November 2025

Market Commentary

A Broad-Based Market Bounce

November was a volatile month for the markets, yet most indices finished the month higher after overcoming significant mid-month declines. A broad-based rally ushered in new leaders for the month across size, style and sector categories. The S&P 500 Equal Weight Index outperformed the market-cap-weighted index. Small and mid-cap stocks outperformed their large-cap peers. Value stocks outperformed growth-stocks by the widest margin since March's trade policy announcements. And tech stocks logged losses globally, reversing their long-standing leadership.

Technology Weakness in Focus

The S&P 500 finished the month modestly higher, gaining 0.10% despite being down as much as 4.3% heading into the final week. The tech-laden NASDAQ was a focal point for investor selling, and ended the month down 1.51%.

Technology was the weakest performing sector, declining 4.8% and ceding its October leadership position. In contrast, the healthcare sector posted a strong 9.3% monthly return. Eight of the S&P 500's eleven sectors outperformed tech this month.

Drilling deeper into mega-cap tech performance, it is interesting to note that market darling Nvidia declined nearly 13% despite its stellar earnings and guidance, as investors reconsidered its dominant market position. Meanwhile, Magnificent Seven (Mag 7) member, Alphabet, was the big AI winner last month, gaining more than 13% as investors celebrated its advanced in-house AI model, Gemini 3. Despite weakness in technology, the S&P 500 still advanced – a sign of this month’s participation across sectors.

AI Euphoria Turned to Investor Angst

Investor excitement around AI was tempered this month as concerns arose around increasing competition, the sustainability of heavy investment spending, and timing of future payoffs for investors.

Today, AI hyperscalers are racing to supply the hardware and software “stack” to meet the insatiable demand from corporations and individuals for AI. Committing billions to capex spending, AI infrastructure companies are banking on corporations broadly adopting this transformative technology to enhance productivity, reduce expenses and support long-term profit growth.

With that backdrop, investors refocused this month on the valuations of these AI-driven companies, scrutinizing the return on investment and monetization capabilities of these now capital-intensive business models. This exercise resulted in significant selling pressures across AI-exposed companies, as investors trimmed positions and locked in gains this month as they continue to wrestle with these long-term profitability concerns.

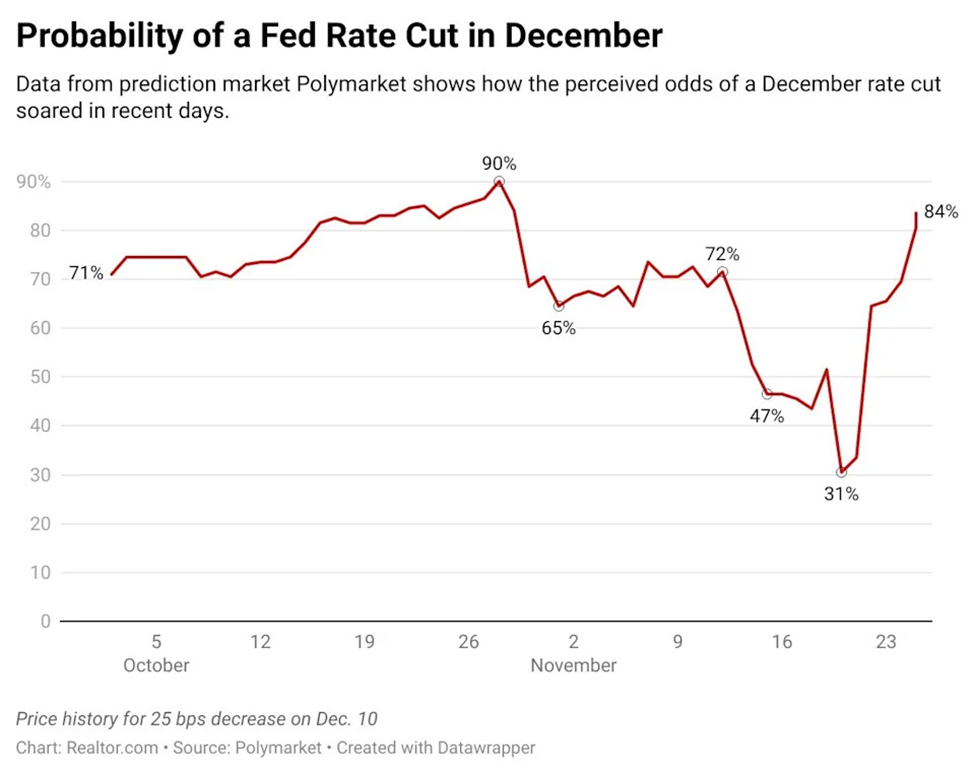

Rate Expectations Whipsawed Markets

Rapid shifts in expectations for Federal Reserve rate cuts upended markets this month. Equity and fixed income markets ebbed and flowed based on December’s Federal Open Market Committee (FOMC) rate decision. With economists and investors “flying blind” in November due to the dearth of government data, market participants feared the Fed would elect to “stand pat” – with no further rate cuts in 2025. This position was reinforced by several Fed members in their prepared remarks, which prompted a “risk-off” tone for equity markets and pushed Treasury yields higher.

By mid-month, the probability of a December rate cut had fallen to around 30%. But that shifted dramatically after permanent voting member NY Fed President Williams commented that he “sees room for a rate cut,” with softening labor market conditions and easing inflation risks. His comments were a turning point for markets, convincing investors that a December cut was back on the table. Subsequently, rate cut expectations rose to near 100% by month-end and markets cheered, sending bond yields lower as the S&P 500 climbed by roughly 4.8%.

Looking Ahead

We may or may not be treated to a Santa Claus rally this year. Regardless, it has been a very good year for investors holding multi-asset class diversified portfolios, like the ones we construct at Cape Cod 5. As we enter the last month of 2025, the economic and market backdrop remains constructive. Positive earnings revisions and all-time high profit margins provide fundamental tailwinds for the market, while an economy that remains resilient - despite subtle signs of labor market weakening – provides a positive macro backdrop into year-end.

We’re here for you

As always, your Cape Cod 5 team of advisors is here to help you build a financial plan that will weather anything that comes. If you have any questions, please reach out to us.

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.