Market Review Q1 2020 | Market Review Q2 2020 | Market Review Q3 2020 | Market Review Q4 2020

Market Review Q1 2021 | Market Review Q2 2021 | Market Review Q3 2021 | Market Review Q4 2021

Quarter for the Record Books - A year's worth of activity in a quarter's time

A challenging macroeconomic and geopolitical backdrop from the onset

After posting fresh highs, the stock market started to show signs of stress in January. Rising rates triggered selling and the emergence of the Omicron COVID variant upended economic activity. Market participants, now cognizant of a hawkish Fed pivot, the prospect of rapidly rising rates and quantitative tightening, began to sell richly valued, high-multiple growth stocks on valuation fears as the month came to a close. February ushered in the hottest inflation data in 40 years, with a rise in the consumer price index of 7.5% year over year. Fears surfaced that the Fed, now behind the curve, might become adversarial in fighting inflation.

As March approached, Russia mounted a full-scale invasion of Ukraine, roiling global equities and disrupting commodity markets. A commodity price shock ensued, most notably driving WTI crude oil prices to $130 a barrel (a high not seen since 2008), resulting in additional broad-based inflationary pressures. By mid-March, the Fed commenced its anticipated rate hiking cycle, raising the federal funds rate 25 basis points and mapping out six more hikes in 2022. A terminal fed funds rate of 2.8% was projected, up from 1.6%. As the quarter came to a close, Fed Chair Powell also hinted of a readiness to raise rates in 50 basis point increments and an accelerated balance sheet run-off to hasten tightening financial conditions to quell inflation.

Looking ahead, the future path of inflation, interest rates and the hope of resolution to the Russian invasion of Ukraine are helping to determine the course of humanity, global markets and the economy.

Inflation – Once deemed transitory, inflation today is better characterized as persistent and broadening in scope and scale. Inflation of “stickier” elements (wages and shelter) are resulting in negative implications for both consumers and businesses. The overriding concern is with headline inflation, now close to 8%. With no signs of abating from this level, inflation could derail our economic recovery. It is important to note that this cycle’s rampant inflation is a result of both severe supply constraints and excessive demand. This unique combination of inflationary factors presents a challenge to tame and leaves more questions than answers: when will it peak? When will supply constraints ease? Will demand destruction dent it and will it come under control?

Consumers continue to spend, despite an acute awareness of the rising cost of living. Up to this point, inflation has not impeded insatiable consumer demand, but recent negative trends in retail sales and consumer sentiment point to a more cautious consumer. Consumer confidence levels, which are a leading recessionary indicator measuring economic optimism, bear watching.

Corporate America will provide some economic clarity when the first quarter earnings season kicks off mid-April with revenue, profit and margin growth providing a window into how companies with wide-ranging inflationary pressures are faring.

While the 2022 U.S. economic growth outlook has been downgraded by the Fed to 2.8% from 4.0% due to strong inflationary headwinds, revised projections remain above trend for the year – an encouraging sign. Consumer spending is meaningfully shifting from goods to services, with a recent surge in travel, dining and entertainment, but a higher cost to live and borrow may present a challenge to future growth.

Interest rates – Market participants spent a good portion of the first quarter repricing assets to reflect the Fed’s priority pivot from labor market growth to curtailing inflation. The Fed has also accelerated the pace and punch of its policy. Only three months ago it telegraphed only three rate hikes in 2022; today, it intends to raise rates at every meeting this year, totaling eight potential hikes. The magnitude of the rate increases has intensified, too. Predictions shifted from a measured, data-dependent 25 basis points to a front-end-loaded cycle with a high probability of a 50 basis point increase at each of the next three meetings. This acceleration begs the question – will the Fed be able to break the back of inflation and engineer a soft landing for the economy? We will monitor this delicate balance as it unfolds in the months ahead.

