Your credit score plays a key role in your financial health and ability to make important life purchases.

A credit score is an important number that is assigned to you by each of the three credit reporting agencies, and it can influence many areas of your financial life. To help you understand what goes into your credit score and how your score is impacted, we’ve outlined some information, including best practices for improving and managing your credit, as well as advice on how to keep it protected from fraudsters.

A credit score is an important number that is assigned to you by each of the three credit reporting agencies, and it can influence many areas of your financial life. To help you understand what goes into your credit score and how your score is impacted, we’ve outlined some information, including best practices for improving and managing your credit, as well as advice on how to keep it protected from fraudsters.

How are Credit Scores Calculated?

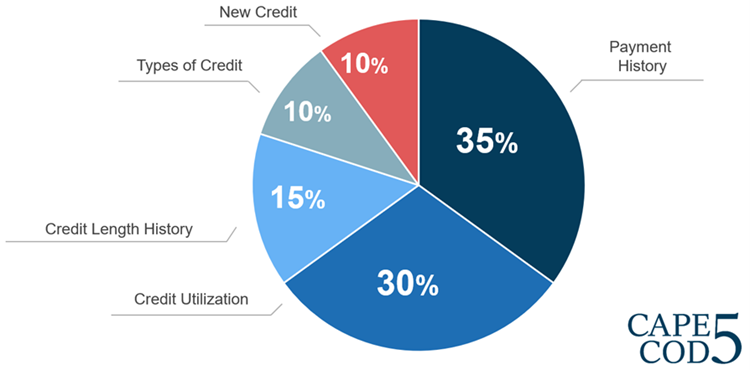

Credit scores are based on five factors of varying importance in terms of their impact. The chart below shows how each factor affects your score.

Payment history: Paying your bills on time is the most important factor in your credit score. Improve your score by paying your bills in full and on time each month.

Payment history: Paying your bills on time is the most important factor in your credit score. Improve your score by paying your bills in full and on time each month.

- Credit Utilization: This is calculated by the amount you spend vs. the amount of credit available to you. To improve your score, try to stay below 30% of your credit limit and work on paying down your balances.

- Length of credit history: Borrowers with longer credit histories are considered less risky because there is more data available to determine payment activity. Improve your score by sticking with the same credit card or keeping older accounts open, even after you’ve paid them off. Be sure to keep an eye out for associated fees and be aware that certain credit providers will close your account if you do not use your credit line for a certain period of time. Keep your account active and in good standing by using it and making payments on a regular basis.

- Types of credit: According to FICO, borrowers with a good mix of credit and loans are generally less risky to lenders. Therefore, a diverse mix of credit types is considered favorable.

- Recent credit inquiries: Each time you fill out a credit application, an inquiry is added to your credit report. The number of recent inquiries made to your credit is considered in your credit score. To improve your score, avoid filling out too many credit applications that result in a hard credit pull within a short timeframe.

Want to build good credit but not sure where to start?Most of your credit score is based on timely payments and low usage. Paying your bills on time and using less than 30% of your credit limit will go a long way toward ensuring a healthy score. |

Protecting Your Credit

With cybersecurity concerns at an all-time high, it is crucial that you take the right steps to protect your credit from fraudsters. The tips below can help.

- Place a free security freeze on your credit report: Security freezes restrict access to your credit report, preventing anyone, including yourself, from opening a credit line in your name. You must place and remove the freeze with each Credit Reporting Agency: Equifax, Experian and TransUnion. Remember to unfreeze your credit report online if you plan on filling out a new credit application.

- Set up a quarterly reminder to check your credit report on each of the three credit reporting sites: Keep an eye out for anything that doesn’t look familiar, such as credit inquiries, previous employment or personal addresses.

- If you do become a victim of fraud or identity theft, take immediate action: Contact your bank and credit card issuer, as well as the credit agencies, to place your account on fraud alert or a security freeze. You could recover some of your money if you act fast!

Credit histories can and will improve with time and good habits.Automating your bill payments and building emergency savings so that you can be ready for the next "rainy day" are two great places to start. |