoin and other cryptocurrencies rallied in response to these changes. However, Bitcoin sold off in the last quarter, falling approximately 24% and dispelling the theory that they are like digital gold and would provide a hedge during market volatility.

Source: Morningstar

Precious metals were the big winner in the fourth quarter and for the year, providing a meaningful silver lining in a tumultuous year. Gold posted an 11.8% return in the fourth quarter and a 64.4% return for the year. Silver, often overlooked, posted its best return since 1970 with a 51.4% return in the fourth quarter and a 141.4% return for the year. Not only are these metals a safe haven in times of uncertainty, they also have industrial applications that are seeing rising demand while physically in short supply.

Conclusion

As we wrap up 2025, an important lesson in sticking to one’s investment plan remains clear: even in times of vast uncertainty, maintaining a disciplined plan should help you attain your long-term goals. Moving ahead, diversification and selectivity will be key in 2026 as we enter a historically volatile mid-term election year. Other headwinds include elevated valuations following a prolonged bull market, expectations for accelerating earnings growth, and heightened geopolitical risks. At Cape Cod 5, we remain committed to helping you determine the best approach for your needs and risk tolerance to weather even the cloudiest environment.

Nancy Taylor, CFA, CAIA®

Senior Investment Officer

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Rachael Aiken, CFP®, Chief Wealth Management Officer

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer, Manager, Financial Planning

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Investment Officer

Craig J. Oliveira, CFA, Senior Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.