The Fed’s hawkish agenda dramatically changed the shape of the yield curve in the first quarter. The front end (maturities of 2 years or less), where rates change quickly to express the Fed’s future path for rates, repriced from a low of .16% a year ago to 2.29% at the end of the quarter. The longer end of the yield curve (represented by 10-year maturities), moved up less aggressively and the shape of the yield curve turned remarkably flat before finally moving into inversion briefly on March 29.

An inverted yield curve, where interest rates are lower on longer term maturities than short term maturities, signals that perhaps the economy will buckle under the pressure of rapidly rising rates. Such conditions can negatively impact housing affordability, with higher mortgage rates increasing the costs of servicing existing debt and curtailing future borrowing activity by consumers and businesses. This “inversion indicator” has been correlated with past recessions but is not necessarily a cause of a recession. The flashing red signal bears watching. Historically, a yield curve inversion is an early warning signal, but the economy and equity markets can continue to do well, averaging an additional twelve to eighteen months following an inversion. The odds of recession in 2022 remain low, with economic growth supported by a strong labor market, healthy consumer and corporate balance sheets and a consumer willingness to spend. As the Fed continues to raise rates, we will carefully watch inflation, labor markets and consumer response for any cracks in the economy.

Invasion - Russia's invasion of Ukraine remained in the forefront of the headlines this quarter. The humanitarian crisis and loss of life is heart-breaking with no détente in sight. There are also short and long-term economic impacts of continued war and global unrest. In the near term, commodity price shocks ranging from oil, natural gas and gasoline to wheat, corn and soybeans, to precious and industrial metals, fan inflationary fires across the global economy. These spikes impact prices with a lag and we anticipate higher prices at the producer price level, as well as the consumer price baskets, for months to come. The longer-term economic agenda will be reshaped by concerns and governmental actions in response to global food insecurity, accelerated plans for energy independence, enhanced cybersecurity measures to protect global infrastructure and policy enhancements to ensure the smooth functioning of our financial markets.

Fixed Income

The bond market showed signs of stress in the first quarter, reflecting investor concerns about global growth as central banks pivoted toward removing policy accommodation. Such concerns led to global sell-off in bonds that accelerated when it became apparent that the Fed would be ever more hawkish. The yield curve flattened out with the short end rising more quickly, pricing in an aggressive Fed, while longer-dated Treasuries rose less quickly, pricing in an economy bending to the pressures of rising rates resulting in a flattening curve.

