Market Review Q1 2020 | Market Review Q2 2020 | Market Review Q3 2020 | Market Review Q4 2020

Market Review Q1 2021 | Market Review Q2 2021 | Market Review Q3 2021

2021 began with great promise on many levels - the anticipated approval and availability of vaccines to stem the tide of the pandemic, an economy that had turned the corner, and economists, corporations and analysts all forecasting a strong year. Optimistic, bullish investor sentiment rose and along with it a change in investor behavior. Encouraged by strong economic and earnings projections, flush with cash and in search of growth, a growing cohort of (individual retail) investors ventured into speculative and emerging areas of the markets investing in once esoteric areas such as special purpose acquisition companies (SPACs), cryptocurrency and non-fungible tokens (NFTs) in search of meteoric returns and looking to electronic bulletin boards for advice and online apps for execution. In addition, inflows into the broader equity markets rose to record levels.

Our economy powered ahead with annualized GDP growth well above trend. Economic momentum fueled market momentum. Traditional fixed income investments were eschewed in light of extremely low interest rates and the mantra TINA - “There Is No Alternative” - still rang true. In the ongoing battle between growth and value, technology and cyclical stocks vied for market dominance, which was often dependent on the durability of the economic and earnings recovery and, by extension, COVID-19 cases. By the numbers, the DJIA, NASDAQ and S&P 500 repeatedly hit new all-time highs with the S&P 500 posting a new index record in each and every month of the year.

The year was not without uncertainty, challenges and upheaval. The market’s “wall of worry” to scale included the pandemic, with COVID-19 cases waxing and waning, and the introduction of not one, but two aggressive variants challenging our progress to control infection. While disruptive, the economic impact has been relatively short-lived, but the human toll remains difficult to bear.

As a country, we are navigating each wave of the virus and learning how to live in a potentially endemic environment. As individual communities, we are addressing the needs of many impacted by health concerns, both physical and emotional, job loss and change, as well as remote and in-person learning and working. The heroes we saw emerging in 2020 remained steadfast heroes in 2021 - frontline workers, scientists, health experts, central banks, social and corporate leadership and even politicians.

