Market Review Q1 2021 | Market Review Q2 2021 | Market Review Q3 2021 | Market Review Q4 2021

Market Review Q1 2022 | Market Review Q2 2022 | Market Review Q3 2022 | Market Review Q4 2022

Market Review

“History Doesn't Repeat Itself, But It Often Rhymes”

– widely attributed to Mark Twain

The first quarter of 2023 has been a daily exercise in following a rapidly changing economic and political landscape. Following the unusual year of 2022 when both equities and fixed income investments declined double digits, there was hope for some relief from the negative news cycle. An industry standard portfolio of 60% equities/40% fixed income had not suffered double-digit losses to this extent since the early 1930s.

In January, it started to look as if there would be some relief as the S&P 500 and the NASDAQ rallied by 6% and 10.5% percent, respectively. Investors were hopeful the Federal Open Market Committee (FOMC) would be close to the end of a rate hiking cycle initiated last year in an attempt to reduce persistent and pernicious inflation. The full weight of the rate hikes remained to be seen. Typically, there is a lag in certain aspects of inflation reduction indexes in part because the services sector of the economy, which includes the labor market and shelter costs, has reacted very slowly to the rate hikes. This is especially true in our current economy, as labor shortages and housing demand post-pandemic have been quite strong.

The January jobs numbers came in at 517,000 new jobs added, much stronger than the expected 186,000 new jobs and the unemployment number dropped to 3.4%, the lowest in many decades. The strength of the labor market and its impact on the outlook for future inflation readings led the Fed to increase the federal funds rate by 25 basis points. Although the Fed continued on their path of monetary tightening, the smaller rate hike alleviated investor concern about a more aggressive 50 basis point hike. Despite these positive signals, the stock market gave back some of the January gains.

In the second week of March the financial world took another unexpected turn with news that Silicon Valley Bank (SVB) ceased operations and entered FDIC receivership, followed quickly by the failure of Signature Bank. For a deeper dive into this, please read our March 17 Market Commentary here.

A crisis of confidence in the banking system was quickly averted by the Federal Reserve Board (FRB) announcement that they would backstop all deposits in the affected banks, which had a significant percentage of deposits over the $250,000 FDIC insurance coverage, and do whatever is necessary to stabilize the banking system, indicating that the problem is not systemic in nature. The market response to these actions was generally positive and facilitated the Fed’s ability to approve an additional 25 basis point rate hike at its March meeting.

After raising rates at each meeting over the previous 12 months, the FOMC is facing the dilemma of balancing a slowing economy while reducing inflation without triggering an economic recession. The stock market reaction to the March events was muted and even dismissive as the S&P 500 rose 3.51% and the NASDAQ was up 6.69% in the month.