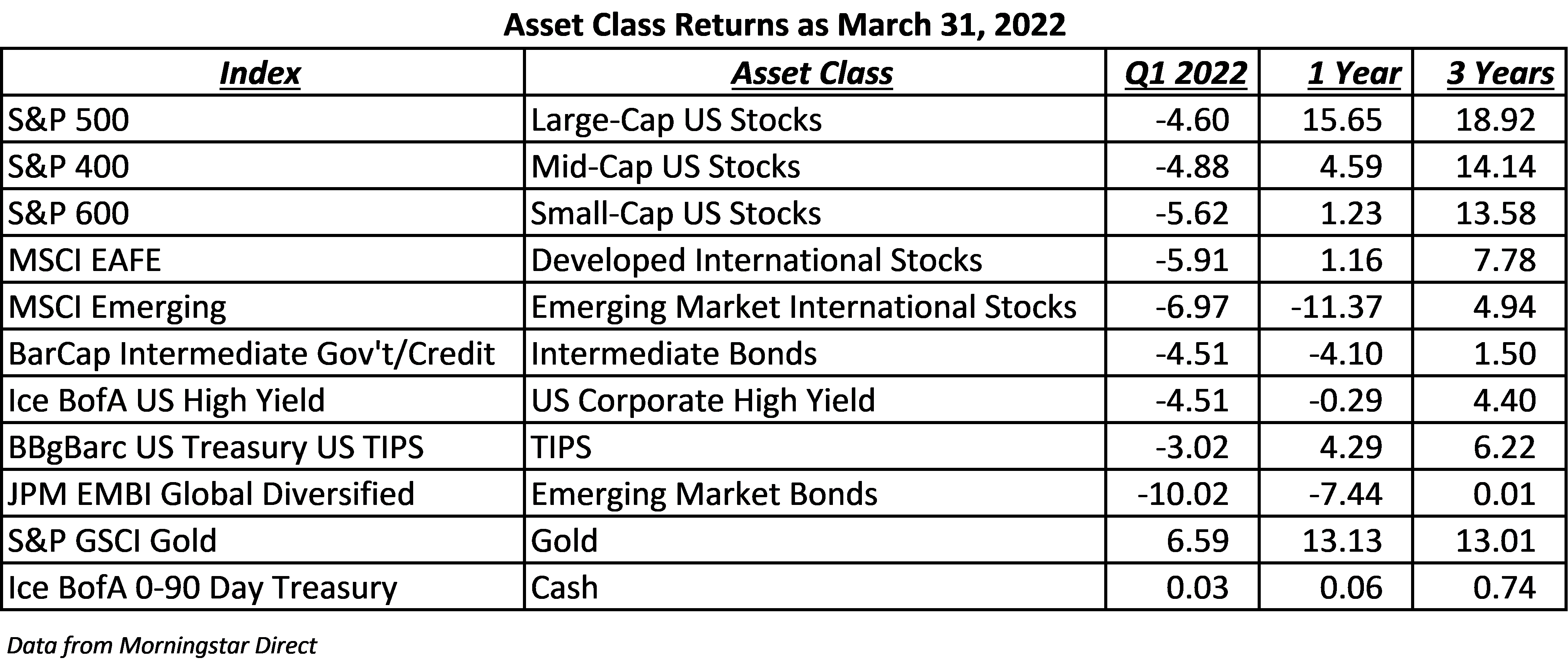

Bond prices fell as rates rose. The Barclays Aggregate Bond Index, a proxy for the broader bond market (US Treasuries, Investment-Grade Corporate Bonds and Mortgage-Backed Securities) declined 5.93% this quarter, resulting in the bond market posting greater losses than the equity markets. Areas of the credit market relatively immune to talk of higher rates and hotter inflation in 2021 were not immune to the broad decline: high yield and treasury-inflation indexed bonds ceded ground. The rout in the bond market carried into international bonds, with both developed and emerging fixed income indices also posting quarterly losses.

Equity Markets

After a record-setting decline in January followed by continued weakness in February, the market reversed course late in March. Buyers stepped in to take advantage of the 13% broad-based swoon, helping to erase more than half of the declines in a matter of nine trading sessions. The S&P 500 finished lower by only 4.6%, still snapping its seven straight positive quarterly returns. With declines across all asset classes, styles and geographies, with the exception of commodities, there was nowhere to hide this quarter. The energy sector continued its march higher, with oil and gas prices rising in response to increased demand and geopolitical unrest curtailing supply, while industrial and precious metals provided ballast by posting positive returns.