Economy

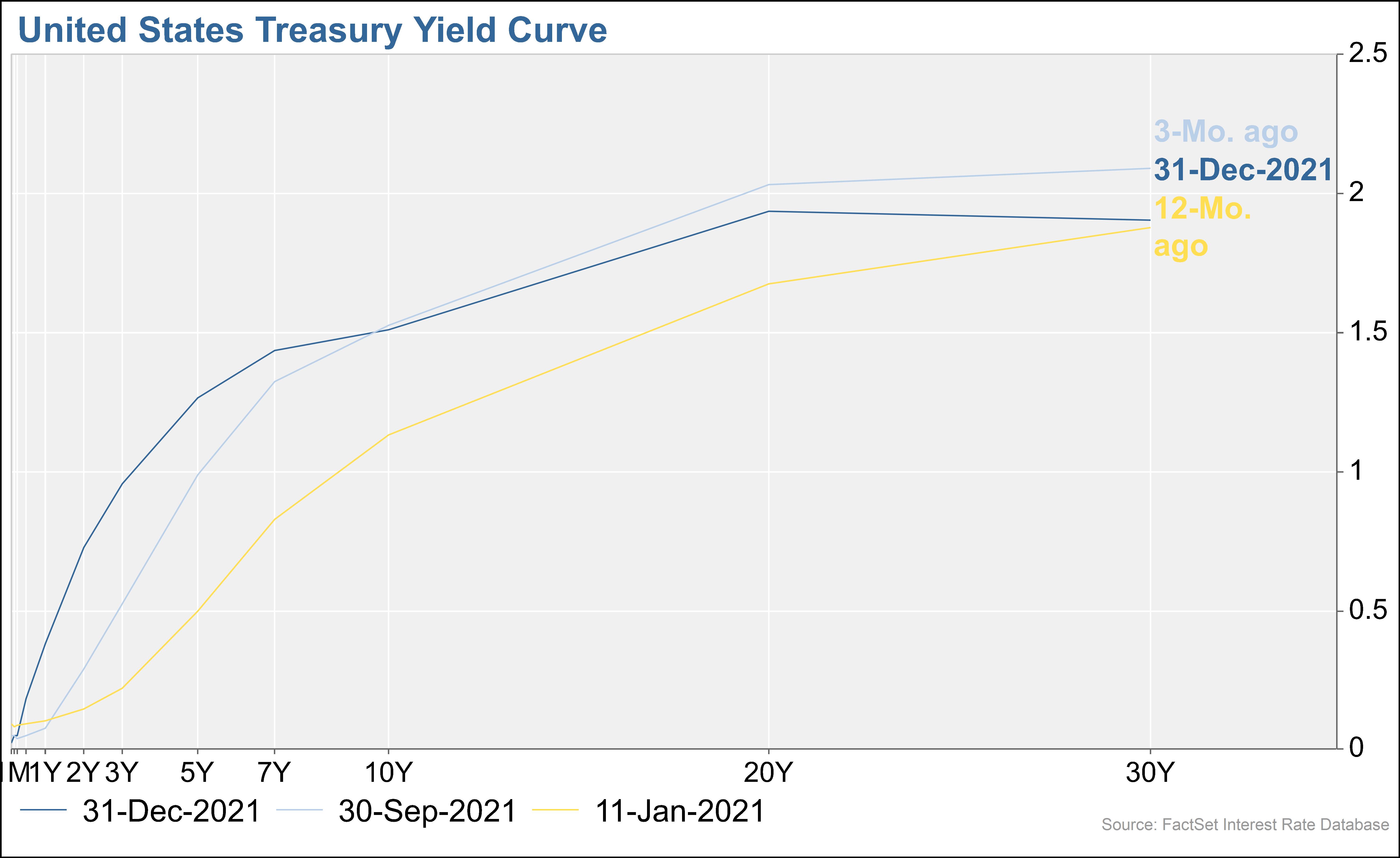

In November, after a surge in inflation, the Federal Reserve announced that its bond buying program (Quantitative Easing or QE) would wind down in June 2022. In mid-December, the Federal Open Market Committee (FOMC) held its final meeting of 2021 and announced an acceleration in the taper program. “In light of inflation developments and the further improvement in the labor market, the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities,” read the Fed statement. This was twice the taper announced the previous last month. The Fed had indicated that any rate increases will occur after the conclusion of QE. Based upon revised economic projections, which include inflation and unemployment figures, a potential of 3 rate increases are possible in 2022. Analysts predict that 10-year treasury yields could exceed 2% by the end of 2022.

Inflation has also roared onto the scene, being especially prevalent in the last quarter. It is not just on the minds of the Federal Reserve Committee and financial pundits, but on consumers’ minds as well. This spike has spawned a debate as to whether the inflation is transitory (temporary based on present conditions) or persistent (lasting over longer period of time). With most of the global economy now open for business, demand for oil, building materials and products has soared and supply is not keeping up for a variety of reasons, such as lower oil supplies and supply chain bottlenecks due to labor and materials shortages. High demand and lack of supply created one of the hottest inflationary environments in 39 years with November Headline CPI peaking at 6.8% over the prior year. The housing market continues to be tight, but still very strong with high home sale prices and low inventories. Housing sales are on track to reach the highest number in 15 years, with 6 million home sales in 2021. Prices were up 20% through the end of September compared to a year ago. The lack of inventory is creating demand for rentals, and higher home prices are also creating an inflationary rental market, which could be more persistent.

It is widely anticipated that the annual growth rate of the economy will exceed 5% for 2021. Before pulling back to trend-like growth of 2.3% in the third quarter, annualized GDP reached 6.3% and 6.7% in the first and second quarters. A strong labor market resulted in a decline in jobless claims to 198,000 at the end of December versus 763,000 a year ago. The unemployment rate dipped to 4.2%, inching towards the Fed’s target of 3.5%. Corporate America adapted to a myriad of challenges, ranging from supply chain disruptions, labor shortages, logistical nightmares and surging input prices to successively beat analyst expectations and post record earnings and revenue growth. According to FactSet, as of December 17, 2021, S&P 500 earnings were estimated to grow 45.1%, with revenue growth of 15.8%, both the highest on record since FactSet started tracking them in 2008. Profit margin growth is estimated to be 12.6%, well above the 11.5% record high in 2018.