Economy

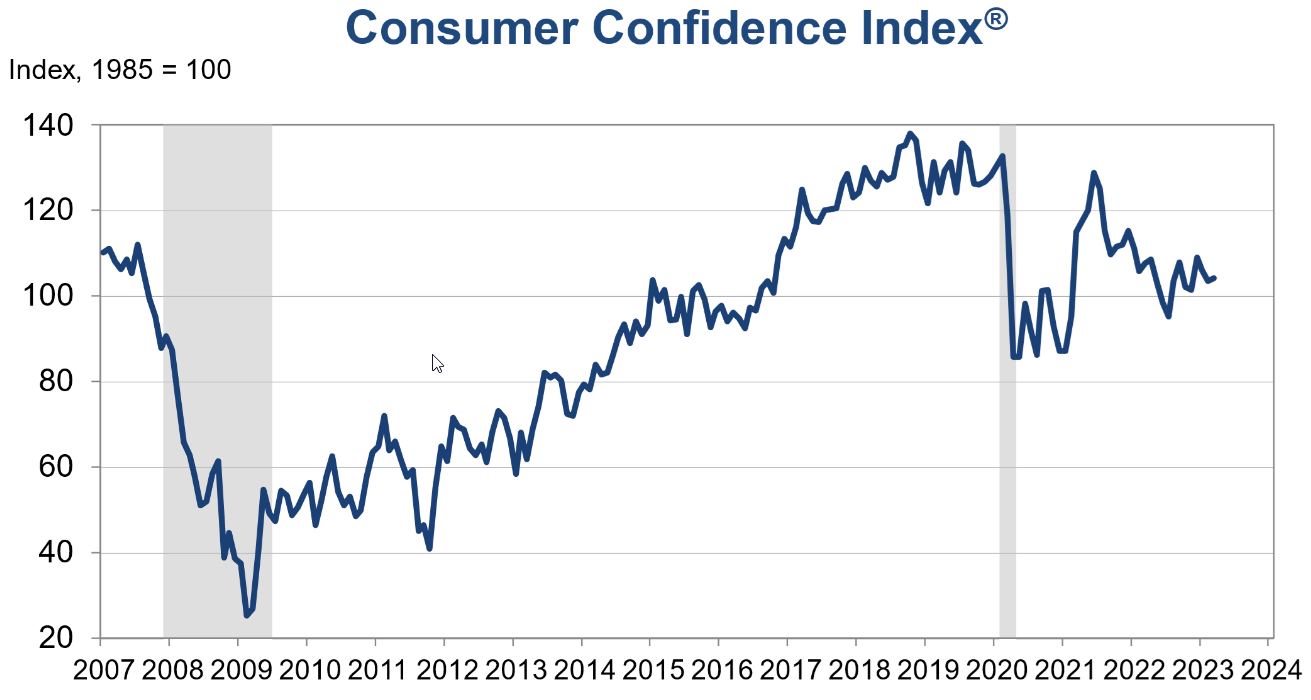

Q1 2023 economic growth, as measured by the Gross Domestic Product (GDP) index, is anticipated to be in the range of 2.5% annualized. The influence of the tightening interest rate environment on consumer confidence and spending has not been too negative, but there are indications that credit card balance buildup and late payment rates are beginning to rise. Consumer confidence numbers are important as consumer spending contributes almost 70% to domestic economic growth. The chart below indicates a drop in confidence in 2022 as the rate hiking cycle began, though it appears to be stabilizing.

Fixed Income

The full effect of nine interest rate hikes in twelve months has yet to bring inflation down to the Fed’s 2% target range. However, short-term interest rates in the 4-5% range for the highest quality credit is something we have not seen for many years. Bonds are now offering more attractive yields than in the past several years. Current coupon interest rates may benefit the income investor looking out to the future rate environment and possibly offer an opportunity for price appreciation.

The rapid rise in Treasury coupon rates is displayed in the chart below.

| 03/31/19 | 03/31/20 | 03/31/21 | 03/31/22 | 03/31/23 | |

|---|---|---|---|---|---|

| US Federal Funds Target Rate | 2.50% | 0.25% | 0.25% | 0.50% | 5.00% |

| US Benchmark Bond - 2 Year | 2.27% | 0.20% | 0.16% | 2.29% | 4.06% |

| US Benchmark Bond - 10 Year | 2.42% | 0.68% | 1.74% | 2.32% | 3.49% |

| US Benchmark Bond - 30 Year | 2.82% | 1.32% | 2.42% | 2.45% | 3.69% |

Equity Markets

The past three months showed quite different reactions to the various economic data and the rate moves by the FRB. The chart below indicates the monthly performance of the primary stock indexes for the two previous years and the first three months of 2023.

| 2023 | |||||

|---|---|---|---|---|---|

| Index | 2021 | 2022 | Jan | Feb | Mar |

| S&P 500 | 26.89% | -19.44% | 6.18% | -3.62% | 4.00% |

| DJ Industrial Average | 18.73% | -8.78% | 2.83% | -4.21% | 1.87% |

| NASDAQ Composite (TR) | 22.18% | -32.54% | 10.72% | -2.95% | 7.49% |

For the Q1 2023 period, the greatest rebound was in mega-cap tech stocks within the S&P 500 and NASDAQ, the market sector that dropped the most in 2022. The Q1 recovery of stocks was largely driven by the same group that dominated strong returns in 2021 but lagged in 2022. Ten mega cap growth companies, including Apple, Microsoft, Alphabet and Amazon, had a positive impact on the major index returns in the quarter.

