Market Review Q1 2023 | Market Review Q2 2023 | Market Review Q3 2023 | Market Review Q4 2023

First Quarter 2024

A Quarter of Stats for the Record Books!

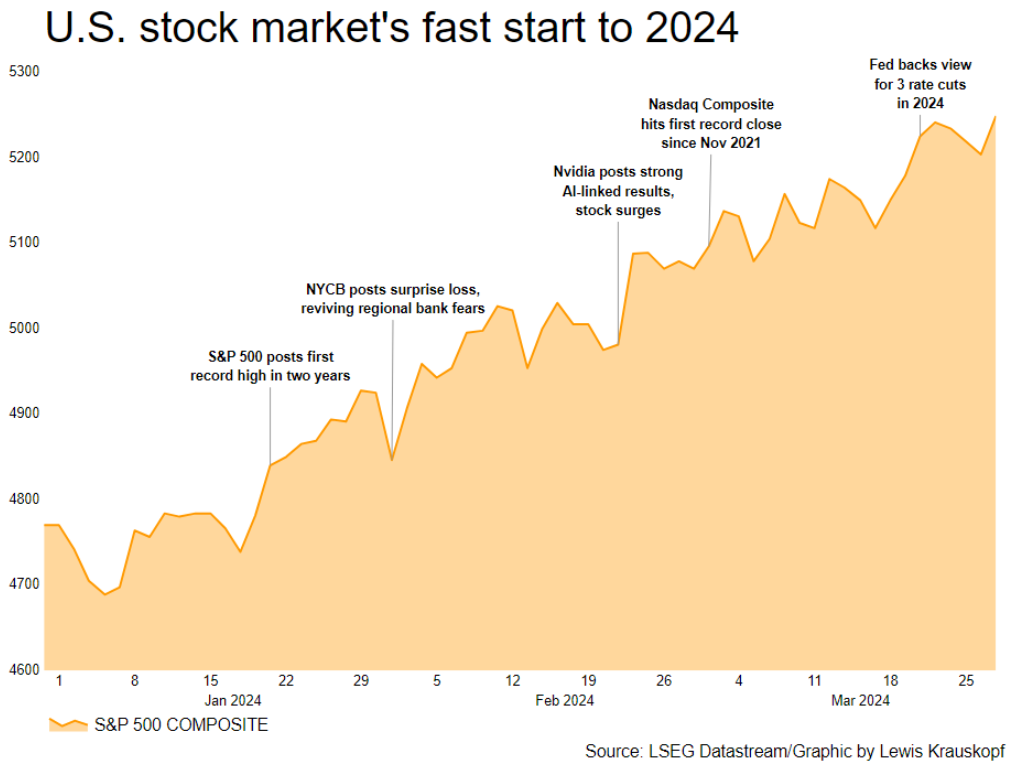

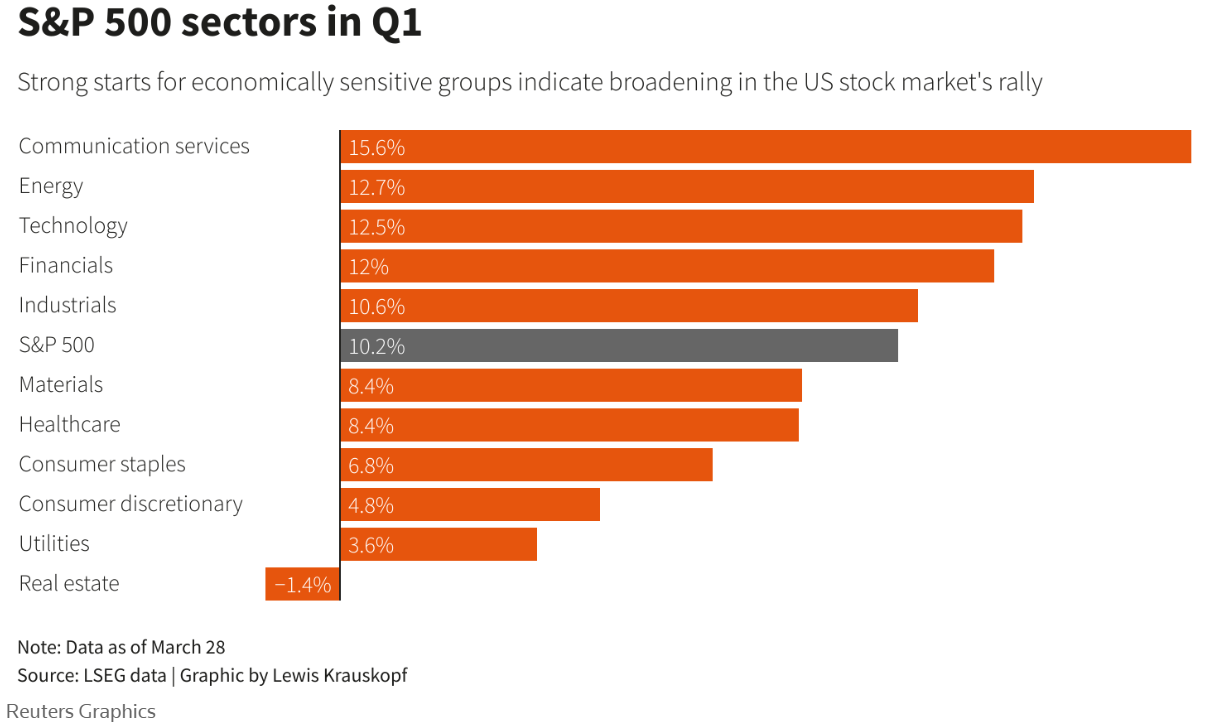

After an exciting grand slam ending to 2023, markets started the new year with all of the promise that Spring Training brings to the new baseball season. Will the stars of 2023 be standouts in 2024 or will new heavy hitters emerge? The much celebrated “Magnificent Seven” team was the primary driver of last year’s finish with a winning score of a 24% return for the S&P 500 Index. In a 2024 pre-season surprise, the U.S. stock market continued to soar, due to the expanded contributions of cyclically sensitive players stepping up to the plate, finishing strong with a second straight quarter of double-digit returns of 10.16%.

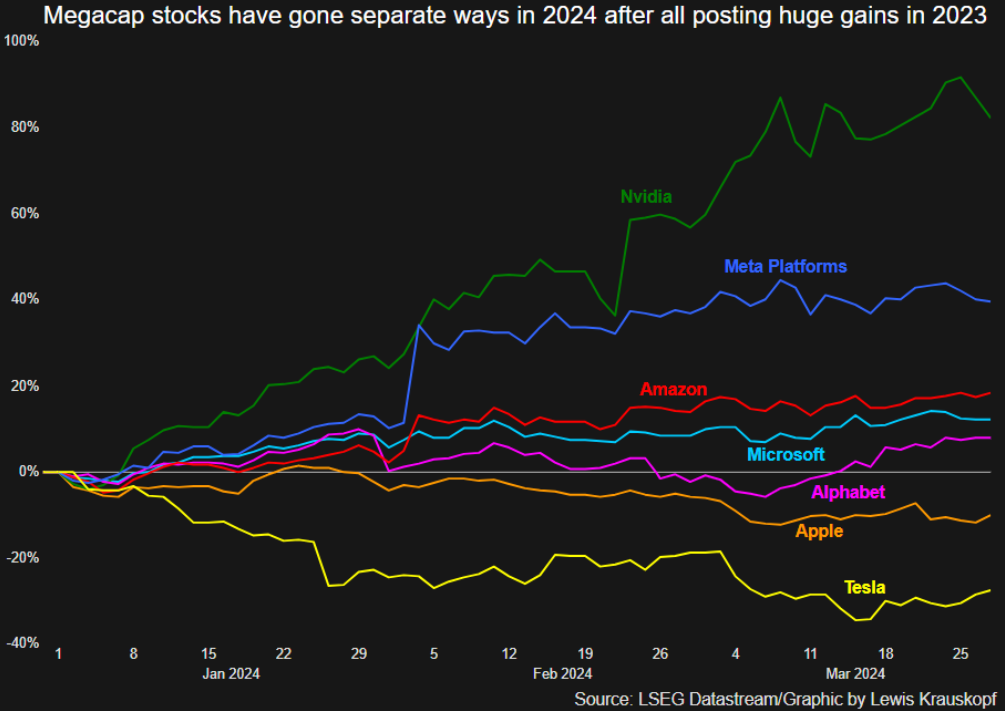

While last season’s leaders remained standout contributors to the first quarter’s scores, some historic fan favorites re-emerged – energy, industrials and financials had first quarter stats matching or nearing those of the technology sector. With pundits questioning the durability of a concentrated market run, fears were assuaged with 10 out of the 11 S&P 500 sectors scoring higher in the first quarter. Highest on the leaderboard were communications services +15.57%, energy +12.69%, tech +12.48%, financials +11.97% and industrials +10.57%. This was a welcome broadening of the S&P 500’s rally, reinforced by strong gains in Mid-Cap US stocks, as well. One Magnificent Seven team member, Nvidia (NVDA)’s batting average stunned with an 82% return for the quarter, with two other members, Apple (AAPL) and Tesla (TSLA), being sent down to the farm team, returning -11% and -29% respectively. The Magnificent Seven still managed to contribute to 40% of the 3-month return for the S&P, which produced 22 new highs in the first quarter. Economists and investors are looking for that soft landing safe slide into home base.