Equity Markets

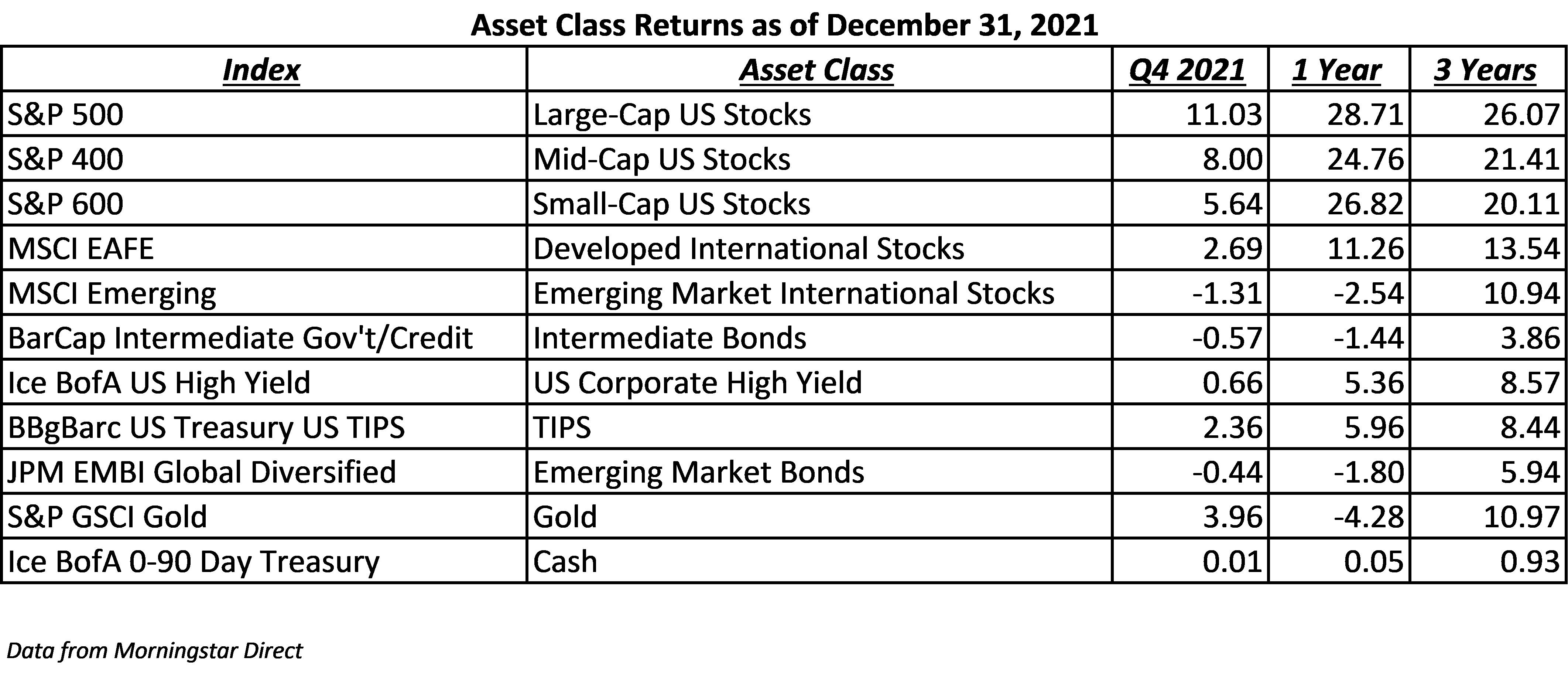

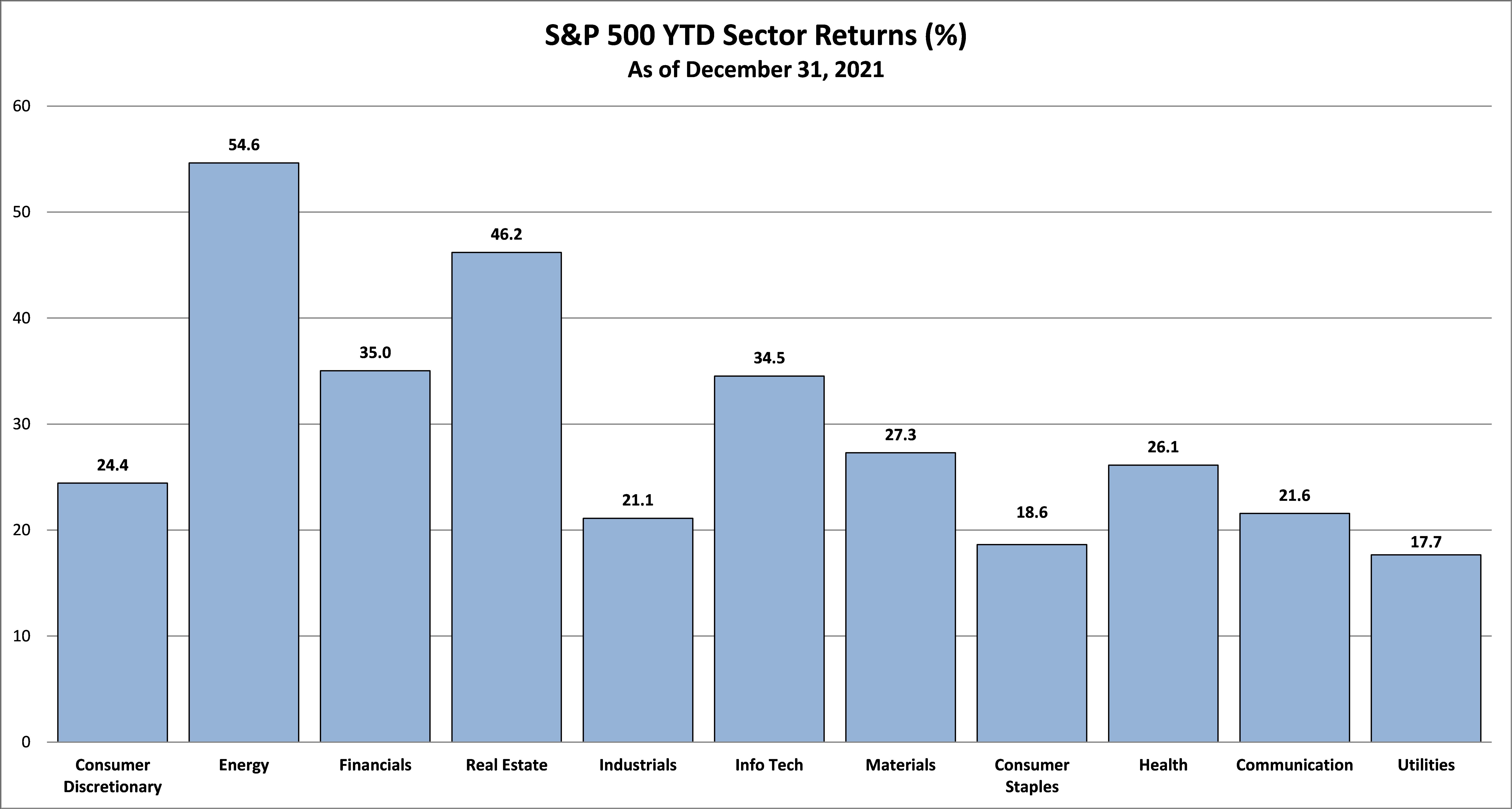

With the S&P 500 reaching 70 new highs in 2021, it closed the year with a 28.7% return. This caps three strong years in the market, with the 3-year price return on the S&P 500 at 90.13%, – its highest level since 1999. The gains in 2021 have been across asset classes, with large, mid and small capitalization stocks posting 20+% returns. At the sector level, all 11 sectors posted positive double-digit returns. At the top of the leaderboard, the energy and real estate sectors posted eye-popping 54.6% and 46.2% total returns respectively. Meanwhile, staples and utilities were the laggards, returning 18.6% and 17.7%.

On the surface, the divergence tells the story of a market that rewarded companies leveraged to economic growth and that shunned traditionally defensive areas of the market. But a deeper look reveals an interesting set of sector returns that exemplify the internal tug of war in the markets: the almost equal returns of technology and financials with the year finishing with no clear sector winner – financials at +35% and technology at +34.5%.

As the S&P 500 continued to post new record highs, its steadfast march upwards masked an underlying and ongoing violent rotation with sector leadership changing month to month, week to week and in some instances day to day. These gyrations often triggered risk on/risk off sentiment changes, as participants digested changes in the yield curve, inflation data and waves of COVID-19 infections. As we move into 2022, infection rates and interest rates will remain key factors to watch as we gauge market sentiment.