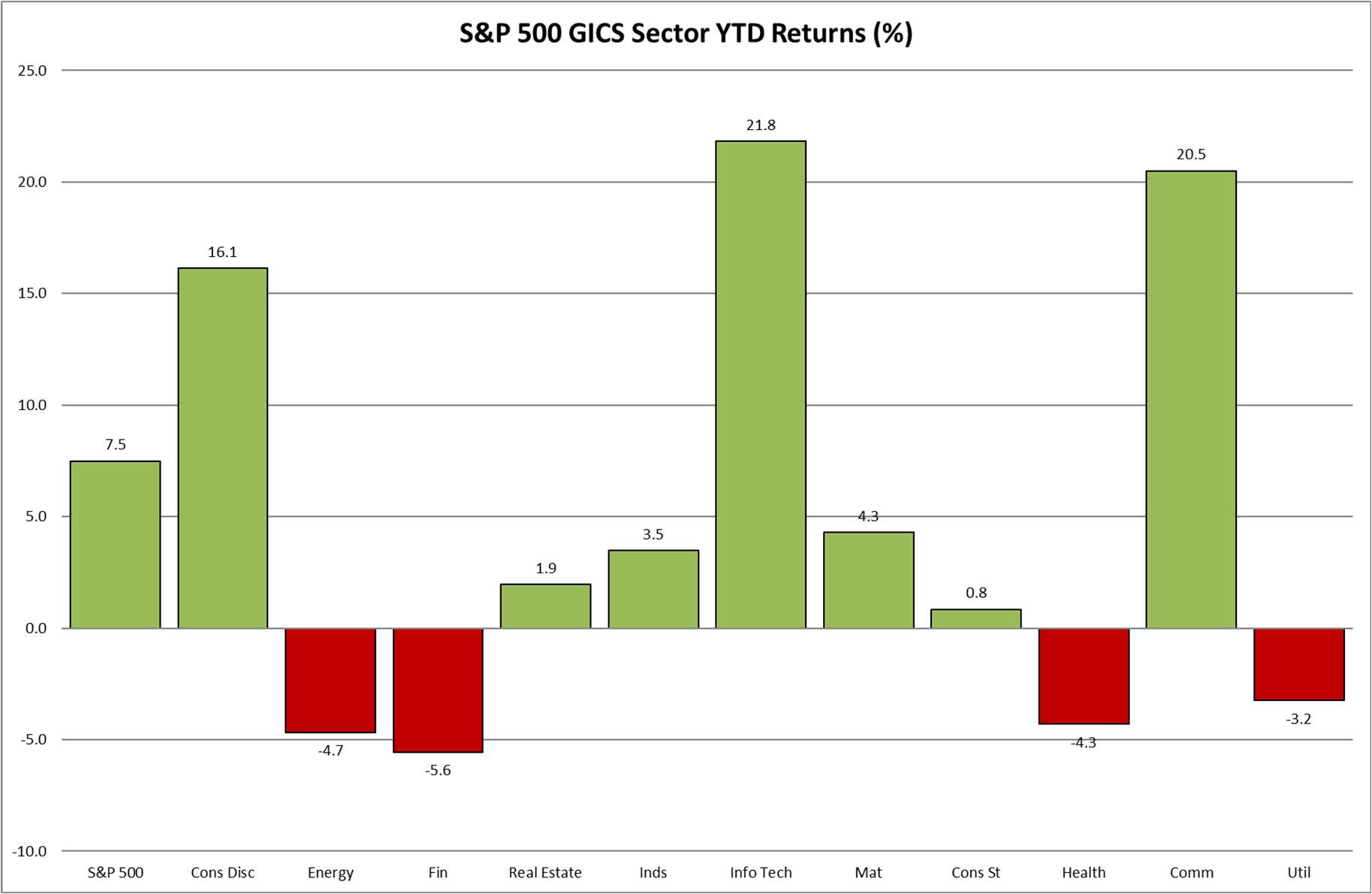

Sector performance can vary dramatically, as illustrated by the sector chart for the past quarter below. Diversification is but one tool the Cape Cod 5 Investment team uses to manage risk and adapt to changing economic environments in a thoughtful way and always with the best short and long-term interests of our clients front of mind.