The U.S. Economy Prevails

As 2024 kicked off, markets were ebullient at the prospect of possible rate cuts. Economic stat after stat pointed to an economy more resilient than any anticipated. Q4 2023 GDP came in at a now revised 3.4%, well above the 2% trend growth, and the labor markets continued to defy expectations averaging over 200,000 monthly new jobs this quarter. Although jobs were added without a significant rise in wages, hotter-than-expected inflation surfaced in both January and February. This divergence reflects that the deflationary trend is not occurring in a straight downward line. The unemployment rate has remained at or below 4%, since December 2022 – the longest period of low unemployment since the late 1960’s. In fiscal year 2023, Immigration Services approved over 2 million applications for employment authorization, a 70% increase from a record 1.2 million in fiscal 2022. This surge in migrant workers allowed employers to fill openings without putting undue pressure on wages.

According to Reuters, “U.S. manufacturing grew for the first time in one and a half years in March, as production rebounded sharply and new orders increased, but employment at factories remained subdued amid ’sizable layoff activity’ and prices for inputs pushed higher. The survey from the Institute for Supply Management (ISM) suggested the sector, which has been battered by higher interest rates, was on the mend, though risks remain from rising raw material prices. Timothy Fiore, who chairs the ISM's manufacturing business survey committee, said ’Demand remains at the early stages of recovery, with clear signs of improving conditions.’ Although businesses have been operating with higher interest rates for borrowing, tailwinds from artificial intelligence (AI) spending and support from government should continue to modestly reduce the higher rate expenses and their impact on the bottom line.

Consumer spending contributes to 68% of GDP in the United States. With full employment, consumers have income and moderate wage growth, which has increased year over year for the last 13 months. JP Morgan reports that over $12 trillion in wealth was added to US households last year and an additional $5 trillion was added in Q1 this year. Last season, Major League Baseball reported $11.8 billion in revenue in 2023 and expects higher revenue this summer. Sadly, our beloved Sox are lagging in sales so far this year, but hope springs eternal. All in all, the consumer continues to fuel the economy and remains the MVP in achieving the much-coveted soft landing for the economy. Another positive sign in the economy is housing starts, with privately‐owned housing starts in February at a seasonally adjusted annual rate of 1,521,000. This is 10.7% above the revised January estimate, as reported by the US Census Bureau. The current estimation for Q1 2024 GDP is 2.5%.

A Few Bobbles in the Outfield for Fixed Income

Source: CNBC

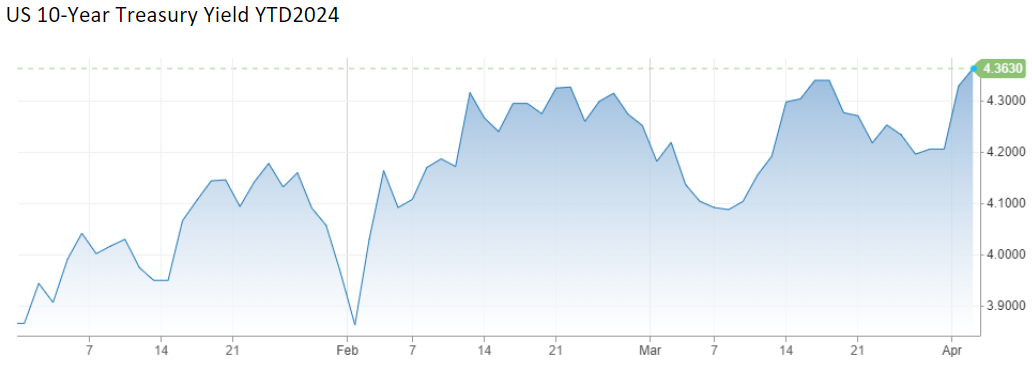

While the Magnificent Seven continued to advance further in the first quarter, fixed income markets took an abrupt turn. Following the brief, but strong, bond rally in December, domestic fixed income markets retreated. The continued strength in labor markets and strong 4th Quarter 2023 GDP growth forced fixed income investors to reevaluate forecasts for the number and timing of the FOMC’s reduction of the Fed Funds Rate. Coming into the FOMC March meeting, there was concern that the Fed would take a more hawkish stance, given the strength in the economy. The FOMC largely maintained that the data show inflation continues to move lower towards their 2.00% target rate and labor markets remain healthy, with the unemployment rate below 4.0%. The FOMC telegraphed it continues to expect three 25 basis point cuts this year, though the expected timing for the first has been pushed into the second half of the year. According to Fed Chair Powell, the data, "haven't really changed the overall story, which is that of inflation moving down gradually on a sometimes bumpy road to 2%." Markets are now also pricing in three Fed Funds Rate cuts, beginning in June 2024, almost perfectly in line with FOMC projections. The March meeting was the fifth consecutive FOMC meeting in which rates were left unchanged, pushing any drops for later in the year.

