Market Review Q1 2018 | Market Review Q2 2018 | Market Review Q3 2018 | Market Review Q4 2018

Market Review Q1 2019 | Market Review Q2 2019 | Market Review Q3 2019

Market Review - Fourth Quarter 2019

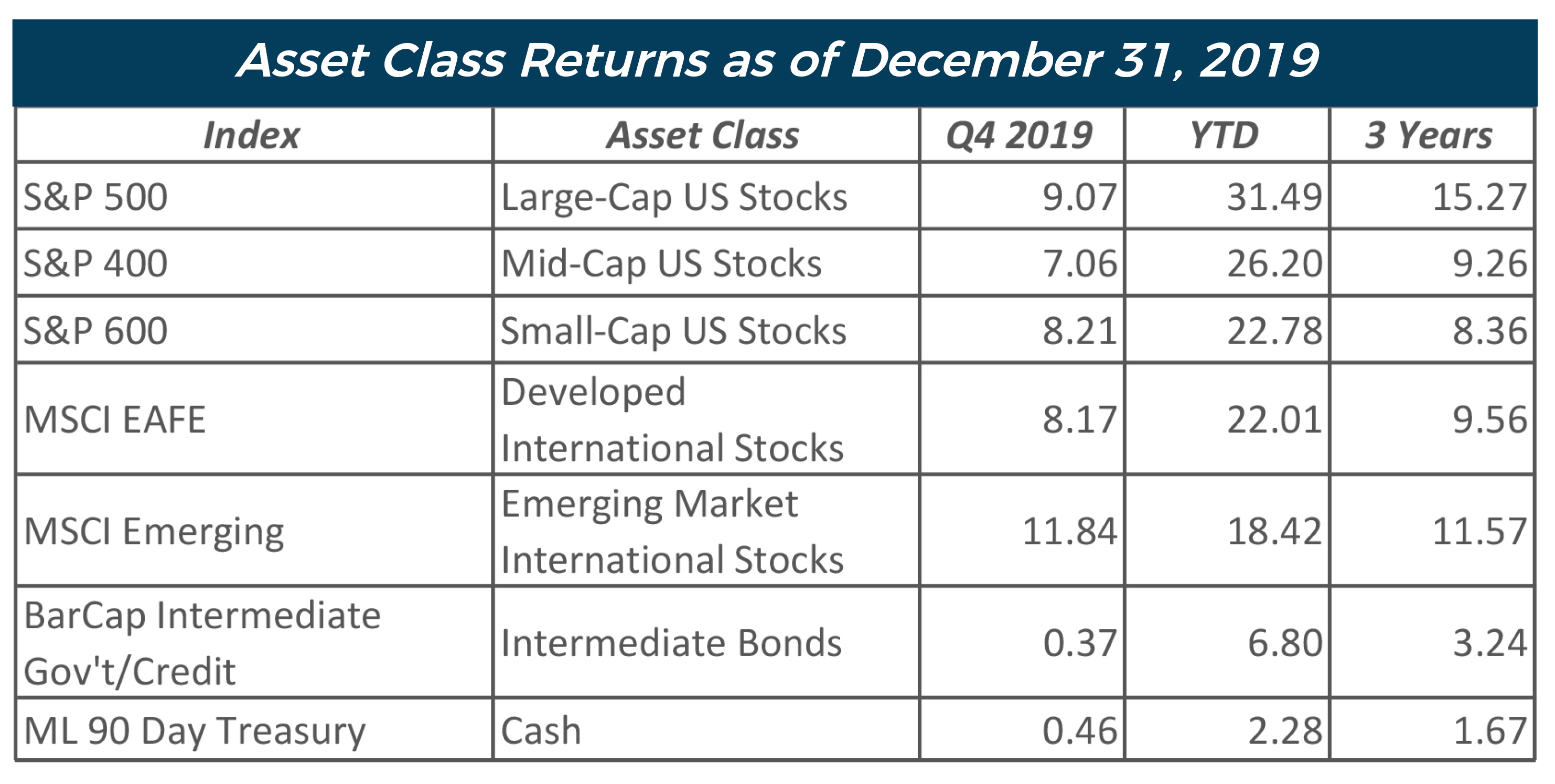

What a year for U.S. stocks! The market ended the year close to all-time highs with the S&P 500 gaining 31.49% for the year, capping an extraordinary decade. U.S. stocks averaged over 13.5% annually for the decade including two years with negative returns, the worst (-6.4%) experienced