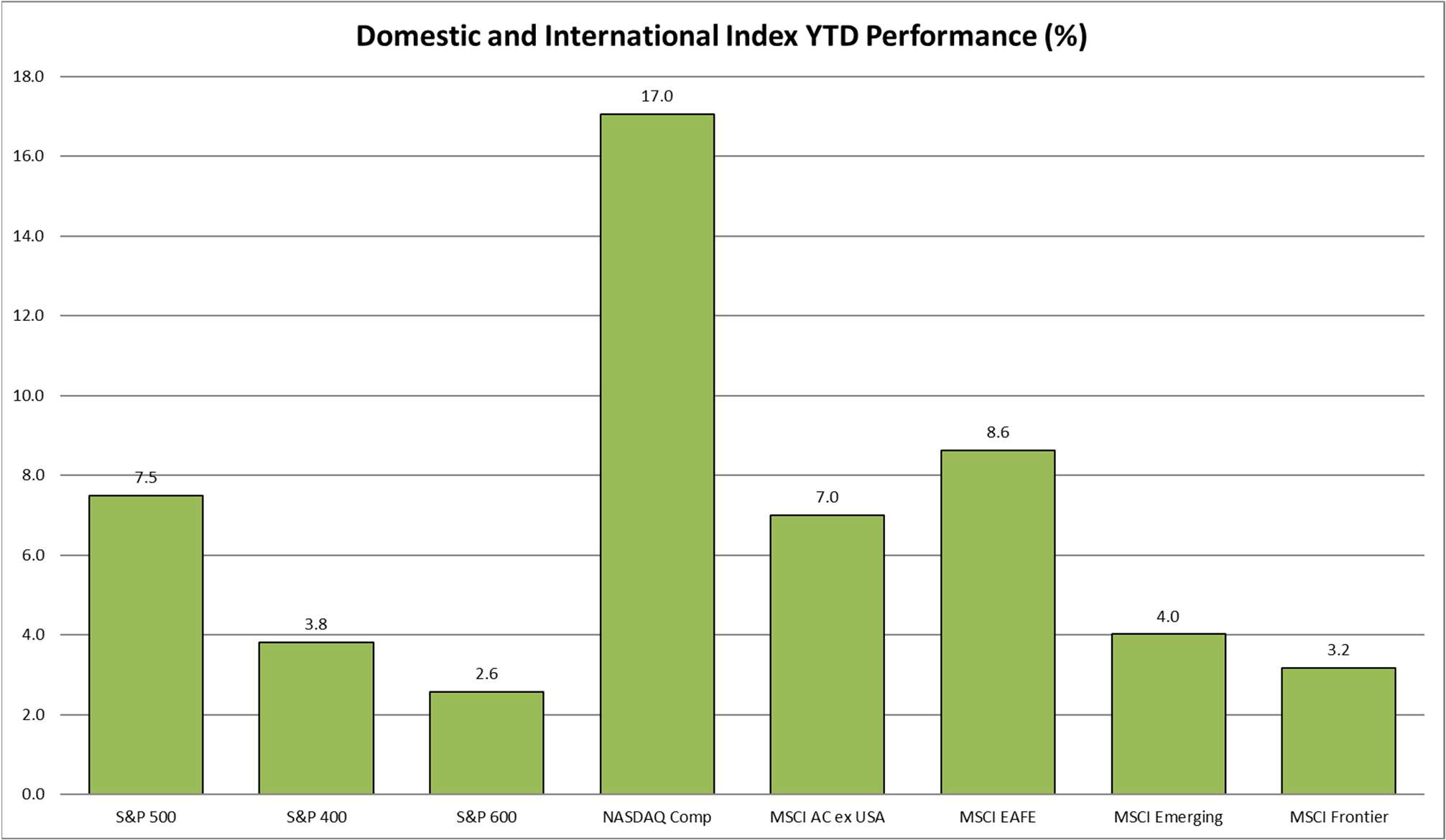

A chart indicating the performance of a broad selection of indexes for the first quarter of 2023 includes domestic and international statistics. Notable is the strong performance of the tech stock-dominated NASDAQ following a drubbing in 2022.

