Whether you’re sending wires, managing ACH, or accessing online tools, these changes are designed to improve efficiency, enhance security and give you more control.

Beginning October 27, 2025, you will access your accounts through our new Treasury Online Banking platform. This upgraded system will maintain the functionality you rely on today, while delivering a more streamlined interface and the added convenience of access while on the go through our new Treasury Mobile Banking App.

Get Started with Your New Experience

It’s time to get up and running with your new treasury banking tools. You’ll find the key steps below, and many of these updates are also reflected in the User Guide.

You’ll receive direct communication from your Treasury Management Officer or Commercial Lender with further details, including login instructions and any setup steps specific to your business. Below is a summary of key actions to take so you can begin using your upgraded tools with confidence.

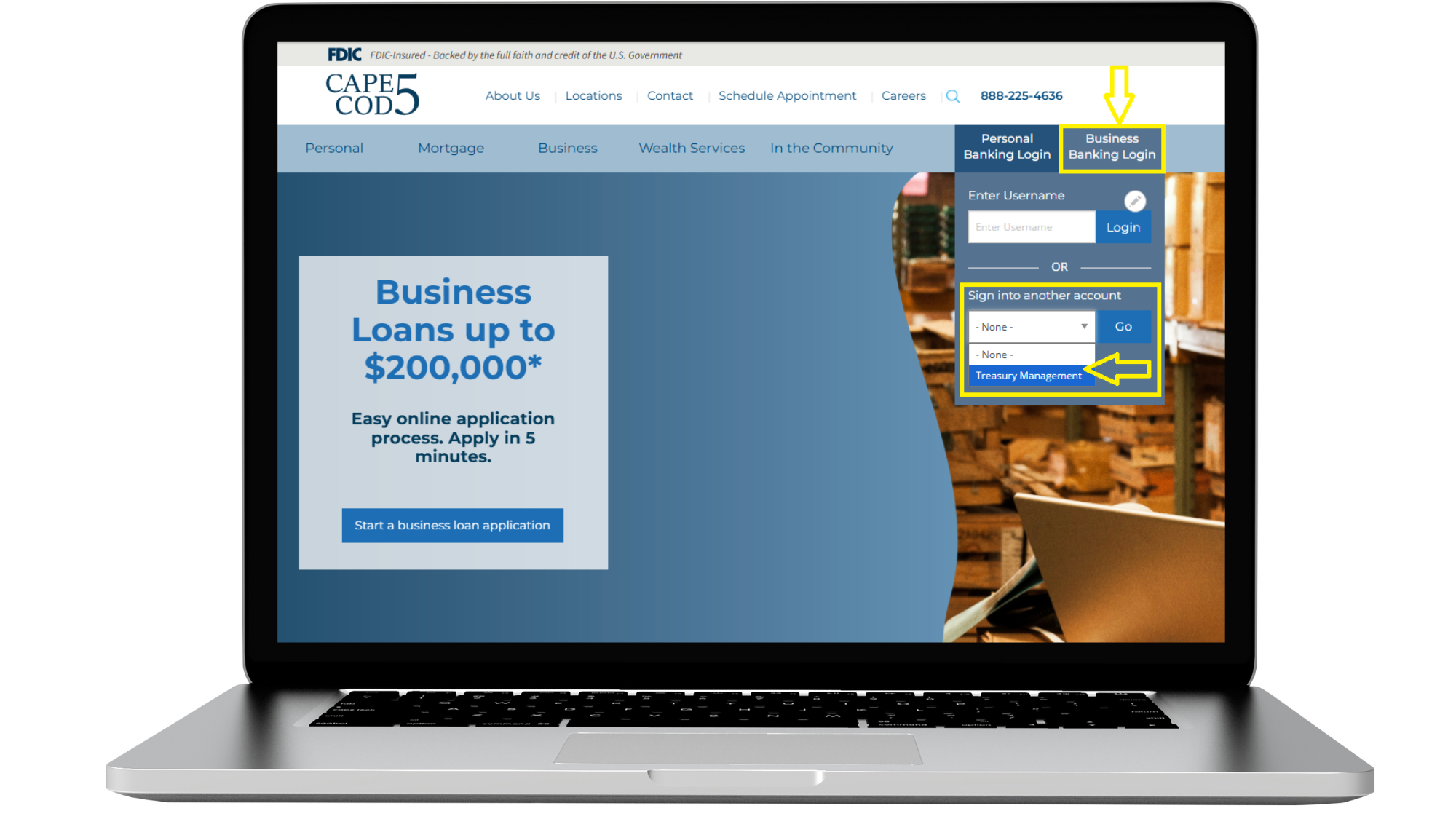

Log In & Set a New Password

Log in to Treasury Online Banking after obtaining your Company ID and Login ID from your company administrator. You will receive a new Login ID and Company ID to login before October 27.

Open your enrollment email and click Join.

Select the Initial Login URL link from your enrollment email. The link directs you to the login page.

Enter your Company ID.

Enter your Login ID.

Select Submit and proceed with the creation of your new credentials.

Key things to consider

You will need to create a username that does not match what you use today.

If you are using the VIP Access mobile app for two-factor authentication, please select "Symantec VIP" when onboarding your login 2FA method. Do not skip onboarding 2FA.