in 2018. Over full economic cycles, earnings become the primary driver behind stock market returns, but not always. In 2018, the S&P 500 experienced earnings growth in excess of 22% yet delivered -6.4% return to investors. While, stocks soared in 2019 earnings growth is expected to be anemic, perhaps even negative. With earnings growth so important to market returns, why the disconnect?

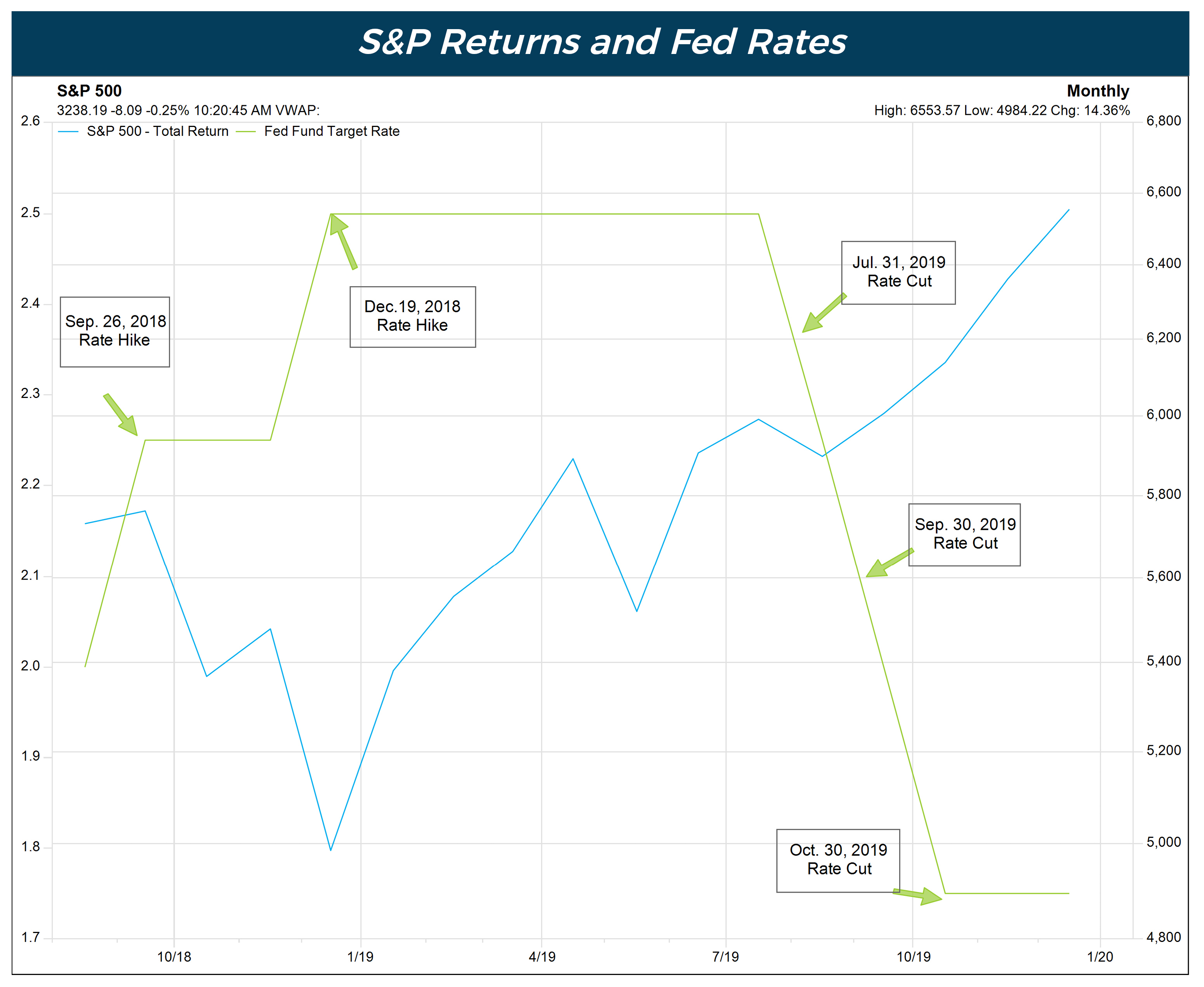

In late 2018 two rate hikes (green line) sent stocks sharply lower (blue line).