Closing

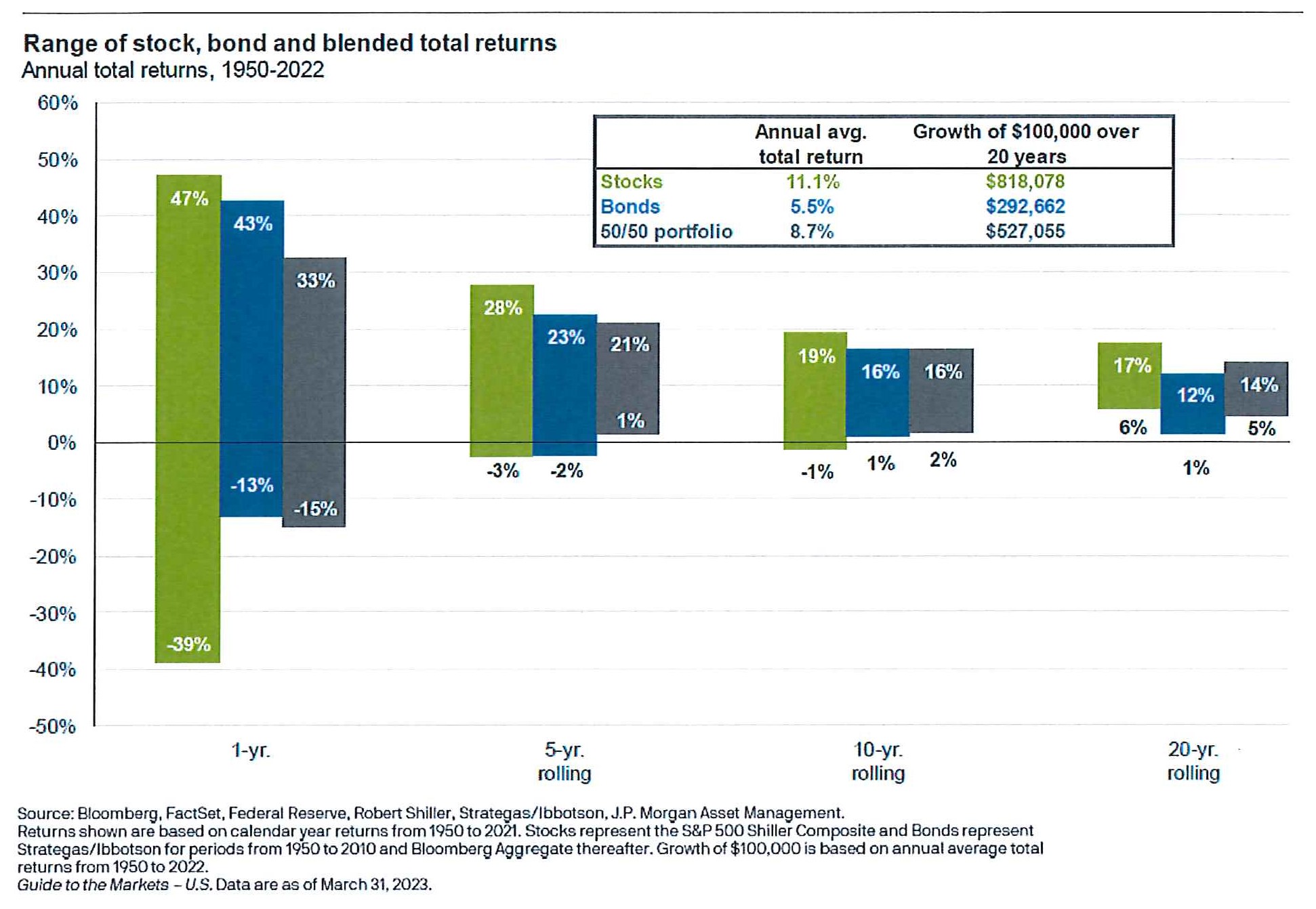

Frequent challenges and unexpected events create crises, but also opportunities. In the current environment, the Fed continues to focus on controlling inflation caused by major supply interruptions and fueled by the worldwide pandemic and war in Eastern Europe and the lack of labor supply and its impact on wage growth. As the chart below displays, volatility in the short term can be disruptive, but time can have a smoothing effect. The value of time and diversification has led to a greater likelihood of satisfactory long-term returns.

Thank you for your continued trust and confidence in the Cape Cod 5 Wealth Management and Investment Services teams. We are always available to review and discuss your individual portfolio.

Robert D. Umbro

Senior Investment Officer

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA®, Chief Investment Officer

Brad C. Francis, CFA®, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Robert D. Umbro, Senior Investment Officer

Craig J. Oliveira, Investment Officer

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.

Read recent Market Reviews

Market Review Q1 2021 | Market Review Q2 2021 | Market Review Q3 2021 | Market Review Q4 2021

Market Review Q1 2022 | Market Review Q2 2022 | Market Review Q3 2022 | Market Review Q4 2022

Contact our Wealth Team More Market Insights from Cape Cod 5