January 2026

Market Commentary

Early Signals for the Year Ahead

January and the Market Outlook

“As goes January, so goes the year” is the long-standing belief that market performance in January can be an early indicator of performance for the year ahead. As we entered year four of a bull market, investors were understandably anxious for signs that the last three years of gains would continue, and indeed investors received some reassurance – the markets closed January higher, with the flagship S&P 500 index up 1.4% for the month.

If the adage proves correct, it predicts this bull market could extend through 2026.

Historical Context: Year Four of a Bull Market

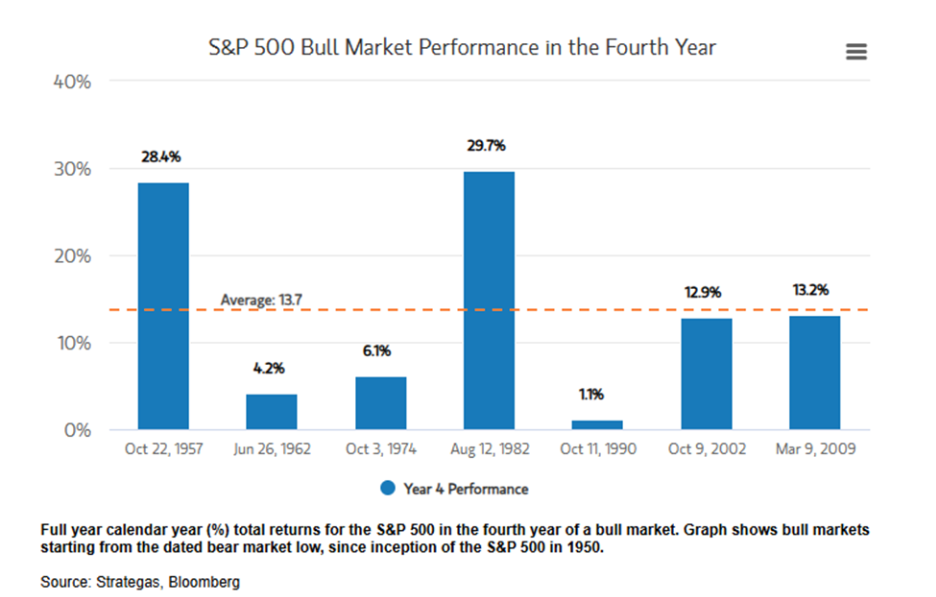

We can also look to history for more potential encouragement for 2026. Bull markets stretching into a fourth year have delivered positive returns in year four since 1950, the inception of the S&P 500 Index. For context, annual S&P 500 returns for the past three years were: 26.3% (2023); 25.0% (2024); and 17.9% (2025). Cumulatively, the index was up more than 86% during this period.

Geopolitical Volatility and Market Reactions

During the month, markets reacted strongly (both favorably and not) in response to geopolitical volatility on the global stage. The United States captured the President of Venezuela and took control of the country’s oil exports. Tensions then escalated between the U.S. and its NATO allies after President Trump announced plans to apply tariffs to several countries that were not supportive of a U.S. bid to purchase Greenland. The tariff proposal was later scrapped after a framework deal was agreed upon with NATO.

Meanwhile, protests broke out in Iran whilst the Trump Administration threatened a military strike against the country for suppressing the demonstrators. Investors watched the markets dip and rise throughout the month as these stories unfolded.

Notably, in contrast to other periods of geopolitical uncertainty, investors largely saw the market dips as buying opportunities, and funds flowed into the markets in anticipation of a rebound. This “buying on bad news” demonstrated that investors are beginning to recognize market pullbacks in response to government policies as fleeting.

Federal Reserve Policy and Domestic Headlines

Domestically, the story dominating headlines was the continuing fight between the White House and the Federal Reserve, culminating with President Trump’s nomination of former Fed Governor Kevin Warsh as the next chairperson. President Trump has been vocal about his belief that the Fed, currently led by Chair Jerome Powell, is not reducing interest rates quickly enough – pointing to inflation and unemployment data that the White House is saying supports a rate cut.

The Fed left rates unchanged at their meeting in January, with economists predicting that rates will remain there for the remainder of Powell’s tenure.

Economic Data and Broadening Market Participation

Against this tableau of uncertainty both domestically and abroad, markets were buoyed by data showing a resilient economy – the unemployment rate ticking down, inflation numbers coming in below expectations, and consumer spending data beating forecasts.

Markets saw a broadening of “hot” stocks, as investors moved beyond the megacap tech companies that have been in favor of late. Purchase activity spread to cyclical or discretionary companies in anticipation of both a potential stimulus payment and higher tax refunds from the One Big Beautiful Bill Act (OBBBA), which could support consumer spending.

Commodities: A Volatile Month for Precious Metals

Precious metals experienced significant volatility in January. Gold and silver rose rapidly early in the month in response to geopolitical uncertainty, plus the added drivers of strong retail and manufacturing demand. That surge proved temporary, however, as both metals experienced their biggest single-day decline in decades before the month came to a close.

Looking Ahead

If January does indeed set the tone for the rest of the year, 2026 may bring continued market volatility, along with potential buying opportunities for long-term investors willing to look past short-term noise.

As always, your Cape Cod 5 Wealth Management team is with you through each turn of the market. Don’t hesitate to reach out to us with any questions or concerns. We’re here for you.

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.