Rate cuts over the summer of 2019 had the opposite effect.

The 2018/2019 narrative did not change materially: trade tensions, Brexit, slow growth, political division, and U.S. dollar – all remained top concerns, except for one. In the fourth quarter of 2018, Fed Chairman Jay Powell made a public speech suggesting more aggressive increases to short-term interest rates. Markets reacted immediately and negatively. In the spring of 2019, in an abrupt reversal, the Fed cut rates and signaled further cuts would be in order. Markets soared. While corporate earnings delivered in 2018, it was monetary policy that delivered market returns in 2019.

Economy

Hampered by trade uncertainties, 2019 saw gross domestic production (GDP) growth in the U.S. move back towards 2%. After a strong start in the first quarter averaging 3.1%, GDP dropped to 2.0% in the second quarter before rebounding to 2.1% in the third quarter. The Federal Reserve Bank of Atlanta, based on their GDPNow model, is expecting fourth quarter GDP to come in at 2.3%.

After more than three years of slowly increasing rates, the Fed reversed course and cut three times in 2019, lowering the Fed funds rate from 2.25-2.50% to 1.50-1.75% easing investor concerns that the Fed may be increasing rates too aggressively.

Payroll growth was very robust in November and remained solid throughout 2019 with employment-to-population ratio remaining at expansion highs.

Buoyed by a strong labor market and lower interest rates, the housing market accelerated in the second half of the year while consumer spending remained solid. Inflation remained low, continuing to trend below the Fed’s long-term objective.