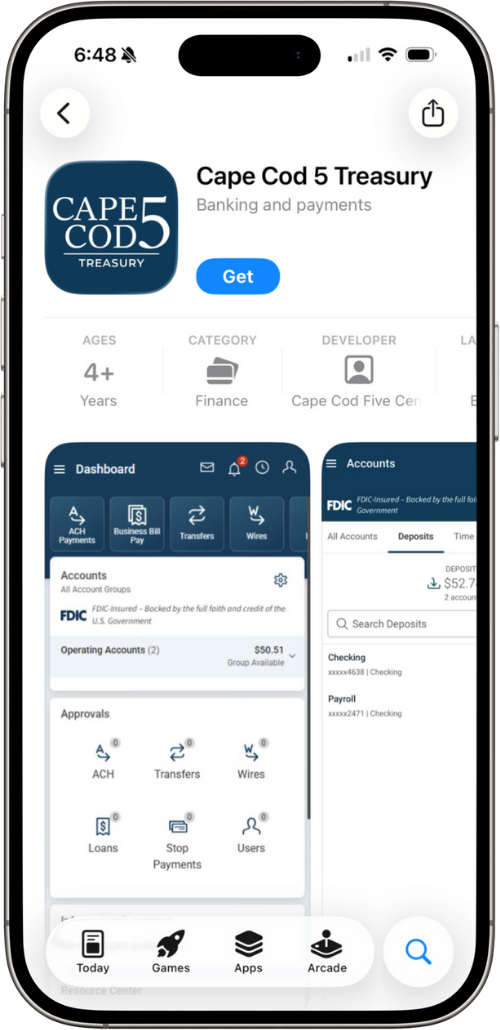

Access & Set Up Mobile App

On or after Monday, October 27, download the new Cape Cod 5 Treasury Banking Mobile App from the Apple® App Store (iOS) or Google Play™ (Android).

Configure your Dashboard

Add the Treasury Online Banking App to Your Phone’s Home Screen

Our new Treasury Online Banking experience uses a progressive web app (PWA) that works seamlessly on mobile devices.

Our new Treasury Online Banking experience uses a progressive web app (PWA) that works seamlessly on mobile devices.

ACTION: Download our New Mobile App

On or after Monday, October 27, download the new Cape Cod 5 Treasury Banking Mobile App from the Apple® App Store (iOS) or Google Play™ (Android).

Configure your Dashboard

After logging in for the first time, we recommend performing the following actions:

Add accounts to your dashboard (see page 10 of the Treasury Online Banking User Guide)

Add the Payments Pending Approval tile (see page 9 of the Treasury Online Banking User Guide)

Choose Your eDocuments Preferences (Statements, Loan, Bills, Tax Docs, etc.)

ACTION: Go to Reporting>Electronic Documents section in Treasury Online Banking to set your eStatement, loan and tax doc preferences.

Reestablish your Alerts

Some alert settings will not carry over to the new system. To avoid disruption, you’ll need to manually reenter these preferences once you log in. Security oriented alerts (e.g. password changes, initiated payments, etc.) will be forced and not require manual re-establishment.

ACTION: Log in and reestablish any alerts you previously used. See page 18 of the Treasury Online Banking User Guide for instructions.

Review Internal Transfers

Internal account to account transfers or loan payments (Cape Cod 5 to Cape Cod 5) created through Online Banking and scheduled to occur after Sunday, October 26 will automatically convert over. To avoid any interruptions to these transfers, please confirm all are accurate and complete.

ACTION: Confirm any scheduled internal transfers (e.g., between business checking and savings) are still correct in the new system. See page 18 of the Treasury Online Banking User Guide for instructions.

Reconnect Third-Party Software (e.g., QuickBooks, Credit Karma)

If your business uses accounting software or financial tools like QuickBooks or Quicken, those connections won’t carry over automatically after the upgrade. These integrations must be manually reconnected in the new system.

IMPORTANT: Quicken/QuickBooks aggregation service may not be immediately available.

Reestablish Recurring ACH and Wire Transfers

ACH and wire transfers are essential to business operations—and while your templates have moved to the new system, please review for accuracy before making a payment.

Check Positive Pay

Beginning on October 27, 2025, check positive pay will provide you with your daily exception items by 6am and you have until 10:30am to finalize and input your decisions. For additional information, please refer to the Treasury Online Banking User Guide.

Additional Resources & Tools

Find helpful guides, instructions and key links to support you before, during and after the upgrade. These resources can also be found in the User Guide.

Quickbooks Users

1st Action Date: Friday, October 24

2nd Action Date: Monday, October 27

As part of our upgrade, clients who use QuickBooks will need to take action to ensure continued access and a smooth transition.

If you connect to your Cape Cod 5 accounts through QuickBooks, please review the conversion instructions below and follow the required steps to ensure a smooth transition.

Note that the conversion instructions reference two Action Dates. Please use the dates provided below:

1st Action Date: Friday, October 24

A data file backup and a final transaction download should be completed by this date. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade.

2nd Action Date: Monday, October 27

This is the action date for the remaining steps on the conversion instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that you get your current QuickBooks accounts set up with the new connection.

Conversion instructions for Treasury Online Banking

QuickBooks Desktop (Treasury Online Banking) – click HERE

QuickBooks Online (Treasury Online Banking) – click HERE

Need Help?

If you have any questions or need assistance, please contact our Treasury Management team at 508-247-1699. Our team is here to support you—and we can also connect you with expert professionals to guide you through the transition.

ACH Templates

Existing ACH templates will be available on the new system. Please review your templates for accuracy.

ACH Positive Pay