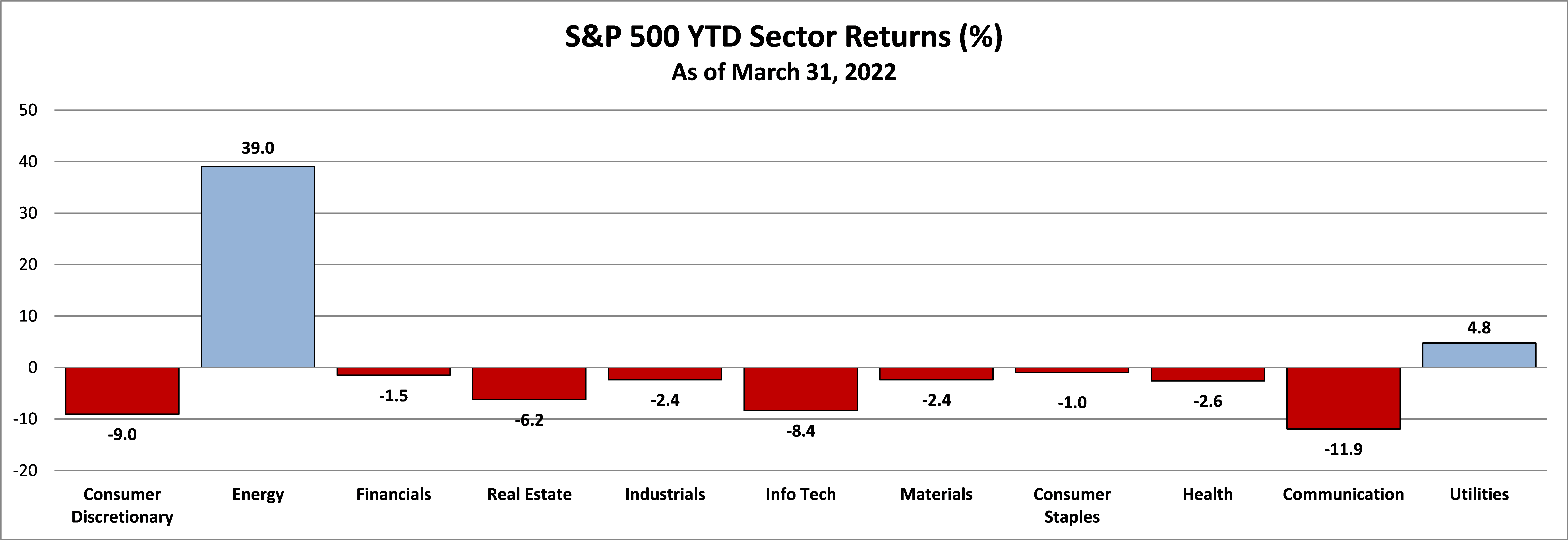

The hardest hit areas of the market included sectors where rising rates challenged their stretched valuations, with profitless, expensive growth companies faring the worst. At the sector level, energy (+39.03%) and utilities (+4.77%) provided positive absolute returns and strong relative returns while the remaining nine sectors posted negative returns. Technology (-8.36%), Communications Services (-11.92%) and the Consumer Discretionary (-9.03%) sectors house many of the companies hardest hit this quarter. Growth, as measured by the Russell 1000 Growth Index, fell precipitously this quarter (-9.04%), while the Russell 1000 Value Index only declined fractionally (-.74%). As a result, the “growthier” tech-laden NASDAQ had the worst performance this quarter, declining 8.9%.

Both developed and emerging markets joined the global equity rout, with emerging markets declining the most with a loss of 6.97%. European bourses, with a value-tilt and better valuation, allowed the developing market index to fare a bit better, declining 5.91%.

We anticipate ongoing volatility as we head into the second quarter, but we choose to focus on the opportunities that volatility presents. A window opens to introduce quality companies, whose valuations look more attractive in light of the recent market selloff, into our portfolios. The ability to tactically harvest losses in stocks and bonds to be used later against anticipated gains is an opportunistic tool, and the chance to introduce more attractive levels of income into our fixed income portfolios is increasing as a result of a higher interest rate environment.

In the face of continued uncertainty, we remain vigilant fiduciaries and mindful of the cross-currents ahead for the economy and the markets. As your trusted financial advisor, we will keep you informed of the investment implications every step of the way. Please do not hesitate to contact your investment officer if you have specific questions about your portfolio at any time.

Thank you, as always, for the trust you place in Cape Cod 5. It remains our privilege to serve you.

Rachael Aiken, CFP®

Senior Investment Officer

On behalf of Cape Cod 5 Trust and Asset Management Investment Committee

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Sean F. McLoughlin, CFP®, CIMA, Senior Investment Officer

Kimberly Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Contact our Wealth Team More Market Insights from Cape Cod 5