Equities

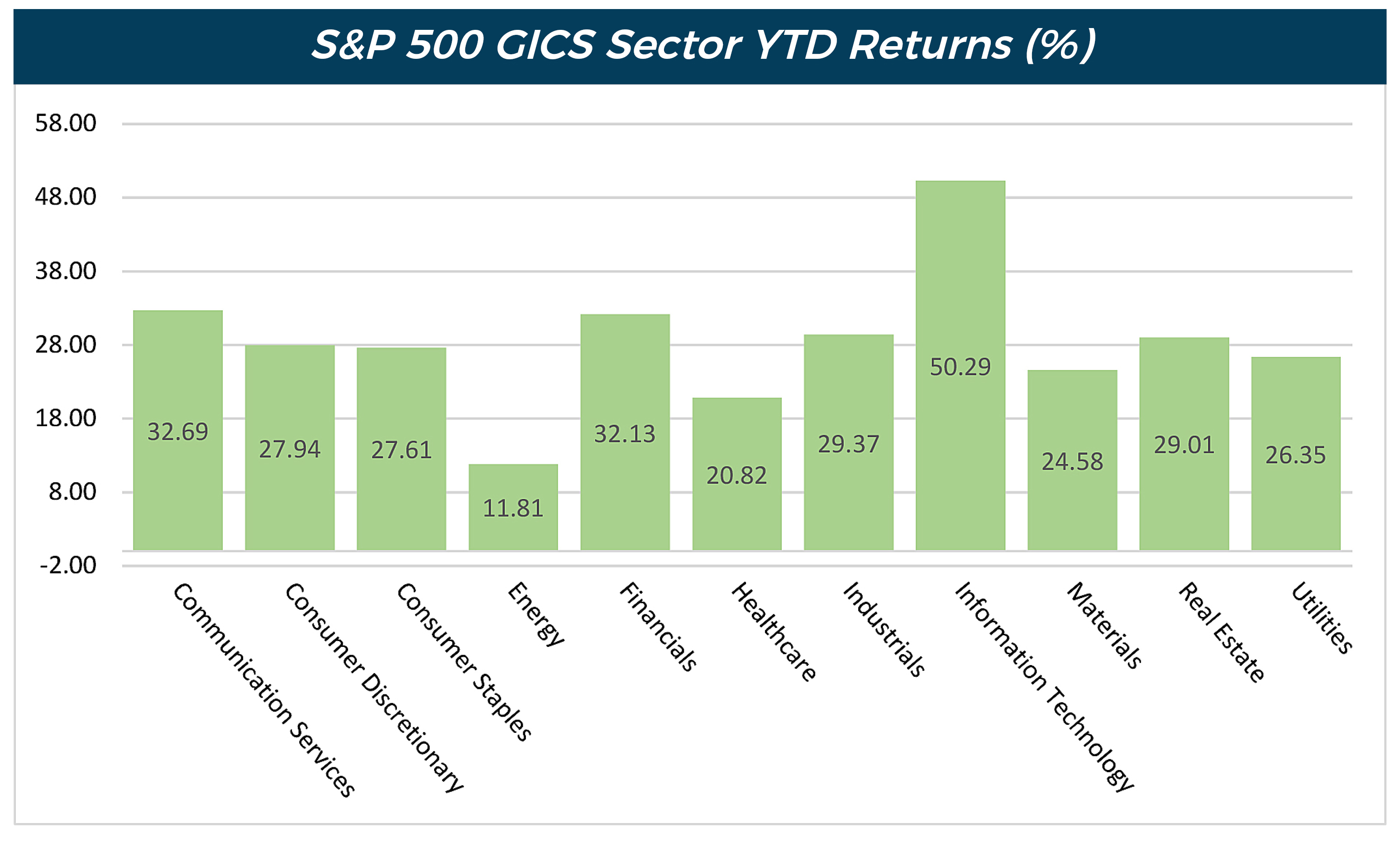

The stock market was led higher by a strong showing from technology, communication services, and financial sectors. Two tech giants – Microsoft and Apple - led the sector and the market higher in 2019 and for the decade.

Small-cap stocks underperformed mid and largecap stocks in 2019. Value stocks underperformed growth stocks, although the gap narrowed.Both developed and emerging international markets ended the year strong. Emerging Markets was the best performing asset class in the quarter (see chart above) returning 11.84%.

In 2019 all U.S. sectors experienced double digit returns, however the range was quite wide with Materials (11.81%) and Technology (50.29%) setting the lower and upper bounds.

After posting impressive earnings growth of 22.7% in 2018 (the best since 2010), companies that constitute the S&P 500 are expected to deliver flat earnings in 2019.