The rapid change in market expectations for the path of interest rates during the quarter resulted in bond price volatility, as rates moved higher to reflect the Fed’s comfort with a “higher for longer” policy. As a result, the U.S. 10-year Treasury Bond yield increased 34 bps in the quarter, moving from 3.87% to 4.21% at the end of March. Since bond prices move inversely to changes in interest rates, bond values declined during the quarter. The yield on a 3-month Treasury Bill at the end of March was 5.23%, higher than the 10-year Treasury, indicating an inverted yield curve remains in place. While changes in the market value of bonds can be unnerving at times, it is important to remember that they continue to pay interest based on stated coupons and mature at par value when held to maturity. The expectation continues to be that interest rates will ease later this year, which will buoy bond valuations. In summary, we believe today’s interest rate environment continues to offer investors a great opportunity to lock in higher yields. Fixed income securities are returning to their more traditional role in portfolios of not only providing yield, but also acting as a ballast to portfolios during volatile equity periods, especially with the potential for appreciation, as rates may decline this year.

Equities Build on Last Season

U.S. Stocks had the best “Pre-Season” performance since 2019 this quarter with the S&P 500’s 10.16% return. Equity markets are now less concerned with when rate cuts will materialize, as long as they are realized. With the markets now in sync with Fed estimates, investors refocused their energies from reading the Fed tea leaves to corporate earnings and market fundamentals. Although corporate earnings concluded last season with a virtual “tie” finishing the year flat, the final numbers exceeded estimates and Q1 earnings strength has provided a tailwind to equity markets. Companies are prepared to navigate higher rates a bit longer, thanks to moderate wage growth and efficient management. The small-cap sector relies more heavily on borrowing and could feel the impact more keenly, as evidenced by its 2% Q1 return versus the mid-cap’s 9.52% finish. Real estate was the only sector with a negative return this quarter.

Outside the U.S., milestones included Japan finally putting an end to negative interest rates, which benefited Japanese banks, importers and companies in general with foreign holders of Japanese stocks. Japanese markets cheered, with the Nikkei rising over 21%. Japan scored highest within the Morgan Stanley Capital International and Europe, Australasia and Far East Index, which returned 5.8% for the quarter.

Alternative investments provided exciting stats, led by gold and Bitcoin, which hit new all-time highs in Q1. Bitcoin provided a jaw-dropping return of 60% in the first quarter with the long-awaited approval of a Bitcoin Exchange Traded Fund, providing the framework and access for a new cohort of interested investors. Gold gained 8% after rallying 11% in Q4. Oil prices rose on the back of continued geopolitical concerns, with crude oil contracts rising 16% and taking the energy sector higher, as well, by 12.69%.

Who and What is on Deck for the Remaining 2024 Season?

We are looking at a repeat match up for the presidential election in November. History shows that financial markets may take a seventh inning stretch leading into the election, but often conclude in a similar fashion for the year, not tied to the outcome of the election.

From a market perspective, $6 trillion is waiting on the sidelines in money markets and other short-term assets that could be deployed into equity or fixed income. If the Fed implements three rate cuts, shorter term money market rates will fall, and we can also expect to see a drop in business and residential lending rates, which would bode well for U.S. companies, the consumer and the economy. We continue to favor large cap U.S. companies, as evidenced by the strong performance in the first quarter. Company valuations have stretched a bit, but we also continue to see attractive relative valuations globally. Since 1928, the S&P 500 has had an average annualized return of 9.9%. But, as we have learned, anything can come out of left field. During the financial crisis of 2008, the S&P 500 dropped 53% from October 2007 to March of 2009. From 2009 through 2023, the S&P 500 has returned 14% on an annualized basis, despite major disruptions over the last few years.

The market’s wins and losses should not distract us from sticking with enduring planning strategies to achieve our long-term goals. Life should be balanced – it isn’t about keeping score and it should always include a little fun. As the official baseball season begins, we have just one thing to say to those in the Big Leagues, the Little Leagues and the Cape Cod Baseball League:

Play Ball!

April is Financial Literacy Month. At Cape Cod 5, we work with our clients through each stage of their financial journey, starting from the very young just learning to save all the way up through those preparing their legacy. If we can be of assistance to you or someone you know, reach out to us. We’re here for you!

Kimberly K. Williams

Senior Investment Officer

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA®, Chief Investment Officer

Brad C. Francis, CFA®, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Nancy Taylor, CFA®, CAIA®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Investment Officer

Craig J. Oliveira, CFA®, Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.