Also worth noting, index concentration has impacted 2021 returns. While the strong index level return in the S&P 500 will get top billing in 2021, so will the dominance of AAPL, GOOG, MSFT, AMZN, META (formerly Facebook) and their collective ability to drive index level returns. These five companies represent 24.7% of the S&P 500’s market capitalization and accounted for roughly one-third, or 9.51% of the S&P 500’s 28.7% return. Between outsized individual positions and outsized returns relative to the broader index, their success disproportionately positively impacted returns. As an example, Apple alone represents 7% of the S&P 500 Index and individually returned 35%. A similar impact occurred in the technology-centric NASDAQ Index which returned 21.9% for the year. As of December 6, with the NASDAQ up 21.7%, if you excluded the top 5 stocks (AAPL, MSFT, AMZN, TSLA, GOOG), it had appreciated just 5.79%. The influence of these stocks on index returns bears watching as we go into 2022.

As the year progressed, valuation became a focal point and a growing concern to investors at the security level with many high-flying stocks sporting triple digit Price/Earnings (P/E) multiples on negative earnings. A fundamental focus started to overtake market momentum thereby grounding some of the year’s biggest winners. At the index level, the powerful growth in earnings across all sectors translated to a lower valuation as the year came to a close. The forward Price/Earnings ratio of the S&P 500 at the current 21X earnings is still above its 25-year average of 16.8X earnings, but it is now lower than the 23X multiple it started with in 2021.

In 2021, domestic markets fared better than their international counterparts. International Developed Markets returned 11.2%, as measured by the MSCI EAFE Index compared to the S&P 500’s 28.7%. Emerging Markets, a leading asset class in 2020, had a negative 2021 return of -2.5 (MSCI EME Index). Chinese Markets struggled in 2021 with factory output and property declines, with third quarter GDP of 4.9% well below estimates. Looking ahead, international markets are poised to perform well with more attractive valuations, greater cyclical representation and higher dividends all being positive fundamental catalysts. In addition, the prospect of a weaker US Dollar in 2022 and a durable global economic recovery could provide a tailwind.

Fixed Income

With stellar returns in equities for the year, the highest inflation data in almost 40 years taking root and the Federal Reserve’s policy shift, most fixed income classes did not shine. The brightest stars in the 2021 galaxy were TIPS (Treasury Inflation Protected Securities) and High Yield Bonds. TIPS, which adjust to inflation, returned 5.96% and 2.36% respectively for the year and quarter with US High Yield Bonds returning 5.36% and .66% for the same periods. Intermediate Corporate Bonds, as measured by the Bloomberg Intermediate Government Credit Index, ended the quarter in negative territory at 0.57% and this star fell by 1.44% for the year. Internationally, emerging market bonds lost .44% in the quarter, and lost 1.80% for the year. TIPS outperformed intermediate corporate bonds, high yield and emerging markets bonds for the year.

The 10-year Treasury began 2021 with a .92% yield in large part due to the Federal Reserve’s rate cuts and Quantitative Easing to support the economy and markets during the height of the 2020 pandemic, along with strong overseas investing in US Treasuries. Despite the low yields, US Bonds provided quality and higher yields relative to most other parts of the world. The 10-year Treasury ended 2021 with a 1.51% yield. Many financial analysts are suggesting that this yield will be in the 2 to 2.5% range at the close of 2022.

Final Thoughts

The pandemic has sparked not only a need to adapt, but also a desire for change. We have witnessed this from the highest levels of government and corporate management, right down to each unique individual. The desire for change appears in such ways as job migration, as workers have re-evaluated their life goals and reframed what “working for a living” can be for them. The pace of innovative technology has enabled virtual communication and commerce to thrive, not merely continue. This is evident in the strong economic growth and market returns.

Challenges remain as we head into 2022, but challenges provide opportunities. Looking ahead, inflationary and trade conditions bear watching, but both equity and fixed markets adjust and have produced positive returns in inflationary times. Companies are generally advancing into 2022 with healthy balance sheets. We look forward to embracing new opportunities and navigating the challenges, always with a foundation of discipline, diversification, quality, communication and a desire to understand the unique needs of our clients.

Thank you, as always, for the trust you place in Cape Cod 5. It remains our privilege to serve you.

Rachael Aiken, CFP®

Senior Investment Officer

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA®, Chief Investment Officer

Brad C. Francis, CFA®, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, CIMA, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5