Fixed Income

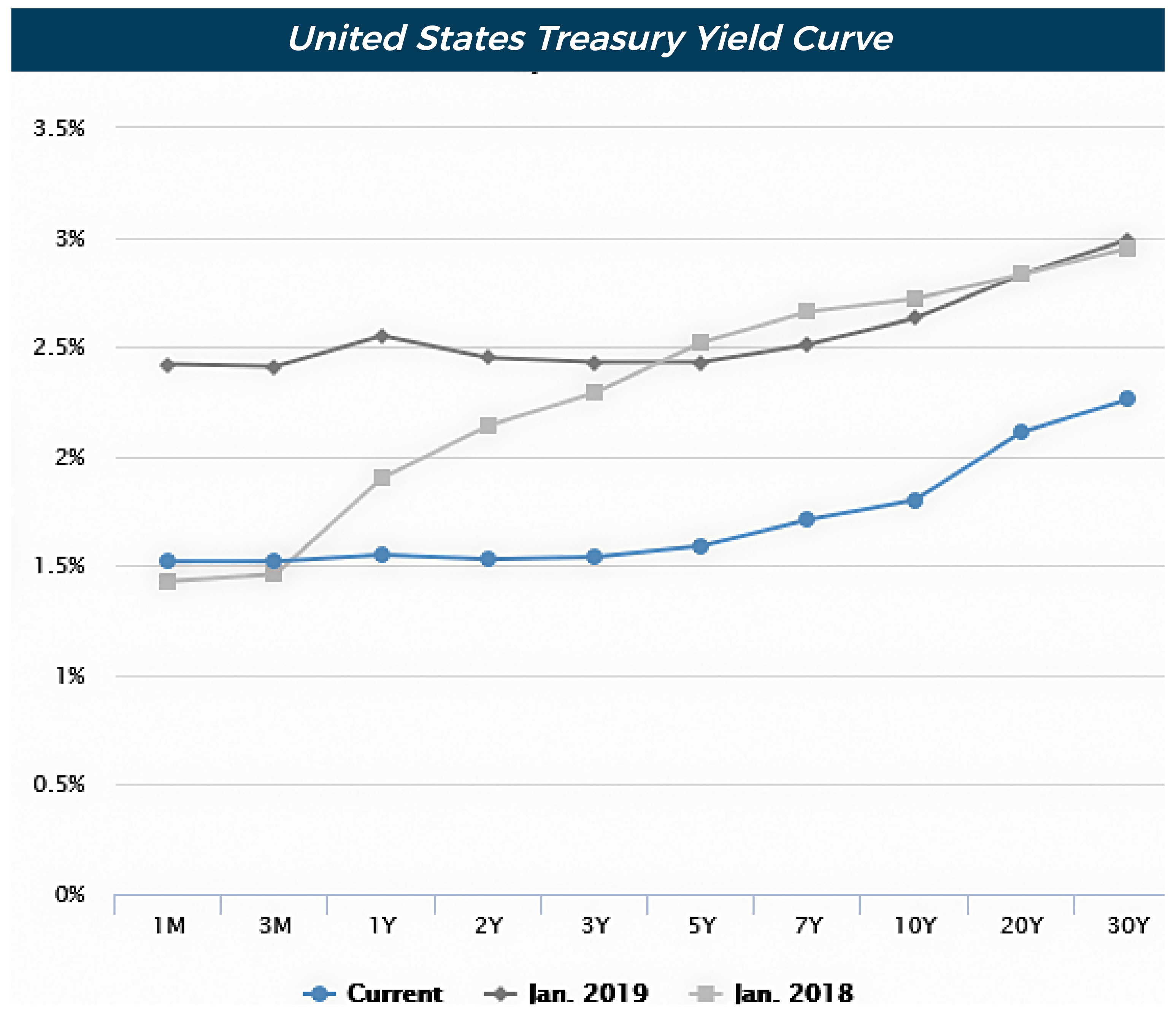

The 10 year U.S. Treasury bond started the year with a yield of 2.68% and all expectations were for rates to continue to rise throughout the year. In August the Fed delivered a rate cut in an abrupt reversal, sending yields to a low of 1.47% for the year. After climbing off the lows, the 10 year bond

started the fourth quarter at 1.68%, rising to 1.92% by year end.

Bond prices move in the opposite direction of yields and the total return, as measured by Barclays Capital Intermediate Government/Credit Index, was 6.80% for the year. The majority of that return was derived from capital appreciation. High yield bonds and investment grade corporate bonds also performed well for the year.

Fed Rate cuts eliminated curve inversion and reduced rates along all maturities.

Final Thoughts

Investors enter 2020 with a U.S. economy continuing to deliver modest growth, low inflation, low interest rates, low unemployment, solid consumer spending and a robust housing market. The current data would suggest the longest expansion in modern U.S. history can continue into 2020.

With price-to-earnings (PE) ratios stretched, we would expect earnings growth, along with the economy, to be a key catalyst for U.S. stock market returns. With less flexibility today, we would not expect monetary policy to have the same influence on the markets as policy did in 2018 and 2019.

As we enter an election year, investors will be listening and evaluating each candidate’s platform and how it could affect economic growth in the future. Historically, the last year of a presidential term has been the weakest period for stocks. Since 1980 the market returned an average of 4.9% in election years compared to an average of 12% in non-election years. As always, we will be assessing the situation as it unfolds.

Wishing you a happy, healthy and prosperous 2020.

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Lee C. Gatewood, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Christopher E. Chen, CFA, Investment Analyst

These facts and opinions are provided by the Cape Cod Five Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.